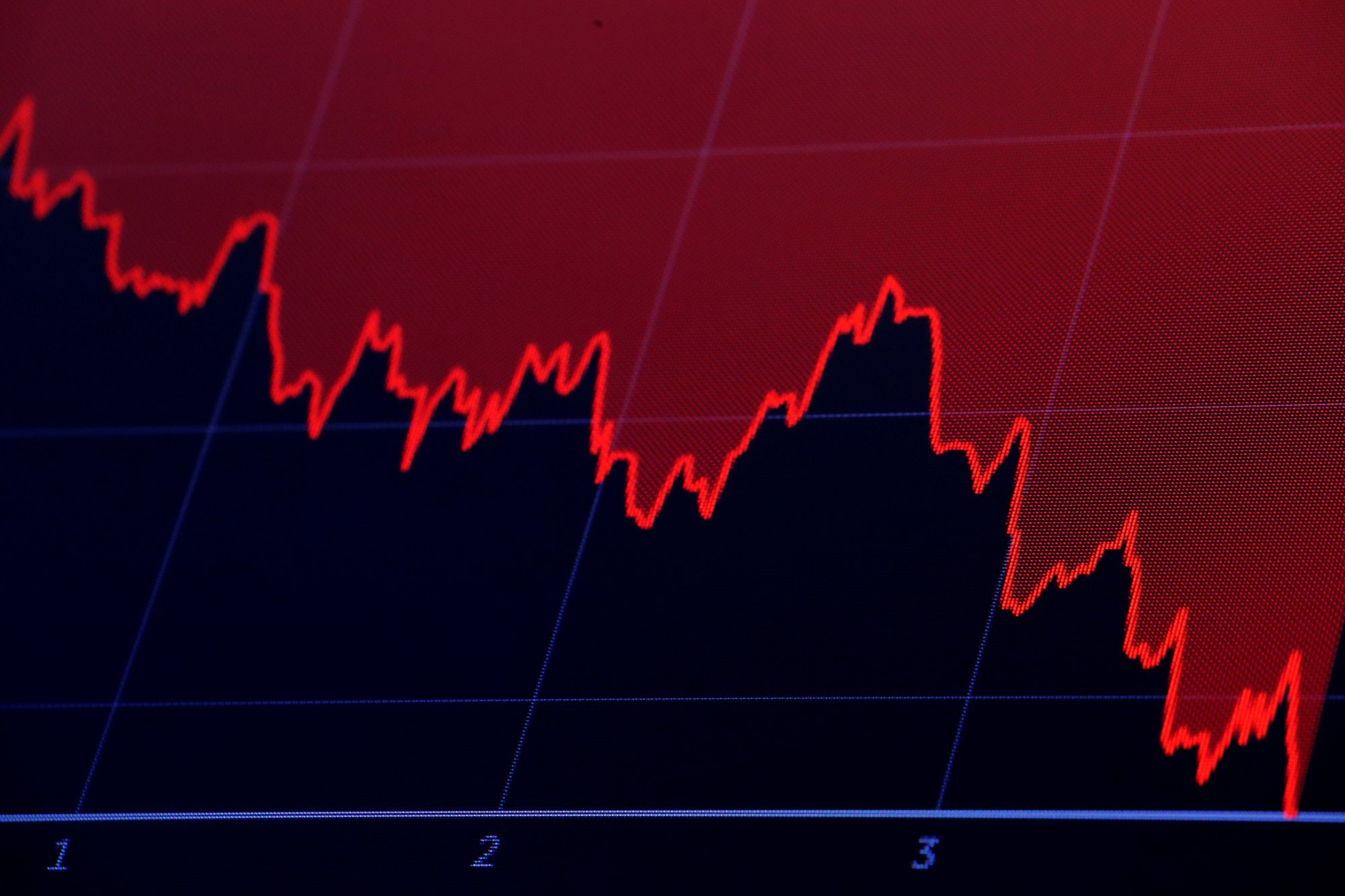

Equities Markets Terrified of Trump’s Trade War

Trump’s aggressive stance toward China and willingness to sacrifice some business profits for his trade war has markets spooked. | Source: Andrew Burton / Getty Images / AFP

Trump’s drum beat and the march to trade war also has equities markets spooked. High tech stocks have suffered already from trade war tensions because many tech companies are highly exposed to the economic downsides of further escalations in Trump’s high stakes game of tariff brinksmanship.

The World Trade Organization finds that the European Union subsidies to Airbus has adversely impacted the United States, which will now put Tariffs on $11 Billion of EU products! The EU has taken advantage of the U.S. on trade for many years. It will soon stop!

— Donald J. Trump (@realDonaldTrump) April 9, 2019

….The process has begun to place additional Tariffs at 25% on the remaining 325 Billion Dollars. The U.S. only sells China approximately 100 Billion Dollars of goods & products, a very big imbalance. With the over 100 Billion Dollars in Tariffs that we take in, we will buy…..

— Donald J. Trump (@realDonaldTrump) May 10, 2019

Trump’s Trade War A Recession Risk

If U.S.-China trade negotiations completely break down, it could trigger another recession. | Source: REUTERS/Brendan McDermid

As David Hundeyin reports for CCN:

“…analysts from some of the world’s biggest investment banks including UBS and Bank of America Merrill Lynch have detailed their forecasts for what a full-on trade war between the U.S. and China would look should the worst happen.

Among the many hair-raising projections is the prospect of the S&P 500 entering a correction by losing 10% of its value, which would almost certainly trigger a long-feared recession.”

Many Dow stocks are threatened by President Trump’s trade war. Goldman Sachs Chief Equity Strategist David Kostin recently led a team of analysts that issued a warning for the 9 most at-risk Dow stocks should trade talks fall through.

The trade war-weary stocks are Coca-Cola, Exxon Mobil, Intel, Boeing, Procter and Gamble, Pfizer, Chevron, United Technologies, and Merck.

5 Stocks That Offer Shelter From Trump’s Trade War

Trump’s trade war is benefiting U.S. steel companies. | Image: Shutterstock

Here are 5 stocks for companies with characteristics that might make them more resilient to any more anticipated or actual economic shocks from U.S. trade policy:

Nucor Steel Corporation – Because steel prices have soared in the U.S. under Trump’s steel tariffs, profits for U.S. steel companies are up too. Charlotte, North Carolina-based Nucor Corporation is the largest producer of steel in the United States. After Trump’s steel tariffs took effect in May 2018, Nucor’s profits doubled within five months.

HCA Healthcare Inc.

Based in Nashville, HCA Healthcare is a Fortune 100 operator of hospitals. Major U.S. health care companies like HCA are a good stock shelter from trade war fallout because they get their revenue from U.S. customers, not from overseas. HCA’s P/E ratio is 12.10, which is quite healthy compared to historical and current averages.

AT&T Inc.

Dallas-headquartered AT&T is another company with most of its assets and revenue base in the United States. AT&T is a good choice for value investors, with solid financial indicators such as its P/E and PEG ratios.

Altria Group, Inc.

Altria’s most notorious brand is Marlboro. It’s the largest tobacco maker in the United States. It’s as well insulated from Trump’s trade as U.S. telecom and health care companies are because of operations that almost entirely within the United States. Altria has a record of raising prices and keeping costs trim to stay profitable as sales decline.

Newmont Goldcorp

Gold is the go-to hard asset for investors to protect and grow their wealth when most paper assets are tumbling. It’s a sensible position to take during times of high political and global economic instability. One way to invest in gold without holding physical specie or bullion is to buy a gold mining company’s stock. Fresh off a merger, Colorado-based Newmont Goldcorp is the largest gold mining company in the world.