Since Luxor, a bitcoin mining pool, mined a record-setting 3.96 MB block (#774,628) on the Bitcoin blockchain, block sizes have been larger than they were prior to that block height in the past 12 days. Statistics show that blocks larger than 3 MB are now quite common, and demand for Ordinal inscriptions has risen as they have surpassed 65,000 this weekend.

Sustained Use of Blocks Larger Than 3 MB Continues on the Bitcoin Blockchain

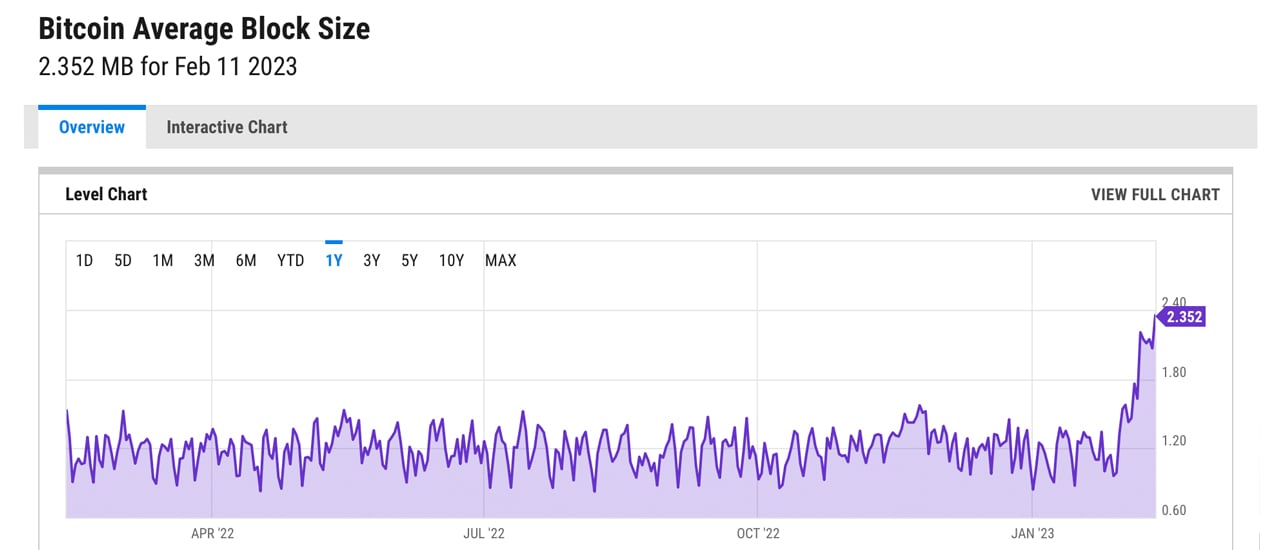

Observers saw history made on Feb. 1, 2023, when Luxor mined the largest block in the Bitcoin blockchain. The record-breaking block (#774,628), measuring 3.96 MB, surpassed the previous record set on Aug. 11, 2022, when Antpool discovered block #748,918, which was 2.765 MB in size. At that time, there were fewer than 1,000 ordinal inscriptions on the Bitcoin blockchain, but the trend rapidly increased to reach 50,000 inscriptions by Friday. By Sunday afternoon on Feb. 12, over 66,000 inscriptions had been recorded.

As a side effect of the ordinal inscriptions trend on the Bitcoin blockchain, fees for sending a BTC transaction have risen. Bitcoin.com News recently reported a sharp 122% increase in Bitcoin network transfer fees one week after Luxor mined the 3.96 MB block. On that day, the average fee for a transaction on the Bitcoin network was $1.704, and today it is 0.000079 BTC or $1.74 per transfer. In addition to the rising fees, block sizes have regularly exceeded the 3 MB range since the record-setting block #774,628.

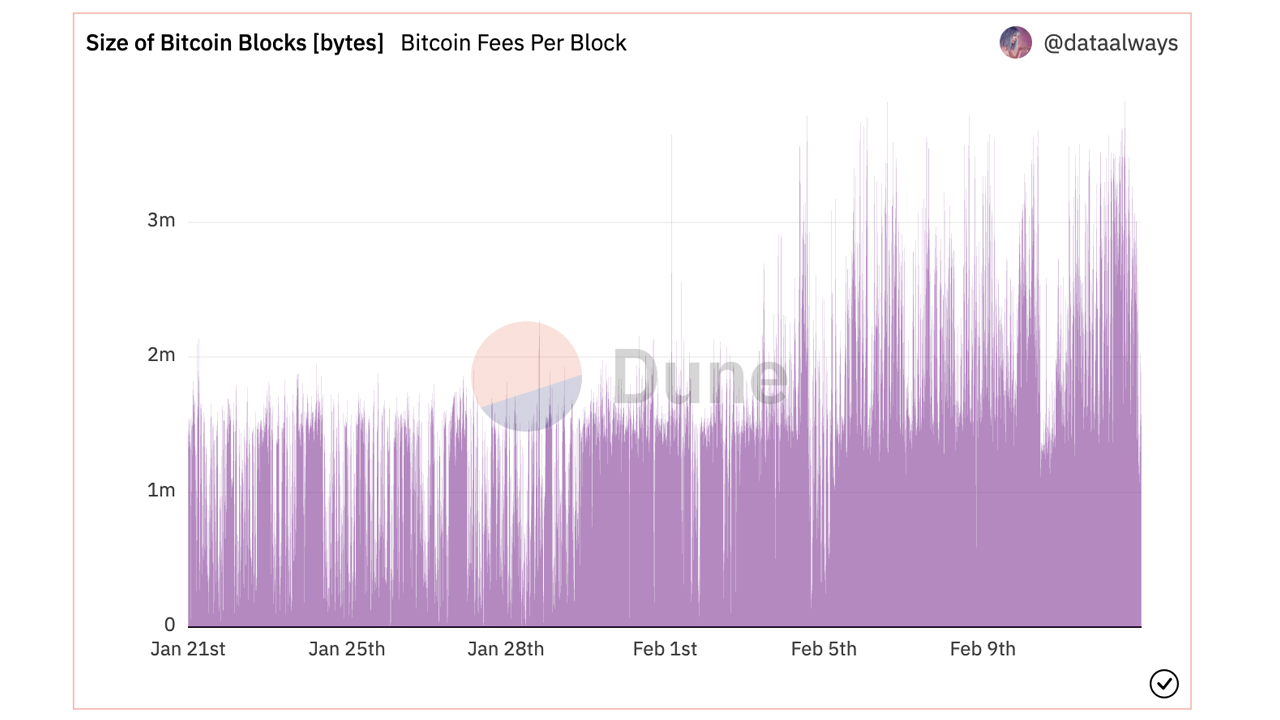

Data from Dune Analytics indicates a high number of block sizes exceeding 3 MB after Feb. 5, 2023. Metrics from mempool.space also reflect this trend, as 3 MB block sizes are easily visible by scrolling back over the last 12 days. For example, block height #776,115, mined on Sunday, was approximately 3.30 MB and held approximately 795 transactions. Block height #776,116 was 3.367 MB and held roughly 912 transactions.

There are numerous instances of 3 MB+ blocks, and our analysis shows that larger blocks confirm a smaller number of transactions. For example, block height 776,218 was approximately 1.68 MB but held 3,385 transactions. While bitcoin miners work to clear the unconfirmed transaction count in the mempool, statistics from jochen-hoenicke.de and txstreet.com show occasional backups.

What do you think about the sustained use of larger block sizes on the Bitcoin blockchain? Let us know your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.