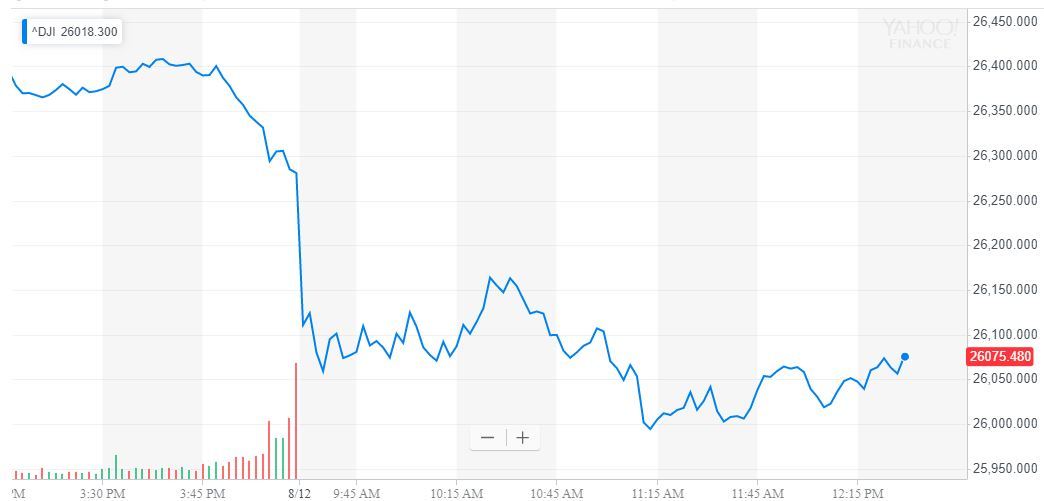

The Dow Jones continued to expose its vulnerability on Monday, as the index traded down 267 points (0.85%) to 26,019.

Most of the damage was done at the opening bell, with protests in Hong Kong, a shocking vote in Argentina, and Jeffrey Epstein fallout adding to a potent soup of bearish news for global risk appetite.

Truly Global Risks Weigh on Dow Jones

As if the significant trade standoff between the US and China was not enough, escalating tensions between Hong Kong protesters and the government are starting to be taken seriously by stock markets.

There was also an apparently bearish reaction from Wall Street as Attorney General William Barr commented on “serious irregularities” in the handling of Jeffrey Epstein in Federal Custody. Fears are rising that there is going to be some dramatic political fallout from the custody suicide. The fact that Trump was tweeting a conspiracy theory over the weekend is certainly adding to the instability.

JUST IN: Attorney General William Barr says the Department of Justice has learned of “serious irregularities” at the federal facility where Jeffery Epstein died and that the department’s Inspector General will “get the bottom of what happened.”

— NPR (@NPR) August 12, 2019

More problems for the Dow emerged as another populist domino fell, this time in Argentina. Concerns mounted both over the risks to the South American nation as well as the contagion that might spread from a deepening economic crisis there.

European stock markets swooned as domestic banks took a major hit from falling yields. Commerzbank stock hit a record low.

Trump Unlikely to Pump Stock Market Anytime Soon

Predicting the direction of the Dow Jones and forecasting the trade tactics of Donald Trump go hand in hand.

Unfortunately, Kathy Lien – managing director at BK Asset Management – believes that stock bulls hoping for a speedy resolution to the trade war standoff are likely to be disappointed.

“It’s clear that President Trump has no plans to make a deal with China this far from the 2020 election. He’s on a rampage to show his constituents that he’s fulfilling the promises that he’s made in 2016 and in doing so he’s hurting the markets and the US dollar.”

Dow Stocks: Goldman Sachs Falls, Apple Rises

After bouncing off its 200-day moving average, Dow Jones bears appear to be selling the recent rally.

Goldman Sachs and JP Morgan Chase were both significant losers, with the former down 2.4% amid the parabolic surge in global bonds. Pfizer was the worst performer, shedding over 2.96% as uncertainty swirled over a potential dividend reduction.

Apple and Johnson and Johnson were the only Dow 30 stocks shining in green, though both gains were extremely moderate.

Click here for a real-time Dow Jones Industrial Average chart.