Introduction

Firstly, thank you kindly for clicking on my click-bait title — it’s trench warfare out here on the environmental, social and corporate governance (ESG) front at the moment, and comparisons are being thrown around left, right and center.

Nobody hates comparisons more than I do, but as long as long bows are being drawn, I reserve the right to pull the “muh military!” card. But first, we must understand how the military-industrial complex (MIC) is inextricably related to the legacy financial system, via the mothers of all legacy industries, oil and the petrodollar.

The MIC is more essential to the financial system than you may think. Obviously, I had my suspicions and the basic facts, but this piece for Bitcoin Magazine by Alex Gladstein, chief strategy officer of the Human Rights Foundation, really drove things home for me. Gladstein’s piece is a brief read, 6,500 words or so, and should be considered a mandatory minimum prerequisite reading for basically all Bitcoiners, certainly ones who are serious about getting into the ESG or human rights discussion.

This piece will aggregate the current literature on military emissions, as well as a summary of methodology and assumptions behind these numbers. I will then compare these numbers to Bitcoin. It is heavily reliant on the following four sources (I would recommend reading all of them if you’re interested in this topic):

- Crawford, N. (November 2019), “Pentagon Fuel Use, Climate Change, And The Costs Of War,” Watson Institute Of International And Public Affairs, Brown University.

- Parkinson, S. (March 2020), “The Carbon Boot-Print Of The Military,” Responsible Science Journal, No. Two.

- Parkinson, S. (May 2020), “The Environmental Impacts Of The U.K. Military Sector,” Scientists For Global Responsibility.

- Parkinson, S. and Cottrell, L. (February 2021), “Under The Radar: The Carbon Footprint Of Europe’s Military Sectors,” Scientists For Global Responsibility.

While solid data only exists for the U.S., Europe and the U.K., they make up a dominant enough share of the world’s military industry and expenditure that global conclusions can be drawn. Dr Stuart Parkinson of The Scientists For Global Responsibility, an author of three of the abovementioned reports, concludes in one of them:

“I estimate that the carbon emissions of the world’s armed forces and the industries that provide their equipment are in the region of 5% of the global total. But this does not include the carbon emissions of the impacts of war — this could be as high as 1%. So the total military carbon boot-print could be 6%.”

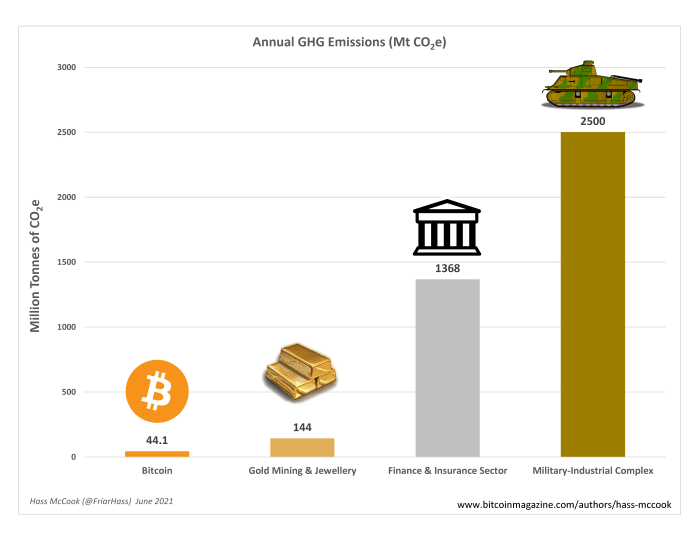

As at time of writing, The Cambridge University Centre For Alternative Finance estimates Bitcoin’s energy use to be 97.9 terawatt-hours (TWh), with total emissions of 44.1 million tons of carbon dioxide and carbon dioxide equivalents (MtCO2e), a measly approximate 0.09% of world’s 50,000 MtCO2e emissions, and over 55- to 65-times less than the MIC.

Scope Definition

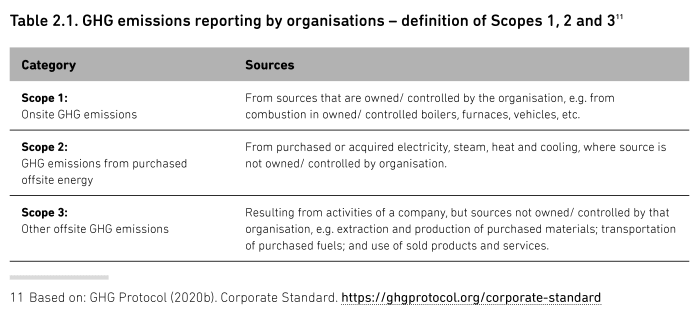

While I was both positively surprised and alarmed by the level of detail that the U.S., U.K. and some EU governments voluntarily disclose to the UN Framework Convention On Climate Change, the data divulged is a little light on scope. The below table shows the different levels of scope to consider when it comes to assessing greenhouse gas (GHG) emissions, and is used as the basis of scope definition in the reference texts listed above.

Although great disaggregated data exists on scopes one and two items, this article will also consider the scope three items, which tend to account for the lion’s share of total emissions. For example, while scopes one and two account for the general operation of an aircraft carrier, they do not account for the design, construction and eventual disposal of said aircraft carrier that scope three calls for.

The only explicit items excluded from the numbers are the knock-on social and environmental impacts of war itself, but some qualitative comments will be made on these in the conclusion of the piece.

What Do We Know About The World’s Largest Armies?

U.S.

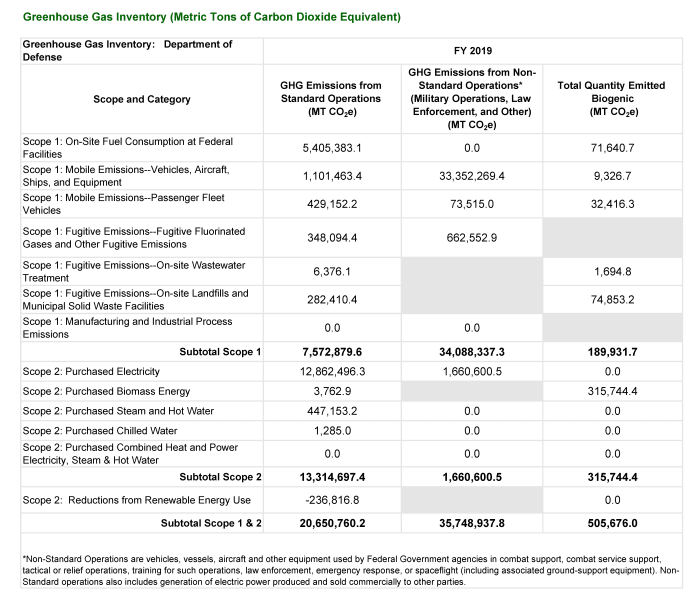

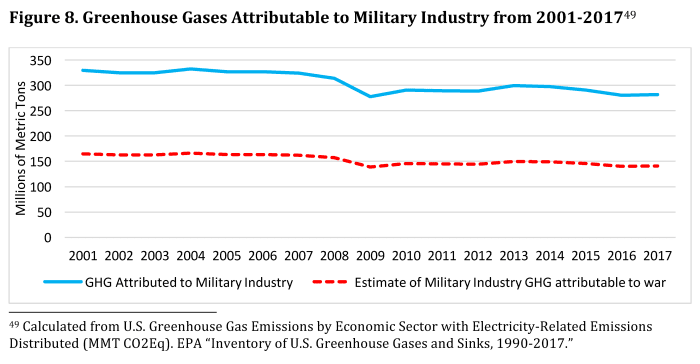

“Pentagon Fuel Use, Climate Change, And The Costs Of War” by Professor Neta Crawford presents available public data on the U.S. military’s emissions, and goes further by calculating the carbon footprint of the U.S. MIC. Although these are older, 2017 financial year figures, the latest 2019 figures only show some slight improvements.

To quote Professor Crawford:

“[A] complete accounting of the total emissions related to war and preparation for it, would include the GHG emissions of military industry. Military industry directly employs about 14.7% of all people in the U.S. manufacturing sector. Assuming that the relative size of direct employment in the domestic U.S. military industry is an indicator for the portion of the military industry in the U.S. industrial economy, the share of U.S. greenhouse gas emissions from U.S.-based military industry is estimated to be about 15% of total U.S. industrial greenhouse gas emissions.”

She notes that the 15% number does not even allow for “indirect military jobs, and therefore indirect military related emissions.”

I’ll go easy on The TroopsTM and we’ll just call it 15%. This results in an additional 280 MtCO2e, of which more than half is directly attributed to an active war effort, on top of the 56.9 MtCO2e covered under scopes one and two. This brings total U.S. military emissions to 336.9 MtCO2e, almost seven times Bitcoin’s impact.

Dr. Stuart Parkinson is the author of all of the research papers looked at in the following three sections on the U.K., EU and rest-of-the-world armies, respectively. His methodology is very similar to that of Professor Crawford, but goes into more granular detail on the military industrial complex of several nations. The highlights are as follows.

U.K.

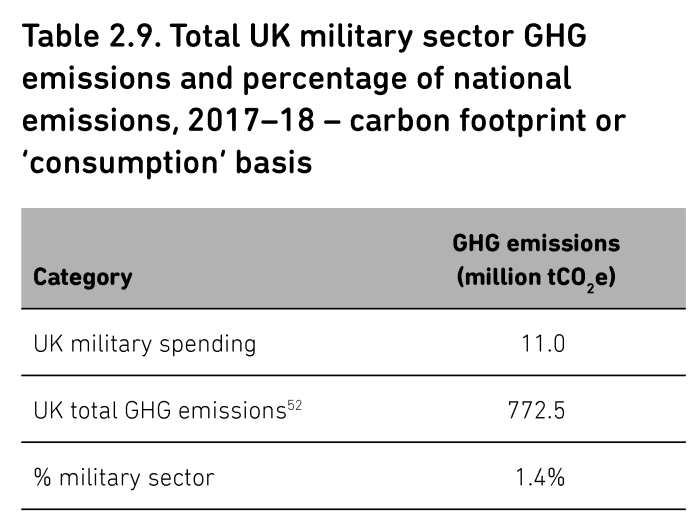

In terms of the scopes one and two items, while far humbler than the U.S., the carbon footprint of the U.K. MIC was about 11 MtCO2e. 1.22 MtCO2e stems from the “standard” emissions of all of the MOD’s estate, which covers 1.5% of the U.K. landmass (excluding foreign installations). Another 1.81 MtCO2e come from the fuel use of it’s 5,000-plus land vehicles and tanks, 700-plus aircraft and almost 100 naval vessels. Based on the aggregated GHG reporting of the largest 25 military suppliers and exporters based in the U.K., which employ 85,000 of the 110,000 jobs resulting from MOD spending, 3.23 MtCO2e was produced. Indirect employment accounted for 1.67 MtCO2e, and non-U.K.-based operations account for the remainder. In all, it’s roughly 1.4% of the U.K.’s total emissions.

EU

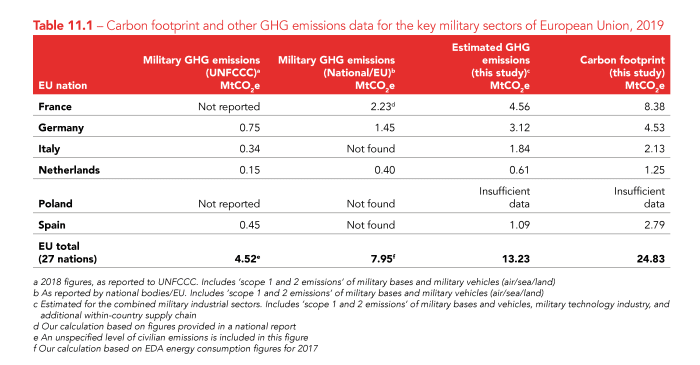

In “Under The Radar: The Carbon Footprint Of Europe’s Military Sectors,” Parkinson uses the same methodology from his UK. .analysis, but using European data from sources such as NATO, individual nations and reported data from the largest military contractors in Europe. Summary data is below. A total of 24.83 MtCO2e was spewed by The EU27 militaries.

Rest Of The World

In “The Carbon Boot-Print Of The Military,” Parkinson goes over his U.S., U.K. and EU data, but quickly concedes that precise figures for large military spenders like China, Russia, Saudi Arabia and India are much less transparent. As you can read in the introduction, he concluded that emissions as a result of global military spending results in 5% of global emissions in a “quiet” year, and 6% or more during a year with active conflict. With 50,000 MtCO2e being produced globally, this results in between 2,500 to 3,000 MtCO2e/yr, depending on what your definition of “quiet” is.

Conclusion

The numbers, as always, speak for themselves. Bitcoin, in the scheme of things, emits nothing compared with the positive value it provides, and compared to its legacy counterparts. While the legacy MIC runs around desperately changing all of its lightbulbs to LEDs to slightly offset the emissions of their bomber fleets, Bitcoin miners and sovereign nations are literally piping into volcanos for zero-emission mining. Many Bitcoin miners currently run on negative-emissions energy by mining using waste flared methane. For Satoshi’s sake! There are actual serious people alive today who believe it is possible to stop Bitcoin. I repeat, The El Salvadoran government is literally figuring out how to pipe into a volcano in order to produce 95 megawatts of lava-powered, clean and cheap energy to mine bitcoin — this would account for just under 1% of all energy currently consumed by the network.

The MIC will NEVER improve from an environmental point of view, let alone the social and economic disaster and ruin it brings in its wake. Bitcoin plugs into the wall (or a methane vent, or a volcano). That’s it. Nobody has to die. I have little doubt that by 2025, 25% of Bitcoin’s energy will come from stranded energy sources, and by the end of the decade, Bitcoin will have negative emissions, due to the amount of methane emissions it will offset. This will not be because Bitcoin miners are environmentalists, but because it’s the most profitable thing to do.