Bitcoin’s past performance can help you understand where its value is heading. Here’s bitcoin’s price history delineated since its inception.

Introduction

How many times has bitcoin been declared dead? At least 463 times. And it’s never been because of its monetary system failing or its technical operation breaking down, but because of its price crashing.

Some may argue that those two things — tech development and price actions — are inherently connected, but that’s not the case.

Price swings in bitcoin are mainly driven by its own halving cycles as well as macroeconomic events. Since it roared into life from humble beginnings, bitcoin has had a turbulent history. Its infamous volatility has resulted in multiple appreciations of 1,000% in value, only to later drop by as much as 80% or even 90% — such as in 2014.

Every single time, though, it has bounced back, recovered its previous highs and gone on to set new ones. This resilience has proven some of the most seasoned investors wrong and won new supporters along the way.

In this article, we take you through bitcoin’s price history in detail, year after year, around the critical events that shaped it as an innovative monetary system.

Price History

Bitcoin was created in 2008 to challenge the existing system of centralized, credit-based money issued by bureaucrats and unstable banks. By trusting code instead of human vulnerabilities, bitcoin offered a way out of that debacle.

At first the new invention was nothing more than an experiment, but those who read the white paper and were knowledgeable of cryptography, money and finance, could already see it turning into something much bigger than a simple cryptographic toy.

For the first year, bitcoin didn’t have a market price; it had no premine or any rounds of investment from big venture capital firms. Something changed in 2010 when it started to be traded for goods and services which would set it on the path toward today’s innovative and alternative currency system — a journey from $0 in 2009 to $68,000 in only 13 years.

Next, we’ll explore how bitcoin grew from a tech plaything with lofty ambitions to a bona fide monetary asset that’s continuing to deliver on its promise.

January 2009-December 2013

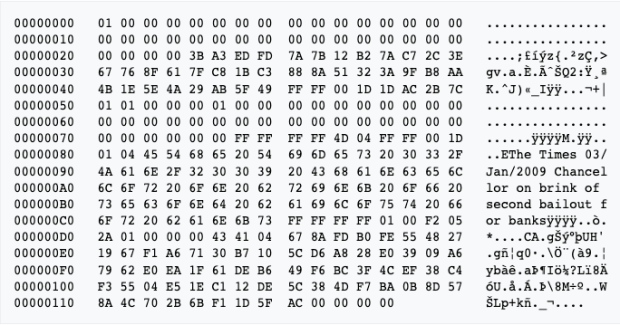

Bitcoin’s proof-of-concept was emphasized in the white paper published on October 31, 2008, by Satoshi Nakamoto. All through 2009, anyone could join the network by mining blocks of Bitcoin with their computers’ CPUs without much effort. All things considered, the price was still $0.

2009: Genesis

Price Range $0-$.0009

Satoshi mined the genesis block with the famous text note and headline from the London Times, “Chancellor on Brink of Second Bailout for Banks” — a clear reference to the 2008-2009 financial crisis.

The block reward was 50 bitcoin and people were mining thousands of bitcoin every day. The New Liberty Standard Exchange recorded the first exchange of bitcoin for dollars in late 2009, though people were mostly trading bitcoin over the BitcoinTalk forum.

The European sovereign debt crisis began in November when Greece revealed that its budget deficit was nearly double the prior estimates. While this event was too early in Bitcoin’s history to affect the price in any meaningful way, indebted sovereigns would continue to be a worry in the legacy monetary system against which bitcoin compared itself.

On October 12th, 2009 a member of the BitcoinTalk forum traded 5050 BTC for a sum of $5.02 via Paypal, which implies a price of $0.00099 per coin and one of the lowest prices per BTC ever recorded. This transaction kicked off a series of OTC purchases in the succeeding months.

2010: Bitcoin Begins Trading

Price Range $.00099-$0.4

On the 20th of February, a person on reddit using the username theymos claims to have sold 160 BTC for $.003, which would make it the lowest ever price recorded.

On May 22, Laszlo Hanyecz bought two pizzas for 10,000 bitcoin which is held as an iconic first exchange of bitcoin for a real-world product; Bitcoin Pizza Day was born.

The first large-scale bitcoin exchange, Mt. Gox, made its appearance on July 18.

In August, the most significant vulnerability in the history of the Bitcoin network was exploited when an attacker managed to spend billions of bitcoin they did not own. The bug was spotted and fixed within hours, and miners had to fork the network and release a new, updated Bitcoin protocol without the malicious transaction included.

2011: Dollar Parity

Price Range $0.4-$4.70

Bitcoin achieved a milestone in February when it reached parity with the U.S. dollar for the first time. On April 26, 2011, Satoshi Nakamoto sent his final email to fellow developers stating he had “moved on to other projects” — and was never heard from again.

Bitcoin payment processor BitPay was founded in May to allow companies to accept bitcoin as a form of payment. By June, the price of one bitcoin had reached $30 but slowly dropped back to the $2-$4 range that it sustained for the rest of the year.

Nonprofits like the Electronic Frontier Foundation and WikiLeaks began taking bitcoin in donations, the latter turning to bitcoin after PayPal had frozen WikiLeaks’ accounts in December 2010.

In June of 2011, Mt. Gox experienced its first hack in which hackers managed to access the company auditors’ computer and change the price of bitcoin to 1 cent.

2012: European Debt Crisis

Price Range: $4-$13.50

The beginning of 2012 was still marked by the European sovereign debt crisis, with some member states becoming highly dependent on the European Central Bank and the International Monetary Fund to service their debts. Cyprus was particularly hard hit, with incremental demand for bitcoin coming from the areas most affected by the Cypriot financial crisis.

Coinbase was founded in June 2012, offering a new way to buy and sell cryptocurrencies.

On the 9th of August, a Mt. Gox glitch caused bitcoin to be priced at $1B a piece on the exchange. 11 days later on the 20th of August, the price tumbled 50% from $15.28 to $7.60 as news of a dubious Bitcoin savings and trust fund scheme offering a 7% weekly interest rate was closed. The operator of the fund, Trendon Shavers would later be sentenced in the first Bitcoin securities-fraud case.

Bitcoin spent the remainder of the year consolidating, and in November it went through its first Halving. The price at the end of the year was $13.50.

2013: The Silk Road Seizure

Price Range: $13-$755

Bitcoin experienced its first post-halving bull run. The year started with a price of just above $13, rallying to $26 over the course of a month. The rally continued in April and quickly rose to $268, before crashing 80% to $51 from the 10th to the 13th of the same month.

In June Mt. Gox stopped processing US withdrawals and by July, the price had retraced back to $68.50. It continued to trade at just above $100 when Silk Road was seized by the FBI in October.

On the 12th of August, the German regulators officially declared Bitcoin a unit of account.

By December, it had spiked to a new all-time high of $1,163, rising 840% in 8 weeks and then fell back to $687 only days later. In December, the People’s Bank of China (PBOC) prohibited Chinese financial institutions from using bitcoin, resulting in a drop to just above $700. It wouldn’t be the last time China “banned” bitcoin.

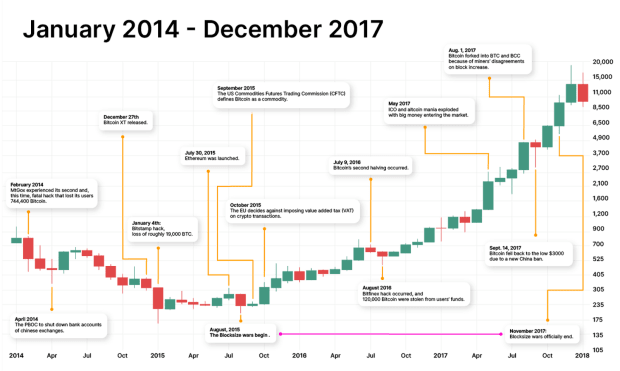

January 2014-December 2017

This period is identified by the advent of altcoins and the injection of big funds into the cryptocurrency market, components of the ICO mania of 2017. Bitcoin went from just over $800 in 2014 to trading at close to $20,000 in 2017.

With big money came greater attention from the media and financial institutions, and governments started to observe Bitcoin and its phenomena more closely — sometimes putting pressure on the market through strict regulations, especially in China.

2014: Mt. Gox Is Hacked

Price Range: $767-$321

Bitcoin’s infamous volatility was very high in 2014. The year started with a price recovery to above $1,000, but by the end of February, it had already retraced back to under $600 with a flash crash down to $111 (a 90% drop from its $1,000 high!) due to troubles at Mt. Gox. — the hack involved user funds of around 750,000 bitcoin. The exchange had to file for bankruptcy following the episode.

The PBOC instructed domestic lenders to close the accounts of Chinese bitcoin exchanges by April 15.

Bitcoin spent the turbulent rest of the year recovering and crashing shortly thereafter and closed 2014 at just over $300.

In December, the first Bitcoin hard fork, Bitcoin XT, was released by Mike Hearn, who aimed to increase maximum transactions per second from 7 to 24. Such an increase meant the block size had to be expanded from one megabyte to eight megabytes.

2015: The Beginning Of The Blocksize Wars

Price Range: $314-$431

On January 4, Bitstamp suffered a serious security breach, losing approximately 19,000 BTC, with a market value of about $5.1m at the time.

Bitcoin started the new year at $314 and kept on relatively quiet compared to 2014, with little volatility and more consolidation. Ethereum was launched on July 30, and its platform triggered the creation of thousands of new cryptocurrencies eager to compete with Bitcoin in the years to come.

On June 22, 2015, Gavin Andresen published BIP 101 which called for an increase to the block size. The Blocksize Wars continued in August with Gavin Andresen and Mike Hearn proposing to increase the block size limit to 20 MB.

In September, the U.S. Commodities Futures Trading Commission (CFTC) defined bitcoin as a commodity. In contrast, the EU decided against imposing value added tax (VAT) on crypto transactions in October. This effectively defined bitcoin as a currency.

2016: Price Recovery

Price Range: $434-$966

The second Bitcoin Halving occurred on July 9, and throughout the year the price of bitcoin was relatively stable, trading between $350 and $700 in the summer months, only to hit $966 at the end of the year.

2016 was marked by the hack of the bitcoin exchange Bitfinex in August, which resulted in nearly 120,000 BTC stolen from users.

2017: Crypto and ICO Mania

Price Range: $998-$14,245

Like 2013, the year that followed the first Bitcoin Halving, 2017 was also historic for bitcoin. In the beginning of the year, the price hovered around $1,000, broke $2,000 in mid-May and skyrocketed to $19,892 on December 15, recording a 20x rise in less than 12 months.

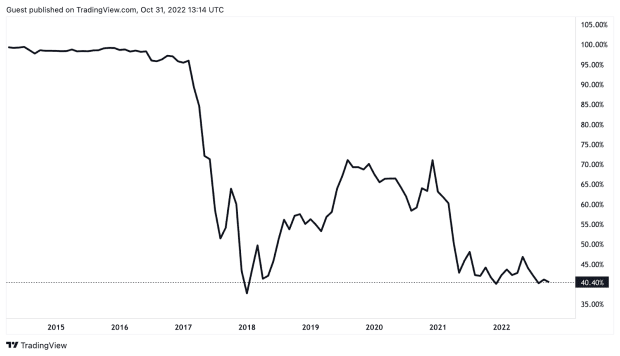

The chart above refers to bitcoin’s dominance in the cryptocurrency market. With the creation of thousands of new cryptocurrencies, and the explosion of the ICO mania, bitcoin’s dominance fell dramatically, as investor funds and gambling money made their way from bitcoin into the altcoin markets.

The ICO mania signaled that venture capital firms had arrived and thousands of crypto projects began to get funding, turning the crypto market into a casino of sorts. Incidentally, the misinformation and FUD around Bitcoin increased around this time.

On August 2, a major bitcoin exchange, Bitfinex, was hacked and nearly 120,000 BTC (around $60m at the time) was stolen by hackers. The bitcoin price immediately tumbled 14% to $214 in a period of just 30 minutes, before it rebounded upwards the very same day — a typical flash crash.

In August, a major upgrade — SegWit — was implemented on the Bitcoin network, which brought some relief to Bitcoin’s scalability issue and enabled the implementation of the Lightning Network.

After breaking $5,000 in the beginning of September, news that China wanted to crack down on bitcoin and cryptocurrencies crashed the price down to the $3,600 range. By October, the cryptocurrency had already recovered to $5,000, and the following epic surge to $20,000 awaited.

Bitcoin futures contracts were first introduced in December, trading on the Chicago Mercantile Exchange (CME).

2017 was the year everyone took notice of bitcoin, from institutional and retail investors to governments and economists. They all started their own battle to back or oppose Bitcoin.

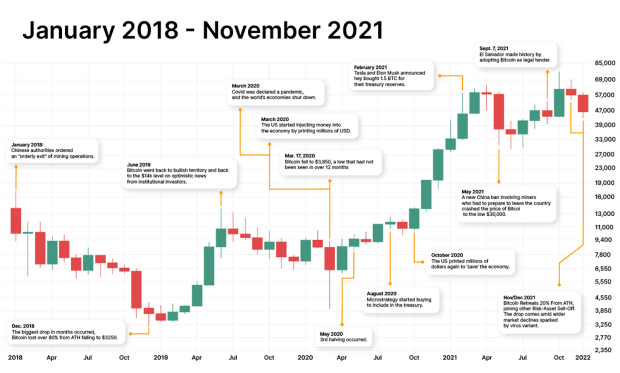

January 2018-November 2021

After the previous era of failed ICOs, the altcoin market tried other ways to raise capital, including STOs (“security token offering”) and IEOs (“initial exchange offering”) — all with poor results. In the meantime, Bitcoin was preparing for a series of technological advances that would benefit its scalability and security, culminating in the Taproot implementation in November 2021.

This was the Covid era, when the world and its economy shut down for nearly two years, bringing dramatic consequences to financial markets and bitcoin. Yet, this was also the era when bitcoin hit the current all-time high of over $69,000 — against all odds.

2018: Bear Territory

Price Range: $14,093-$3,809

After the bullish action at the end of 2017, bitcoin spent 2018 in bear territory, and by the end of the first quarter, its price had already retraced almost 50% from January’s value.

In January, Chinese authorities ordered the closing of mining operations. The notice called for an “orderly exit” without setting a deadline.

On the 18th of June, Facebook announce their cryptocurrency project, Libra. The announcement prompted a swift reaction from government regulators worldwide. The announcement didn’t impact the price of bitcoin too much.

For most of the year, bitcoin traded within the $6,000 and $8,000 range, hitting a bottom of $3,250 in December and closing the year at just over $3,700, down 73% from the beginning of the year.

2019: Leaving The Bear Behind

Price Range: $3,692-$7,240

Bitcoin mainly moved sideways during 2019, with a significant spike in June when positive news about institutional investors and wider adoption of cryptocurrencies converged and triggered a positive move upwards.

Bakkt, the long awaited and much hyped futures contracts was released on the 22nd of September.

For the rest of the year, bitcoin price hovered around the $7,000 mark, ending 2019 at just over $7,200.

2020: Covid Surge

Price Range: $7,194-$28,841

2020 will be remembered as the year of Covid, which affected many aspects of life, including financial markets and bitcoin. When the deadly flu was declared a pandemic in March 2020, markets went into significant turmoil, crashing to price levels that had not been seen since the 2008 economic crisis.

Bitcoin crashed to a low of $4,000 on March 17, as the world witnessed the events unfolding. In May, the third Halving in Bitcoin’s history occurred, and the price slowly recovered, pushing up to over $10,000 again.

MicroStrategy was the first publicly traded company to start accumulating bitcoin in its cash reserves. Micheal Saylor, who had once fiercely opposed Bitcoin, admitted that he did not understand Bitcoin at the time and he had now realized that bitcoin was the world’s only conceivable safe haven and sound money. The company went on to purchase in excess of 130,000 BTC and is showing no signs of stopping.

From the end of August, the series of positive news around bitcoin adoption started to push the price up, as well as the U.S. government’s attempts to help the economy recover by more money printing — bringing the amount of dollars in circulation from 15 to 19 trillion over just a few months. More money printing led many to believe that their dollars were no longer a safe haven, and they started looking at the sound money qualities that bitcoin could offer.

By the end of the year, bitcoin price was back to its previous ATH of $20,000 and surpassed it, closing on December 31 at over $29,000.

2021: From Hope To Despair

Price Range: $29,022-$47,191

After an exciting end to 2020, bitcoin started 2021 with great optimism and had a wild first quarter culminating with the first all-time high of the year in mid-April, at $64,594. Such a bullish movement was likely triggered by claims of continuous liquidity injection in the markets by the Federal Reserve, coupled with news that Elon Musk, Tesla and other businesses had started allocating bitcoin instead of USD in their treasuries. Tesla announced in February that it had acquired $1.5 billion worth of bitcoin — 10% of its treasury — for “more flexibility to further diversify and maximize returns on our cash.”

In May, a new China restriction hit Bitcoin, announcing that financial institutions and payment platforms were prohibited from transacting in cryptocurrencies. Furthermore, all the bitcoin mining plants had to close down. Bitcoin crashed to $32,450 on May 23 and to a new low of $29,970 on July 21. This China ban also had repercussions on the mining industry, with the hash rate dropping significantly in the following months, as miners relocated their ASICs primarily to Russia, Kazakhstan and North America.

In September, renewed optimism followed a series of events, including the hash rate recovery, the news that El Salvador had made bitcoin legal tender and the first futures-based Bitcoin ETF launching in October — which led to the second all-time high for the year at $68,789, on November 10, 2021.

Bitcoin closed out the year by retreating 20% from that all-time high. This decline in bitcoin’s price occurred in conjunction with broader market declines that were triggered by concerns over a new COVID-19 virus variant.

Imminent interest rate hikes, soaring inflation and announcements that the Fed would begin to reduce its bond purchases and slowly drain liquidity from financial markets, were all signs that the world economy was going into recession mode.

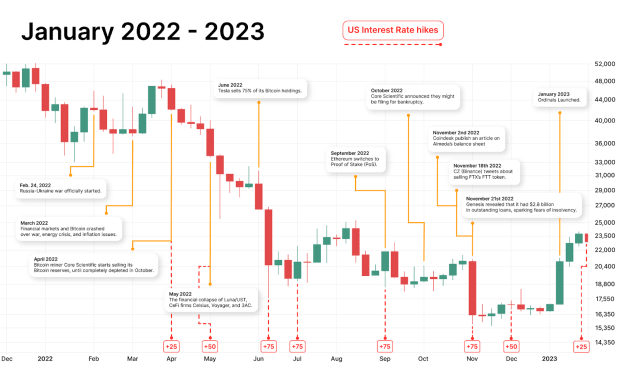

January 2022-Present

2022: Liquidity Is Drained and Insolvencies Begin

Price Range: $46,319-$16,537

The world’s economic and financial turmoil continued in 2022, made worse by a new war on Europe’s doorstep, the removal of Russia from global payment systems like Visa and SWIFT, rising interest rates (.75 basis points each month — totaling 4.25% by year-end), Bank of England bailout, rising inflation, gas and energy crisis and a general recession looming over most of the Western world.

Stricter regulations on Bitcoin and cryptocurrencies called for by governments and regulators added extra FUD to the general mood, further distancing investors from riskier assets.

By January, bitcoin had dropped to $35,000 over the surging threat of an imminent Russia-Ukraine war, which promptly erupted at the end of February. By March, bitcoin had recovered to $47,459, but the global geopolitical and economic crisis caused a new and more durable crash down to the $20,000 range, a level that bitcoin kept for months as the economy tried to find relief.

Beginning in March, the Luna Foundation Guard bought bitcoin as a reserve asset intended to support the Terra Network’s algorithmic stablecoin, UST, in case of “volatile market conditions.” The company acquired 80,000 bitcoin in the process, worth nearly $3 billion at the time.

On May 7, there were early signs of a capital flight from UST as $85 million UST was swapped for $84.5 million USDC, causing UST to lose its peg to the dollar in the process. By the 14th, the Luna Foundation Guard had sold all but 313 of their 80,000 bitcoin in an unsuccessful attempt to defend the stablecoin peg. The bitcoin price was severely affected, dropping 44% between May 6 and May 18.

The fall of Terra caused contagion in the market, leading to the collapse of major CeFi firms Celsius, Voyager and hedge fund Three Arrows Capital (3AC). 3AC was unable to meet obligations toward its partners and creditors, and the default on its loans created a domino effect on all parties involved. FTX rescued these companies in an apparent show of strength.

Tesla sold 75% of its bitcoin holdings in Q2 after the fall in value in previous months.

Mining firm Core Scientific also began selling their bitcoin stack in June, bringing the number of BTC held from 9,618 BTC in April to only 24 at the end of the year. Core Scientific’s liquidity problems only emerged in October, and the company raised the possibility of filing for bankruptcy, listing among the reasons for its struggles the financial exposure to Celsius and its affiliates.

Another bitcoin miner, Argo Blockchain, also experienced financial troubles in October, failing to raise $27 million from a strategic investor and its stock losing over 41% of its value on Nasdaq.

In September, Ethereum differentiated itself further from Bitcoin by switching to proof-of-stake.

At first, November provided respite for the bitcoin price — until Coindesk published a revealing article on Almeda’s balance sheet and the collapse of FTX began. A few days later, Binance’s Chengpeng Zhao (CZ) ignited an exchange war by tweeting his intention to sell $2.1 billion USD equivalent in cash (BUSD and FTT), which triggered a 27% crash over the course of the following two days.

With rumors circulating wildly about Grayscale’s insolvency, Grayscale was forced to release a statement on the 18th declaring that their coins were safe with Coinbase. The markets remained on tenterhooks, and so on the 21st, bitcoin reached a new low of $15,477 as rumors of Genesis insolvency continued.

Bitcoin closed the year at $16,537, down 64% from 12 months earlier.

2023: Price Recovery

Price Range: $16,537 –

With the new year came some fresh optimism as investors began to believe the U.S. Federal Reserve’s interest rate increases would slow down. The bitcoin price broke out on January 10, increasing 24% over the course of four days.

On January 21, Casey Rodomor launched Ordinals, which enabled on-chain Bitcoin native digital artifacts. The price increased 45% in January, closing out the month at $23,150 and showing signs of a strong recovery from a difficult bear market.

FAQs

How much was bitcoin when it first came out?

Bitcoin didn’t have a price when it was first introduced into the world. For several years, there were no exchanges where users could trade it for fiat money and it was only possible to accumulate bitcoin through mining — or buying it peer-to-peer from someone who had mined it.

What is bitcoin’s highest-ever price?

Bitcoin’s highest-ever price is $68,789, reached on November 10, 2021.

Is now a good time to buy bitcoin?

The best time to buy bitcoin depends on the investor’s situation; however, when the price is low, it is cheaper to accumulate more. This article explores bitcoin’s price patterns and the macro environment around it, which should make it easier for investors to more conveniently identify when it’s the best time to buy or sell bitcoin.

Conclusion

It should be clear by now that bitcoin is an asset like no other. Its ecosystem tends to operate on four-year cycles, while its price may be defined by factors relating to monetary policy, such as the implementation of quantitative easing or quantitative tightening policies.

In just 14 years, bitcoin’s incredible growth has established it as a new asset class everyone started to pay attention to.

Bitcoin Magazine provides a lot of help for those who’d like to do their homework to better learn about bitcoin’s price movements and how to make informed investment decisions.

Consider education as a tool to understand why Bitcoin has gone so far in just over a decade, and you may be able to shift to a longer-term vision beyond its day-to-day volatility.