Bitcoin started off the week on the wrong foot. Its price recently dropped below $9,000 for the first time since late May. The sudden bearish impulse sent investors into “fear,” according to the Crypto Fear and Greed Index.

Despite the state of commotion in the market, the flagship cryptocurrency sits above a critical support barrier. The 78.6% Fibonacci retracement level appears to be holding strong and preventing the price of BTC from a steeper decline.

But failing to continue to do so could spark a bear run towards $8,000 or even $6,000.

While some market participants prepare for the worst, data shows that large investors are accumulating Bitcoin on every dip. If history repeats itself, this could be a sign that the pioneer cryptocurrency is poised for a substantial upward movement.

Bitcoin Whales Fill Up Their Bags

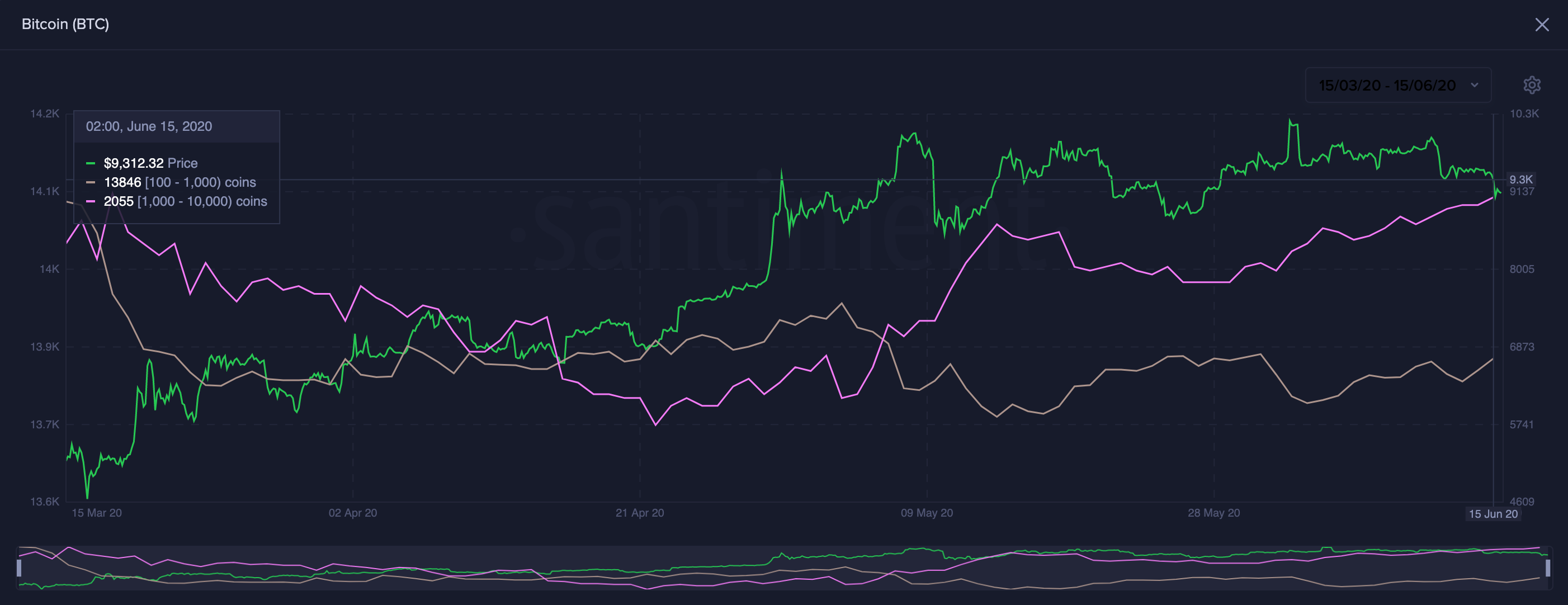

Santiment’s holder distribution chart reveals that something seems to be brewing with Bitcoin. The number of addresses with millions of dollars in BTC, colloquially known as “whales,” is steadily rising despite the recent downward pressure.

Indeed, the number of addresses with 100 to 10,000 BTC has done nothing but shoot up since the beginning of the month. Since then, roughly 75 new whales have joined the network.

The increase in the number of large investors may seem insignificant at first glance, but when considering that they hold between $900,000 and $90 million worth of Bitcoin, the sudden surge can translate into millions of dollars.

Moreover, the enormous holdings of these large investors allow them to have a disproportionate impact on prices. They have the ability to coordinate buying and selling activity and manipulate the market at their will.

If the buying spree continues, the bellwether cryptocurrency may be bound to resume its historic uptrend.

Strong Resistance Ahead

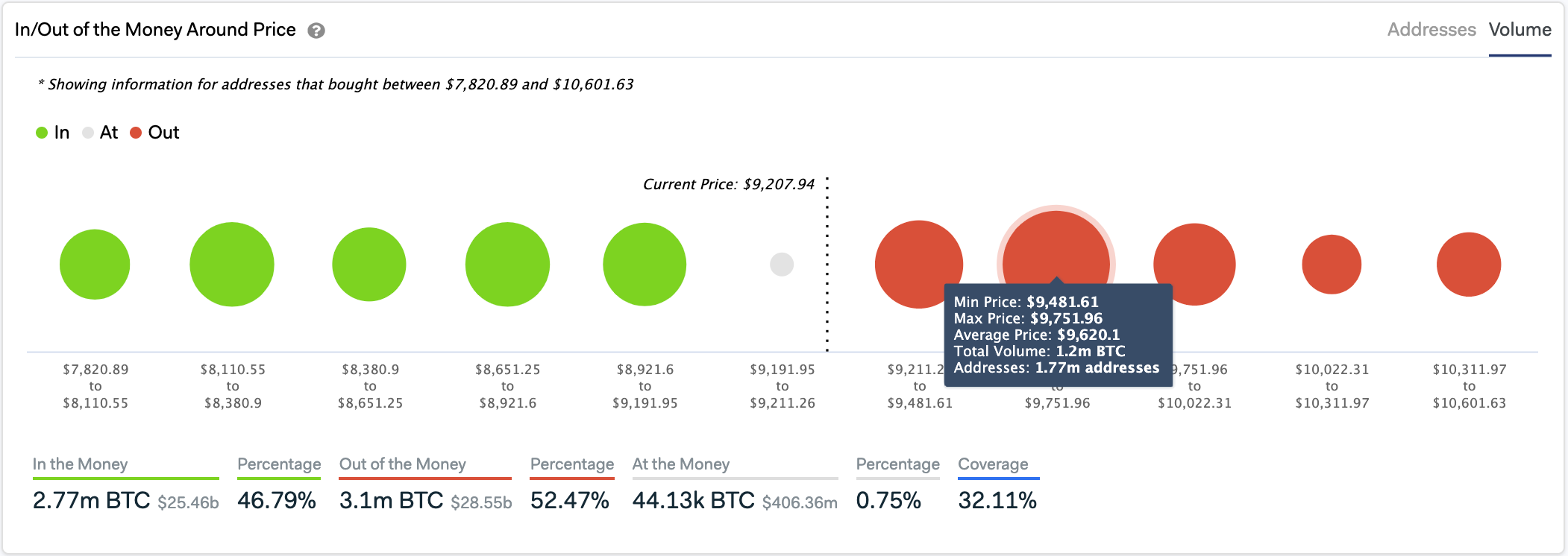

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that there is a considerable supply barrier ahead of Bitcoin that may absorb any upside pressure.

Based on this on-chain metric, the area between $9,460 and $9,730 represents a major resistance level. Here, the IOMAP cohorts show that over 1.8 million addresses bought over 1.2 million BTC.

An increase in demand that allows Bitcoin to move past this resistance wall may allow it to retest mid-February’s high of $10,500 or even reach a new yearly high of $12,000. Everything will depend on the strength of the $9,000 support level and its ability to hold in the event of an increase in sell orders behind BTC.

Due to the unpredictability of the cryptocurrency market, investors must wait for a clear break of the $9,000 support level or the $10,500 resistance to enter any long-term trade. Moving past any of these supply barriers will determine where Bitcoin is headed next.

Featured Image from Shutterstock

Charts from TradingView.com