To put it bluntly: Wealth inequality will not magically disappear in the new Bitcoin economy.

Technology Made Wealth Inequality Worse – Look at Jeff Bezos

A National Bureau of Economic Research report reveals that wealth is more concentrated in the US today than at any point in the last 100 years. Jeff Bezos, for example, is 30 times richer than the richest man was in the 1980s:

Wealth inequality causes the rich to grow exponentially richer. | Source: Inequality.org

Not surprisingly, 100 years ago also marks a pretty significant time in history. That period was known as the “Roaring Twenties” when unrealistic optimism created a massive stock market bubble, a dramatic collapse, economic depression, and ultimately World War II.

If the emergence of modern-day populism is anything to go by, the similarities between then and now are frighteningly similar.

Wealth Inequality in the Burgeoning Bitcoin Economy

Wealth inequality lurks in the new Bitcoin economy. That’s a problem. | Source: Shutterstock

So what does this have to do with crypto? Well, Satoshi Nakamoto is estimated to be worth around $7.5 billion. The pseudonymous creator(s) of Bitcoin is reported to have somewhere in the region of 1 million Bitcoin (BTC). Owning one out of every 21 bitcoins in existence is a very powerful position to be in, not unlike that of Amazon boss Jeff Bezos.

And that potentially leaves us in the same dilemma we face with the current financial system: “if you got all the money, you’re running things, honey.”

Far be it for me to argue that Satoshi Nakamoto doesn’t deserve it. Anyone who contributes to the greater good of society should be richly rewarded. But the fact remains: the new Bitcoin economy may end up being no different than the traditional one.

New entrepreneurs will rise up and build their wealth. And so they should. But what’s to stop these new crypto-capitalists from becoming crypto-socialists? From monopolizing industries and lobbying the newly wealthy? As an employee in the crypto economy, you may want monetary incentives to be aligned with your own ethics. What’s a humble worker to do?

The short answer is governance. The practical answer is that it’s not that simple, especially in a decentralized movement.

Most discussions on governance ultimately go down the on-chain rabbit hole. But perhaps the bigger issue at hand relates to the off-chain dynamics. With how people will create and use the value they’ve earned. Bitcoin, after all, is just a piece of tech. How will it deal with the thorny ethical issues that governments usually tackle?

5/ The exception to “at a certain size, governance problems arise” may be networks like @decredproject that initially focus on nailing governance.

— Chris Burniske (@cburniske) April 6, 2019

Two Solutions to Bitcoin Wealth Inequality

There are no easy answers, but here are two ideas worth exploring today as we build the cryptocurrency economy of tomorrow.

The Hard Income Cap

The income cap is a controversial idea that suggests all individuals in an economy can earn up to a maximum amount. The cap is arbitrary and should ideally be determined by consensus. For argument’s sake, let’s call it $10 million (or ±1370 BTC if you prefer). Anything earned above this cap will be placed in a community fund.

The network must then vote on how best to distribute those funds, perhaps a “clean the oceans” campaign or a low-cost housing solution for the homeless — the idea being to allow individual achievement without sacrificing the greater good.

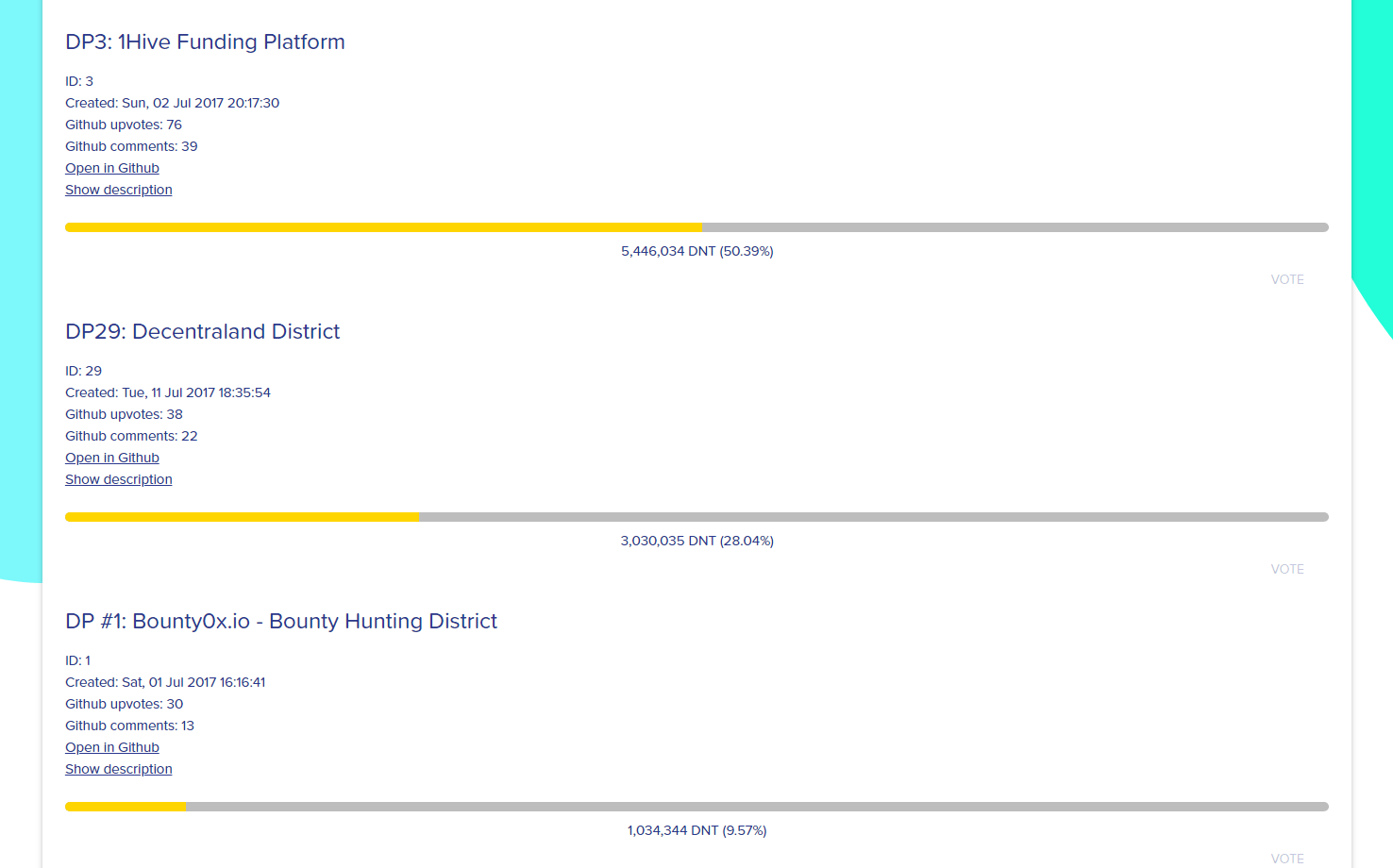

Though not explicitly tied to an income cap, a great example of how this could work can be seen with the district0x voting mechanism.

Token holders voting for the future direction of the network. | Source: district0x

Quadratic Voting

To achieve a greater sense of crypto-community democracy, you need a voting system that cannot just be bought off. Many cryptocurrencies base consensus on the number of tokens owned. In a world of cheap money and centrally run printing presses, bankers can swoop in and just as easily buy cryptocurrency en masse.

Quadratic voting is an interesting idea that prevents the buying of power by assigning every network participant the same amount of voting credits, say 16. The credits have nothing to do with the actual currency of the network. Using a simple squaring rule, the more votes you commit to a specific issue, the more it costs. So:

- 1 vote = 1 credit

- 2 votes = 4 credits

- 3 votes = 9 credits

- 4 votes = 16 credits

This way, everybody in the network has the same 16 credits to vote on issues they are passionate about. Want to clean the oceans? Great. Put all 16 credits on it. Prefer to vote on a whole bunch of other issues? No problem. Spend 16 votes on 16 different issues, thereby spreading your support.

Criticisms

These ideas aren’t foolproof and should definitely be challenged for their drawbacks. For one, they rely heavily on identity-based networks which most crypto fans despise. But that doesn’t mean we shouldn’t explore them. Established norms like nation-states or even the internet were once radical ideas in their own right.

Oh cool, someone’s implementing quadratic voting!

That said, this stuff *does* require a unique-identity layer to work well. I think it’s one of the higher-priority layer-2 infrastructure pieces that could be built right now. https://t.co/fK5uG5kK5u

— Vitalik Non-giver of Ether (@VitalikButerin) July 2, 2018

The Crypto Economy Must Evolve or Die

It’s entirely possible that this issue may not be as big as it appears. The worst thing about ICOs might be the best thing for cryptocurrency. While most new coins have been a complete disaster and many just outright scams, the fact is that for the first time in history anyone can create money and put it on the market.

That means that if Bitcoin, or any other cryptocurrency, fails to meet the needs of its users, they will just pivot to the next solution that can. In the old economy, wealth = power. In the new one, we may actually have a more significant shot at real democracy. The answer will lie in divorcing the acquisition of wealth from the accumulation of power.

The king of crypto is still in good shape, but there are still many questions to be answered if we’re going to prevent excessive wealth inequality from forming in the new Bitcoin economy.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.