Last updated on December 29th, 2017 at 04:39 pm

When Satoshi released his whitepaper explaining Bitcoin, the subtitle was A Peer to Peer Electronic Cash System. There’s a good reason why Satoshi didn’t call it an “electronic payment system.” Like cash, Bitcoin is intended to be used without permission or intermediaries.

Here’s another similarity between Bitcoin and cash: Neither require identification to use them. However, a person’s identity may be traced via their fingerprints (digital or physical) if they handle either form of value exchange without taking the necessary precautions.

Why Buy Bitcoin with Cash?

There are two excellent reasons:

1. Cash purchases are far more private.

Unlike using a regular Bitcoin exchange, cash purchases usually don’t require you to unnecessarily reveal information by submitting a raft of scanned documents to verify your identity. This tactic is a lot safer, given the fallibility of exchanges and the rising risk of identity theft.

And we haven’t even addressed crackdowns by tax authorities. This fate recently befell certain Coinbase users.

2. Cash purchases are faster for first-time buyers.

This reason exists mostly because there’s no waiting for the arrival of bank transfers, or for verification by an exchange. Deposits usually take 1 to 3 business days, and verification can take 1 to 3 weeks. Cash trades save a lot of time. When Bitcoin’s price is skyrocketing, even a few days can equate to a lot of money!

Peer-to-Peer Trading: a Key Part of Bitcoin’s Ecosystem

Experts have suggested that the majority of Bitcoin’s trading volume occurs off-exchange. The possibility of an unimpeded, voluntary exchange is critical to the continued robustness and decentralization of Bitcoin.

If cryptocurrency only becomes tradable with state approval, then it’s reduced to little more than a new form of fiat. Therefore, all serious Bitcoiners should gain some kind of experience with cash trading. If your local government ever cracks down on Bitcoin, it’s good to have a Plan B in place…

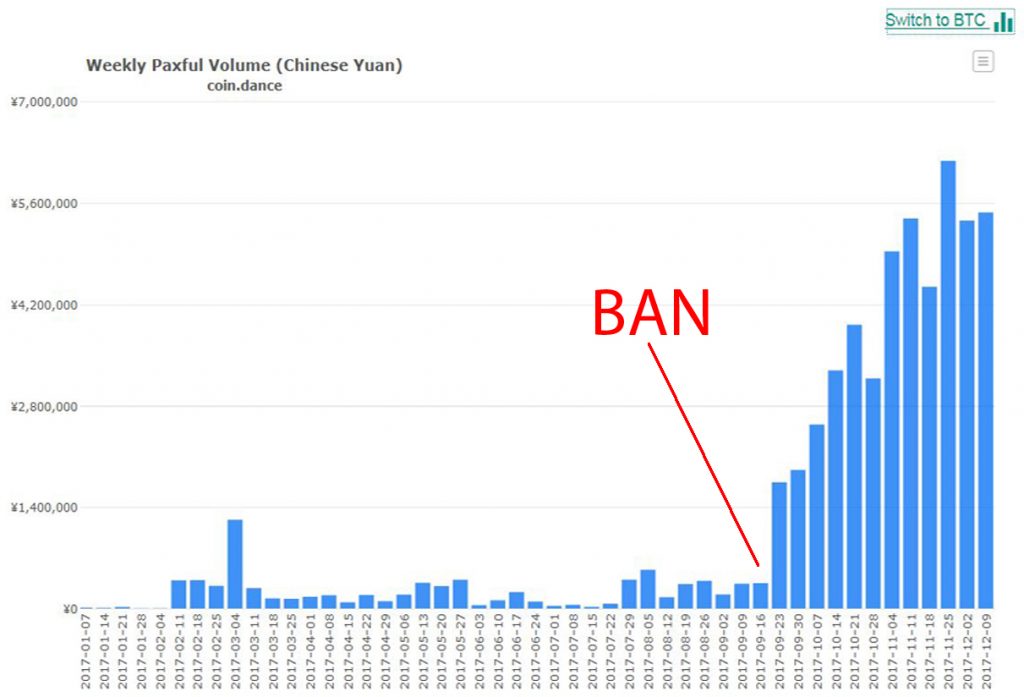

Perhaps the best practical example of the importance of peer-to-peer trading came in late 2017, when China banned Bitcoin exchanges. Nevertheless, OTC trading of Bitcoin continued. These charts depict known Chinese volume for two popular services that facilitate peer-to-peer trading:

As a result of the ban, LocalBitcoins’ volume in China spiked by at least 7x.

Paxful’s volume in China also noticeably spiked. Over a few months, it increased at least 6x.

4 Methods for buying Bitcoin with Cash

We’re going to walk you through the four most popular methods for buying Bitcoin with cash:

Cash purchases in person

These purchases are sometimes referred to as face-to-face (F2F) trades. In-person trades can be pleasant ways to mix a little social interaction into your regular Bitcoin business.

Cash purchases from machines

These purchases are also known as Bitcoin ATMs (BTMs). Some of these machines require identity verification, but others are more lenient. BTMs can be found in most cities that have a substantial Bitcoin community. One of the major advantages is 24/7 availability.

Cash deposits at a bank

This method is probably the most physically secure method for buying Bitcoin with cash.

Cash in the mail

We don’t usually recommend this method, due to the heightened risks of loss, theft, and fraud. It should only be used as a last resort, and only for sending small amounts.

Note: All these methods will likely prove more expensive than buying Bitcoin from an exchange. You may pay the price for:

- Greater anonymity

- No verification

- The seller’s time and risk

Buying Bitcoin with cash In-Person

If you have trusted friends who own some bitcoin they’re willing to sell, you’re all set. To make such trusted friends, consider attending Bitcoin conferences or meetings in your area. To locate these events, search Meetup or Facebook for local Bitcoin groups.

If you want to get straight to business, there are three popular options for finding cash sellers of Bitcoin. Each puts you in touch with nearby sellers, and secures your trading via an escrow service, which is explained below.

Unless you plan to meet near an ATM, make sure you bring the agreed-upon amount of cash. Also remember to bring your phone or laptop with an installed Bitcoin wallet. If you only bring an address, you won’t be able to verify receipt of your coins.

Safety First!

We recommend that you only trade by enabling escrow. In this case, escrow means that a trusted service holds the seller’s Bitcoin.

Don’t hand over any cash until you see the seller release the coins to you, and you get a confirmation of incoming coins on your own device. If the trade is canceled, the escrow service will return the seller’s BTC to their account.

But if you do hand the seller your cash, be prepared for them to check the authenticity of your bills. After that, the seller will release the escrow, and the service will send the BTC directly to your Bitcoin address.

We also recommend that you only do in-person trades in a secure location. Good choices are bank lobbies, police-station foyers, and courthouses. When dealing with a seller for the first time or when trading large amounts, it’s wise to choose a location with access controls, metal detectors, security cameras, and guards.

Overall, exercise common sense; although rare, there have been reported incidents of mugging and fraud.

Two Great Options for Escrowed In-Person Trading

Local Bitcoins buyer/seller matching

LocalBitcoins have been running since mid-2012, and they’ve grown to service most countries and regions. Over that time, they have established a reputation for reliability, and they have become well-known as the go-to site for OTC trading.

To buy BTC there, visit the site, and sign up. You should then click the “Quick Buy” link in the top menu. Enter your location, and select “Cash” as your desired payment method:

A list of sellers will be displayed. If there are none, you’ll have to wait for one to appear, or consider a different method. The seller’s list will display the number of successful trades, as well as the feedback score for each. If possible, choose a seller with many trades and a positive reputation.

After selecting a seller, you will be able to enter your desired purchase amount, which must fall within their limits. Then arrange the further details of your trade via messaging. For more info, be sure to study the documentation about the buying process for LocalBitcoins.

Since you can trust LocalBitcoins to send the coins to you, there’s no reason to wait for multiple confirmations after the seller releases the coins. You can find out more about LocalBitcoins here.

Mycelium Local Trader

The popular Mycelium mobile wallet includes a feature known as Local Trader. This tool serves as a cash-only matching and escrow service for Bitcoin traders. Depending on your area, you may find more or (probably) fewer sellers on this site than on

Pretty much everything you need to know about the Local Trader process is available as a guide on Mycelium’s site.

After payment, the seller releases the coins from their Mycelium wallet to yours. In other words, Mycelium provides an escrow service, and guarantees that the seller possesses the amount of bitcoins that they advertised as being for sale. However, they don’t take actual possession of the seller’s coins, as LocalBitcoins does. Instead, the coins are directly released from the seller’s wallet to yours.

Mycelium has an algorithm that monitors the blockchain, and gives you an estimate of your transaction’s likelihood of properly confirming it. Nevertheless, for larger amounts, we’d advise waiting for actual confirmations.

Buying Bitcoin with cash from a Bitcoin ATM (BTM)

If you’re on a tight or irregular schedule, arranging a meeting with a suitable cash seller of bitcoins can sometimes prove to be troublesome. Bitcoin ATMs are a convenient way to trade 24/7. But when using a regular ATM, be on the lookout for suspicious characters who are lying in wait.

Although BTMs have proliferated since their introduction some years ago, there are still many regions without one. The best way to locate a nearby BTM is to use the CoinATMRadar.

When you click on a BTM on this site, you will see a display with its precise location, fees, limits, and ID requirements (if any). The site will also provide contact details for the operator. You should notate these details, in case there are any issues.

When you go to the BTM, remember to also take your Bitcoin wallet or address!

Cash Deposits at a Bank

Paxful offers a purchase option that you may have encountered on LocalBitcoins or similar peer-to-peer trading sites: a cash deposit. With this method, the seller provides their bank details. You then visit the relevant bank, and fill in a deposit form. Sellers may specify a particular bank. You then make a cash deposit to the seller’s account via the bank teller.

This method is more reliable and physically secure than meeting with a stranger. Specifically, the seller has no way of knowing which bank you’ll be using. The downside is that such services are only available within banking hours. And they’re slower than face-to-face transactions— particularly if there’s a long queue at the bank, or the service is slow to verify your trade.

As with face-to-face cash trading, you should only conduct bank-deposit trades via a reputable escrow service; this action will protect you from fraud.

You can prove to the escrow service that you made a payment by photographing or scanning your bank deposit receipt. Then in the event of a dispute, they’ll release the seller’s coins to your Bitcoin address. So ensure that you keep your receipt. Unlike a bank transfer, it’s really hard to prove that you made a payment without it!

As mentioned, bank-deposit sellers may be found worldwide on Local Bitcoins or Paxful. In the US, there are two more services which specialize in arranging and securing bank deposit purchases: BitQuick and Liberty X (which require smartphones).

Finally, Wall of Coins provides this same service within the US, the UK, Argentina, Australia, Brazil, Canada, Germany, Latvia, Mexico, Poland, the Philippines, and Romania.

Cash in the Mail (not recommended)

LocalBitcoins and Paxful offer services for finding sellers who accept cash through the mail. You may also find suitable sellers on darknet markets. As with in-person purchases, try to only trade with established users who have good reputations. Choosing a reliable seller is your best protection against fraud. And escrow should always be employed.

This method involves some obvious downsides, such as slowness and the risk that your envelope may get lost or stolen en route. We recommend wrapping the bills in a couple of layers of paper, so that they can’t be easily detected without opening the envelope.

In the event that your envelope never arrives, or arrives empty, certain sellers may compensate you. To qualify, you may be requested to film or photograph yourself placing the money within the envelope, sealing it, and mailing it.

For greater safety, we advise using registered mail, then having the seller sign after they receive it. This method creates a degree of proof that you paid via escrow, although the amount of cash within the envelope may still be disputed.

Given the drawbacks of this method, we only recommend it for cash buyers who are too remote for other purchase methods.

Conclusion

Any of the methods described above are available for buying Bitcoins with cash today. If you know of other methods or have questions or comments, be sure to leave them in the comment section below.