Analyst: Bitcoin Price Will Crash Below $2,000

The terms are simple: if the bitcoin price drops below $2,000 before the 2024 halving, Vays wins, and the loser sends him 100 BTC (worth $200,000 that day). On the other hand, if bitcoin does not fall below $2,000 in five years, Vays sends $250,000 or 1 bitcoin, whichever is worth more.

Here is my bet offer as I take off on a 17hr flight:

If #Bitcoin drops under $2K you give me 100 $BTC = $200K that day.

If it does NOT drop under $2K, I give you $250K or 1 BTC (whichever has a higher $ denominated value)

I have until 2024 halving to be sure $2k won’t happen 🙂— Tone Vays [#UnderstandBit] (@ToneVays) March 5, 2019

Right now, it appears that no one has taken up Tone Vays on his offer, but we did our homework and discovered that the odds are stacked against him. In this article, we reveal the reasons why Vays will almost certainly lose that bet.

First Nail in the Coffin: Bitcoin’s Bear Market Bottom Is In

We have one advantage on Tone Vays: He issued his challenge on March 5, when bitcoin was trading around $4,000. Two months of price action has fundamentally altered the market climate, and BTC must now plunge 75% for Vays to run the table.

Here is my bet offer as I take off on a 17hr flight:

If #Bitcoin drops under $2K you give me 100 $BTC = $200K that day.

If it does NOT drop under $2K, I give you $250K or 1 BTC (whichever has a higher $ denominated value)

I have until 2024 halving to be sure $2k won’t happen 🙂— Tone Vays [#UnderstandBit] (@ToneVays) March 5, 2019

We’ve scoured the replies of this tweet, and it looks like no one took Vays up on the offer. However, we have yet to see Vays publicly state that the bet is closed. Therefore, the bet still stands even after bitcoin’s bullish move. Too bad for Vays, the parabolic run over the last few weeks indicates that the bear market bottom is in.

The bitcoin price has multiple support barriers preventing it from falling below $2,000.| Source: TradingView

In the chart above, you will see that bitcoin has four stellar supports that can keep the price from falling below $2,000.

The first support is $7,800. Bulls can make a stand here, but bitcoin looks overextended for now. Therefore, we believe bears will recover this level in the next few days.

The next support is $6,000. Let me remind you how bears spent most of 2018 trying to take out this level. Now that bulls have reclaimed it, we expect them to fight tooth and nail before they give up it again.

Then, we have $4,500. It’s not as strong as $6,000, but when bulls breached this level in 2017, they launched a massive parabolic run that catapulted the market to all-time highs near $20,000.

Lastly, we have $3,250. Whales protected that territory at all costs. In the chart below, notice how volume was on a consistent decline for most of 2018. However, it came back to life when bitcoin approached $3,250.

Volume spiked as the bitcoin price dropped to $3,000. | Source: TradingView

That volume spike was a clear indication that someone with deep pockets stepped in to stop the bleeding. This entity will not allow his investments to suffer. Thus, we believe that the bottom is in.

Final Nail In the Coffin: Whales Bought the Dip

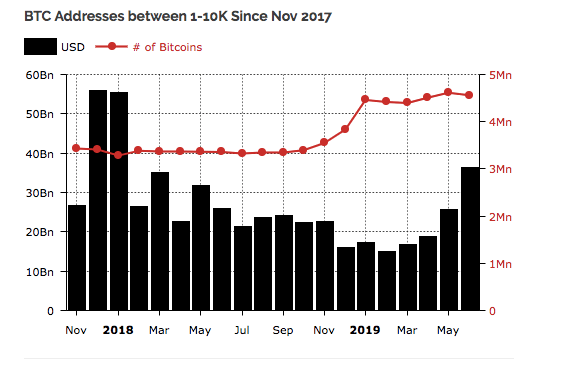

To support our last statement, new research reveals that crypto high-rollers bought 450,000 bitcoins in the last nine months. Most of the buying activity happened towards the end of 2018, which was the height of the bear market.

The rich are getting richer as whales accumulate bitcoin at dirt-cheap prices. | Source: Diar

The prospect of Tone Vays winning the bet is now bleaker after Grayscale revealed that they gobbled up 11,000 BTC in April, 20% of the 54,000 BTC that entered circulation.

You can say that institutions are FOMO’ing (experiencing the fear of missing out). From a technical perspective, however, we believe that these big guns will protect their investments at all costs. In other words, it is very likely that bitcoin will not fall below $3,000 ever again.

Bottom Line: The Bitcoin Price Won’t Breach $2,000

So if you’re the gambling type or if you can spare 100 bitcoins, consider taking the bet issued by Tone Vays. The odds are tremendously in your favor.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.