Reports have surfaced that Grayscale Investments is buying more Bitcoin than can be mined.

According to a recent 8-K filing with the SEC, in a one week period, Grayscale added 19,879 BTC to its assets under management.

One block is produced every 10 minutes, post halving each block now produces 12.5 BTC. Therefore, the average daily rate of production is 1,800 BTC (6 x 24 x 12.5), meaning an approximate average production rate of 12,600 BTC per week.

Comparing the disparity between the figures has led many observers to comment that institutional demand, via Grayscale’s clients, will be the driving force in rocketing the Bitcoin price.

One psuedonymous crypto analyst drew attention to Grayscale’s attempt at “corning the Bitcoin market” by saying it’s only a matter of time before BTC price reacts accordingly.

But, price action has failed to respond according to expectations.

The daily chart of Bitcoin (Source: TradingView.com)

What’s more, others have questioned this narrative, concluding that Grayscale’s activities within the Bitcoin marketplace are widely misconstrued.

Who Are Grayscale Investments?

Grayscale offers digital currency investment products, across a range of trusts, in which individual investors can buy and sell via brokerage accounts.

It became an SEC reporting company in January 2020. A requirement of this status is to register information on its shares and underlying crypto assets with the Commission.

The upshot of this move means accredited investors, who purchased shares in Grayscale trusts, can now liquidate their positions within 6 months of placement. Previously, this period was from 12 months.

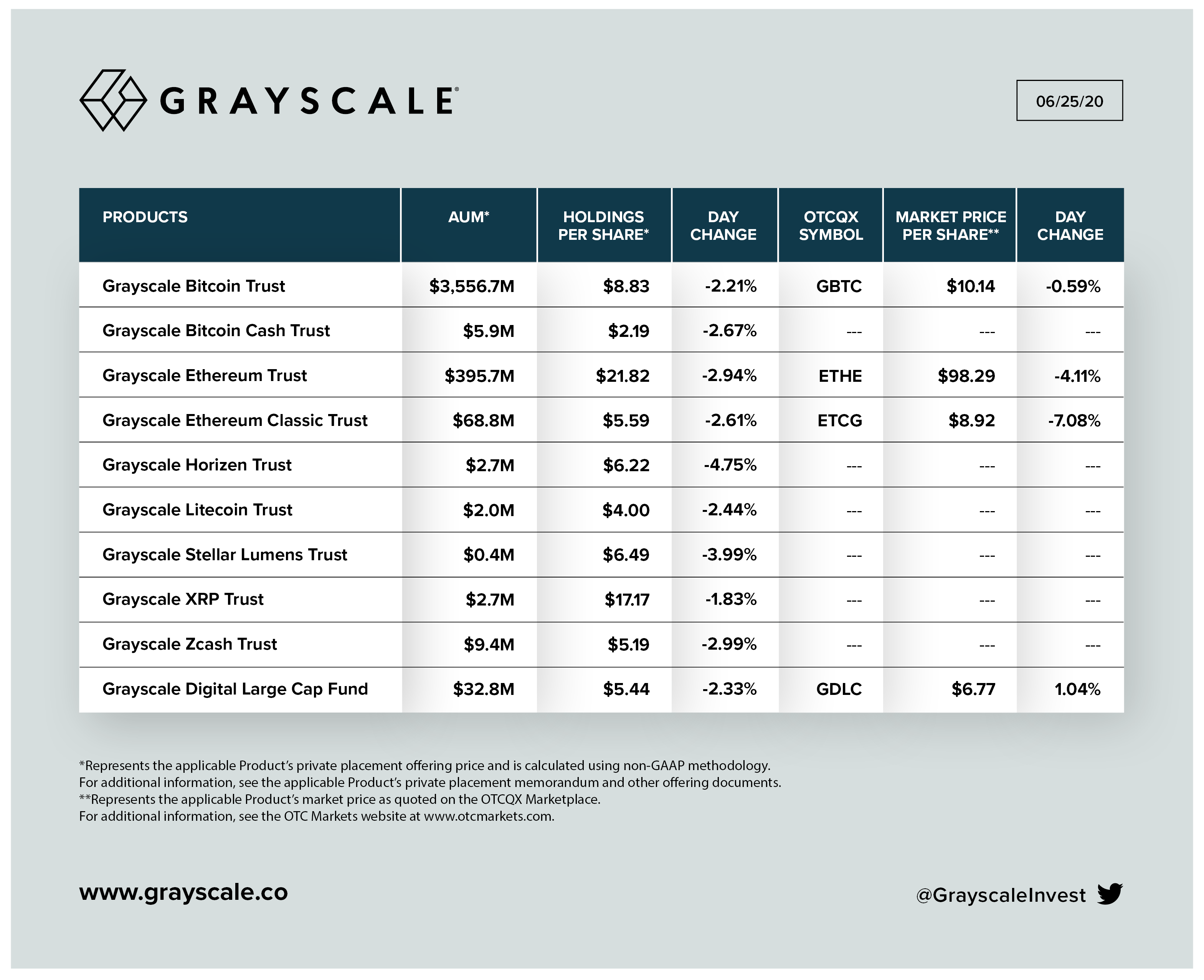

The Grayscale Bitcoin Trust debuted on September 25th, 2013, and is by far the biggest of the Grayscale trusts with $3,557 million of assets under management.

For comparison purposes, the next largest is Grayscale Ethereum Trust, which is 11 times as small at $395.7 million under management.

The assets under management of Grayscale (Source: Grayscale)

The trusts operate in a way similar to physically-backed ETFs, where investors buy and sell publically traded shares.

In respect of the Grayscale Bitcoin Trust, trading occurs under the GBTC ticker. But GBTC is not traded on exchanges, only via the OTCQX – an over-the-counter marketplace.

Grayscale investment trusts, in particular the Grayscale Bitcoin Trust, have gained in popularity as they are accessible through traditional brokerage and retirement accounts. This allows for exposure to cryptocurrencies, but with the safeguards of a reputable third party.

This arrangement solves several challenges with cryptocurrency investing, chief among which is the safe custody of digital assets.

However, these benefits come at a price. Researcher at Messari, Ryan Watkins commented that the value proposition, over direct purchases of cryptocurrency, leaves a lot to be desired.

“Grayscale trust buyers are paying ridiculous premiums for cryptocurrency exposure, and Grayscale purchases much less cryptocurrencies than many would believe.”

Watkins also noted that purchases of Bitcoin by Grayscale are much lower, in real terms, than the figures show at face value.

Bitcoin Supply is Not Being Eat Up by Grayscale

This is a view echoed by others. According to a Reddit post by u/BeakMeat, there are two issues that may exaggerate Grayscale’s seemingly ravenous appetite for Bitcoin.

Firstly, referring to Grayscale’s Q3 2019 report, it was noted that 80% of inflows during this period came from contributions “in-kind”. Meaning “old” Bitcoin, and other “old” crypto assets, were the primary source of their inflows.

This is a distinctly different concept from Grayscale buying the entire daily mining production, and more, in order to “corner the market”.

Also, the Reddit user speculates that institutions are taking full advantage of the reduced 6-month holding requirement to arb the price difference between GBTC and BTC.

“Hedge funds are sending BTC to Grayscale (certainly borrowed on margin) and then 6 months later, can cash it out (GBTC trades at a premium to BTC), pay back the margin loan, and pocket the remaining spread. Wash, rinse, repeat.”

When discounting the “in-kind inflows”, the user estimates that Grayscale is responsible for purchasing just 30% of the newly mined supply.

While there are doubts over the accuracy of this 30% claim, the scenario above is much more fitting with current price action.