This content was originally published on Ellie Frost’s Substack.

In case you missed them, below are the main results from yesterday’s earnings.

- $1.8 billion revenue

- $1.1 billion adjusted EBITDA

- $730–800 million net income

- $223 billion assets on platform

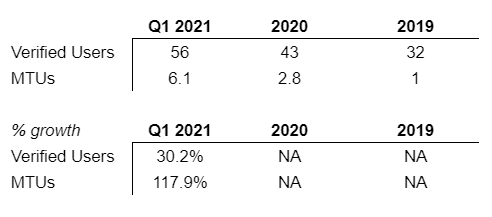

- 56 million verified users (VU) and 6.1 million monthly transacting users (MTU)

What does this boil down to? I had three main takeaways and questions regarding trading take rate, users and 2021 projections.

Trading Take Rate

We are only provided a total revenue of $1.8 billion. If you arbitrarily take this and the $335 million volume, you would get an impressive ≈54 bps as Q1’s take rate. Huzzah! Does that definitively mean that the take rate remained high because retail users came in force? No.

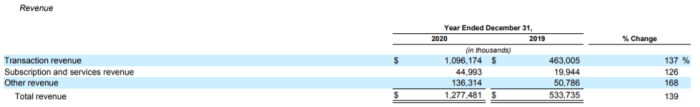

There are three lines of revenue: transactional, subscription, and other. Note that “net revenue” is considered transactional and subscription. However, these three lines of revenue all have different drivers.

Source: S-1 Filing

Transactional revenue is based off of trading volume, which is largely driven by volatility.

Subscription revenue is custody, staking fees, and so on, so it is largely driven by assets under management (AUM).

Other revenue is when they sell their treasury of BTC, ETH, and other cryptocurrencies.

So, you should only be calculating a ratio of trading volume to transactional revenue. For 2020, this was 86 percent of total revenue, but we do not yet have that detail here to definitively say how much of the total revenue was actually transactional.

As an example, assets on platform (AoP) grew from $90 million in Q4 2020 to $223 billion in Q1 2021. People may have bought two quarters ago and kept AoP. With rising asset prices, Coinbase may earn more revenue off of them, but this revenue has nothing to do with this quarter’s trading volume.

Where does that leave us with scenarios for the Q1 revenue? Several possibilities come to mind:

Scenario A. They actually did have massive transactional revenue that made up the majority of the $1.8 billion revenue. The high take rate would imply that retail users came in droves and were using the mobile app that carries higher fees.

Scenario B. They’re getting more revenue from subscription revenue due to higher AUM.

Scenario C. They sneakily sold off more assets in other revenue to put total revenue ahead of their IPO (they’d get called out eventually on this so I doubt it).

User Metrics

User metrics were another win. With 56 million verified users, Coinbase sits far ahead of Robinhood, CashApp and Venmo. But it was also exciting to see the growth trends of VUs and MTUs side by side. MTU growth quarter on quarter strongly outstripped VU growth, which could indicate that Coinbase is successfully resurrecting inactive users.

2021 Revenue Guidance

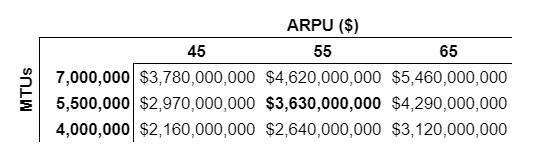

Trading volume is correlated with volatility, which is inherently unpredictable. Coinbase works around this by calculating retail net revenue by MTU x average net revenue per user (ARPU).

Coinbase gave an upside versus base versus downside case for their average annual MTU of 7 million, 5.5 million and 4 million, respectively. They noted that they had an ARPU of $45 in 2020 but did not list ARPUs with each scenario.

It is pretty clear they are playing the game every company plays with projections. Aggressively haircut, then smash through when they report earnings. That is, I find it doubtful they actually think their base case is 5.5 million MTU when they just reported 6.1 million in Q1.

This is what they could have projected for retail revenue for 2021. This feels low given Q1, but we don’t have revenue details yet and they want to blow out any projections given.

If the bull market continues, then MTUs will be significantly higher than what they’ve outlined, even in their upside case. If MTUs increase, then ARPU will rise correspondingly and 2021 could get very interesting, very quickly, for Coinbase.

– Ellie Frost

This is a guest post by Ellie Frost. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.