According to CNBC, only one stock in any major index has outperformed Bitcoin in 2019. Praised as “better than Bitcoin,” Ohio-based ATM manufacturer Diebold Nixdorf (NYSE: DBD) shares have rocketed 250% this year to claim the title of 2019’s best-performing asset.

Barely. The Bitcoin price has surged more than 200% this year, even after dropping more than $1,500 in a matter of minutes on Wednesday.

Even so, it’s notable that one of the year’s top-performing investments aims to eliminate physical cash, while the other’s business model relies entirely on consumers telling the digital payments regime they will have to pry their Ben Franklins from their cold, dead hands.

What could be better than Bitcoin this year? The downfall of cash has been greatly exaggerated… all the details with @SullyCNBC in today’s #RBI. pic.twitter.com/VJpaipgtgE

— Worldwide Exchange (@CNBCWEX) June 25, 2019

Cash ATMs Heading the Way of the Dodo?

Diebold Nixdorf manufactures automatic teller machines and currency processing systems. But only for physical cash deposits and withdrawals. It’s the largest provider of ATMs in the United States and employes around 23,000 people.

CCN recently reported that the number of Bitcoin ATMs crossed the 5,000 mark globally. Unfortunately, Diebold features nowhere in that global share of installations.

That’s probably because the company openly dismisses the Bitcoin ATM industry and continues to do so. Speaking with CoinDesk in 2015, Devon Watson, VP of global software and strategy at the company proclaimed:

“[Bitcoin ATMs] provide only one benefit to the customer, whereas the majority of ATMs have a number of different possible transactions and meet a number of needs. I think it is fair [to say] that it is probably pretty difficult to be a one-trick pony.”

If Bitcoin wasn’t enough of a threat already, consider the ongoing pressure from governments and corporations worldwide to go cashless. A new wave of tech startups and pseudo-banks like WeChat, Alipay, Robinhood, and PayPal are making it much easier for consumers to bypass cash altogether.

You’d Be Wise Not to Catch a Falling Knife

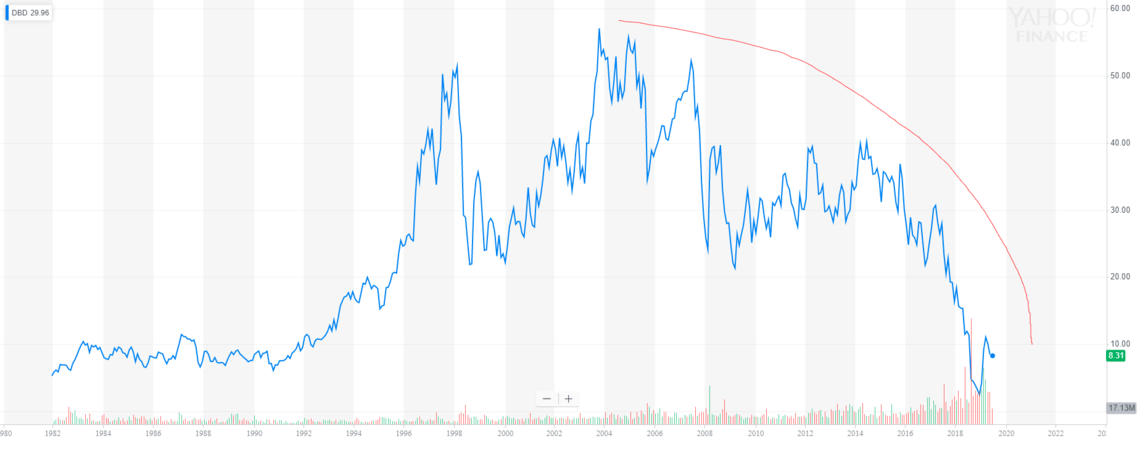

Now that some fundamentals are out of the way, let’s focus on another red flag – the company’s share price. It’s true that investors rebalance their portfolios come year-end, but who in their right mind would want to catch this falling knife?

Even with its flashy 250% gain this year, the stock is down 85% since the financial crisis. An observation that CNBC either missed or conveniently omitted to fit their narrative. Meanwhile, Bitcoin is up several hundred thousand percent since it went live.

In fact, the stock hit a new low of $2.49 a share at the beginning of the year. A level not seen in its entire 38-year history of listing on the NYSE.

You could make the argument that a one year chart resembles just about any other podunk, ripoff cryptocurrency out there. And it might very well go the way of them too.

A Little Bit of Homework Goes a Long Way

The chart speaks for itself. Moreover, a little bit of homework goes a long way.

Like, for example, this late-breaking tidbit. Law firm Kirby McInerney LLP just announced they are investigating claims against Diebold Nixdorf relating to federal securities violations and unlawful business practices.

I think it’s safe to say that the “downfall of cash” has not been exaggerated and is precisely where it’s supposed to be – in the toilet. To quote CNBC’s Brian Sullivan:

“Bitcoin, beaten by a company who’s machines spit out hard cash. Who says currency is dead?”

Anybody with a little common sense. Better than Bitcoin? Um, I think not.