The valuation of the crypto market rose by $1.5 billion overnight as the bitcoin price closed on $4,100 and a handful of tokens recorded gains in the range of 10 percent to 25 percent.

Based on the global average price of bitcoin as shown on Coinmarketcap.com, the bitcoin price has remained above the $4,000 resistance level for more than seven days.

Throughout the past several months, many traders expressed their concerns over the inability of bitcoin to break out of crucial resistance levels and if the dominant cryptocurrency can continue to move past $4,000, the sentiment around the market is expected to improve.

Is the Bitcoin Bottom In? Too Early to Tell But Industry Execs Believe So

Earlier this week, reports suggested that some analysts still foresee the bitcoin price testing its previous low in the $3,122 to $3,500 range before initiating a proper accumulation phase in the upcoming months.

The cautious optimism towards the price trend of bitcoin comes from its performance since September 2018. Since mid last year, bitcoin has shown a pattern of experiencing several months of stability and becoming vulnerable to a large drop thereafter.

Bitcoin could avoid a large retrace to the $3,500 region if it can continue to climb up in the $4,000 and $5,000 range and a growing number of traders have begun to forecast a gradual climb to key resistance levels.

Shorting $BTC here is idiotic

— C3P0 [Wookiemood] (@__BTC3P0__) March 20, 2019

Anthony Pompliano, the co-founder and general partner at Morgan Creek Digital, said that institutional investors and asset managers are likely to buy cryptocurrency funds in the long run, committing to the asset class.

Pompliano, better known to the community as Pomp, wrote:

In my opinion, blockchain and crypto-related investment opportunities will be one of the fastest growing sectors in the alternative asset management space in the next 10 years. This means that every alternative asset manager will have to create a strategy to help their LPs gain exposure to the nascent industry.

If asset managers begin to set up strategies to become increasingly involved in the cryptocurrency market, it could lead to an inflow of capital into the market.

While some investors have said that the closure of the Cboe bitcoin futures market could lead to a decline in the volume of bitcoin, BKCM CEO Brian Kelly said that it could signal a bottom in the crypto market.

While technical indicators point toward the possibility of a downside price movement, fundamentals remain strong in a 15-month-long bear market.

I’d be extremely surprised if the bottom wasn’t in for this $BTC bear market.

If you’ve been on the sidelines, what are you waiting for if not now?

If you’re a long-term bull, the 5 year EV is 25-50x, and you’re going to wait to time an entry that’s 20% more attractive?

— Ryan Selkis (@twobitidiot) March 21, 2019

On the fundamentals side, the hash rate of bitcoin has reportedly increased by more than four-fold since it achieved an all-time high price in late 2017.

The rise in the hash power of bitcoin, which represents the amount of computing power securing the network, shows that miners are willing to take losses to support the Bitcoin network, expecting the price of the asset to recover in the long-term.

As Spencer Bogart, a partner at Blockchain Capital said, the developer activity amidst one of the worst bear markets in the history of the cryptocurrency market is still significantly larger than in the previous correction.

“The development progress in this crypto bear market absolutely dwarfs the last one Last time, broad consensus was ‘crypto is going away’ (remember ‘blockchain not Bitcoin’? That was cute…) This time, everyone knows crypto is here to stay. The behind the scenes progress is [growing],” Bogart said.

Best Performing Crypto Assets on the Day

Against both bitcoin and the U.S. dollar, Ontology, Ravencoin, Tezos, Huobi Token, and KuCoin Shares have been the best performers on the day, recording 12 to 25 percent gains within a 24-hour period.

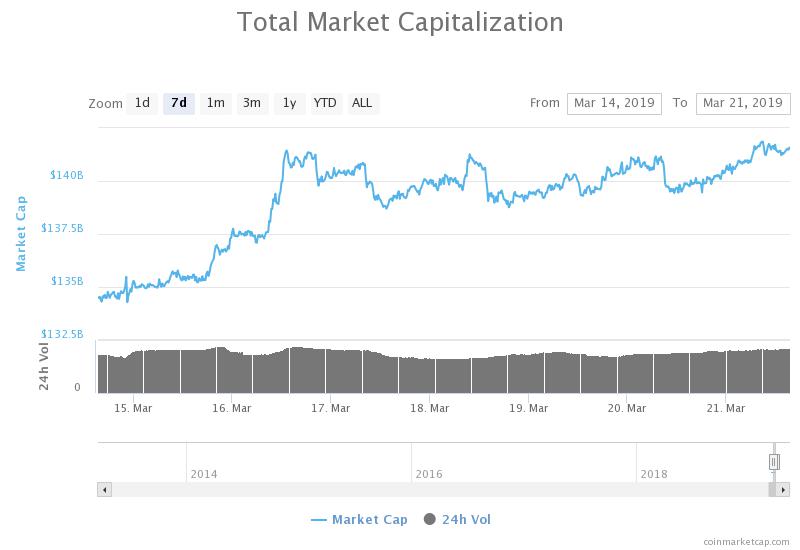

7-Day Crypto Valuation Chart (Source: Coinmarketcap.com)

The valuation of the crypto market has risen from $134 billion to $141.5 billion in the past week, by well over $7 billion.