By CCN Markets: Investors are getting a bit of a reprieve today as the stock market recaptures some of yesterday’s massive losses in what was a brutal day on Wall Street. The trade deal appears to be the impetus for the market, and the tug-of-war between President Trump and President Jinping seems far from over, based on the looks of things. Don’t let the stock market volatility fool you, however. Despite the doom and gloom and the dismal performance of the stock market this week, according to Allianz Chief Economic Adviser Mohamed El-Erian, the violent market swings say nothing about the state of the economy, telling CNBC:

“Our markets are going to remain incredibly volatile despite an economy that’s doing well. I think people have to understand the distinction between the economy and all this silly talk about us going into a recession this year, we’re not. And on the other hands the markets, which are going to be more volatile and require a different approach.”

“People have to understand the distinction between the economy and all this silly talk about us going into a recession this year. We’re not,” says @elerianm

Here’s his explanation: pic.twitter.com/dRo3zzY3nd

— Squawk Box (@SquawkCNBC) August 15, 2019

As Stock Market Suffers Worst Week of 2019, Could a Recession Hit Next Year?

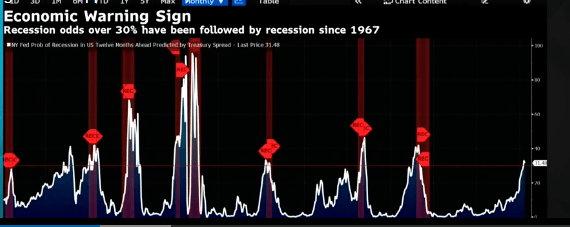

While a recession may not be in the cards for 2019, the former head of the Swiss National Bank suggests that the signs are pointing toward a further slowdown in 2020. BlackRock’s Philipp Hildebrand told Bloomberg:

“I think what the yield curve and interest rates generally tell us now is that the risks of a recession down the line in 2020 are more elevated than they have been in this entire cycle.”

The BlackRock vice chairman believes the economy is in “recession worry territory,” the reasons for which are two-pronged: fundamentals and politics.

Speaking of which, if you ask President Trump, it’s the media’s fault.

The Fake News Media is doing everything they can to crash the economy because they think that will be bad for me and my re-election. The problem they have is that the economy is way too strong and we will soon be winning big on Trade, and everyone knows that, including China!

— Donald J. Trump (@realDonaldTrump) August 15, 2019

The U.S. economic indicators are largely positive, with the exception of manufacturing which could be a function of the tariffs. Meanwhile, consumers continue to hold up the U.S. economy. So while the stock market is trading as though a recession could be imminent, the economic signs appear to be pointing elsewhere.

This article is protected by copyright laws and is owned by CCN Markets.