The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

One of the most common patterns in bitcoin’s on-chain history is that of the long-term holders stacking sats during bear markets and then selling some of their positions for profit-taking near the tops of bull markets. Right now, long-term holder supply is hitting new all-time highs as we brace for bitcoin’s next bull move up.

We last covered long-term holder supply profit dynamics in The Daily Dive #078. The definitions of Glassnode’s long-term holders and short-term holders can be found here.

As new demand enters the market in the later stage of the bull cycle, long-term holders sell bitcoin to new market entrants, i.e., short-term holders, until the market selling and buying is exhausted. This typically signals the local market price top as new demand is eager to buy at any price. Price then cools off and long-term holders start accumulating again.

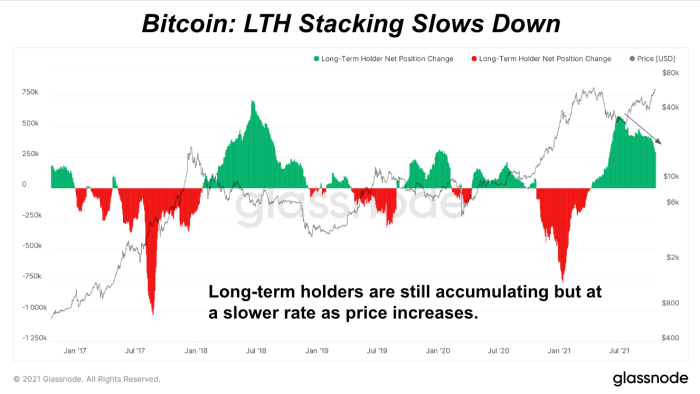

Over the summer, as the bitcoin price fell over 50%, bitcoin entered a mini-bear-market-type environment where long-term holders took the opportunity to stack supply at a rate that we haven’t seen happen before during a bull cycle.

This behavior propelled the long-term holder supply to new all-time highs as long-term holders now anticipate higher prices expecting new retail, institution and futures ETF demand to come into the market. Now, we’re still seeing long-term holders add to their holdings, but at a slightly decelerating rate compared to earlier in the summer