The bad news first: ICOs are in big trouble.

You wouldn’t think so just by looking at the stats: just last week, 400 ICOs were announced according to one of the many ICO newsletters that have gained traction. Last quarter, over $ 1,5 bln were raised by projects accepting primarily or exclusively cryptocurrencies and handing out a token in return. The cottage industry around this new vehicle has grown exponentially, with entire marketing firms and PR agencies rearranging their business to exclusively serve the ICO market.

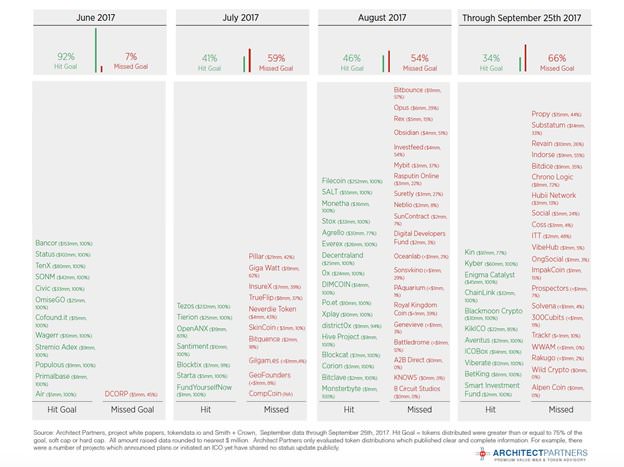

Upon closer inspection though, a rather different picture emerges. More and more ICOs are missing their funding goals (source: Architect Partners).

And some of the most successful ICOs of the past months are in turbulences, too. One of them is already fighting over money. A second one is having trouble delivering the promised tokens to investors, leading some to speculate on its impending implosion. Compared to startups, most crypto ICOs have failed to deliver on a minimum viable product and real adoption, even with millions of funding in the vaults. And of those startups that successfully raise funds, only 1 in 10 actually use the token in their network.

“Of the 226 ICOs analyzed, only 20 – such as Storj, Augur and TenX – are used in the running of their networks…” https://t.co/s72zGRs9vO

— Dr. Julian Hosp (@julianhosp) October 26, 2017

What about that cottage industry? It’s not looking much better. From scam artists to shady “ICO advisors”, from rampant FB marketing to pump & dump Telegram groups, Russian bots, false followers, fake endorsements, email phishing, and insecure Slack channels with millions stolen from investors as a consequence.

This is very much still a wild, wild west.

But the problems run much deeper.

Originally, blockchain evangelists promised us greater decentralization, democratization and true financial freedom, independent from institutions such as banks and governments. But has this vision of the world really come to pass, or even taken a good step closer to being realized? Is the world more equitable thanks to crypto & blockchain?

In reality, most, or many of the projects are even more inequitable than the broader economy. If you take a look at the Gini coefficient of a couple projects using the ICO Transparency Monitor, here’s what you find:

Gnosis:

EOS:

district0x:

Bancor:

At present, ICOs go mostly to savvy old world investors through pre-sales with the smaller investors often times ‘holding the bag’.

What’s still sorely missing are industry level institutions that take on the task of self-regulation. Any functioning branch of the economy has watchdogs, industry associations, quality certificates, and auditors. Ultimately, any economy needs trust and reliable rules in order to function.

For the first seven years, the crypto world talked mostly about technical innovation and societal critique-by-creating. Now, the conversation has started to shift. The enormous sums of money involved created an urgent demand for answers to questions of legality. What are we to expect from regulators? How will governments treat this new technology? The crypto community is realizing that if it wished to maintain and further develop its reach into mainstream society, tech was not enough to get the job done.

This solves a big problem: how do you enable non-blockchain companies to make use of the technologies advantages? Surveying the current blockchain landscape, the large majority of ventures in the space are themselves blockchain projects.

Current ICOs are also near exclusively run by on-chain companies. They offer utility tokens which you can use for on-chain products. Neufund however allows investors to invest into off-chain companies by putting shares on-chain.On first sight, this is something impossible because shares are some piece of paper or a certificate. Anybody who takes this on faces a huge legal challenge.

But there is a solution: the nominee structure. The nominee holds the shares, the nominee issues the tokens. That is per se totally legal in Germany and any other European jurisdiction.

The first seeds of this self-regulation efforts are forming: the Ethereum Enterprise Alliance (EEA) has been successful at gathering the large corporates under its wings. There are now several initiatives starting the work of educating the public and regulators alike, and crafting policy recommendations for the relevant authorities to adopt (e.g. Blockchain Policy Initiative). Some have even been successful in convincing local and state governments to run entire campaigns for attracting startups in the space to their jurisdiction. Forward thinking mayors and governments are quickly realizing the value of competing early in the coming trend of jurisdictional arbitrage.

Rulesets are a competitive advantage, and an increasingly necessary one in a globalized world. Estonia was one of the earliest to realize this and begin its modernization. In the 90s, the tiny country (1.3M residents) upgraded its governmental and business infrastructure to the internet, making it possible to sign contracts, open bank accounts, and file taxes without ever having to visit a notary or governmental office. Now, the country takes it one step further and offers the benefits of its infrastructure to anyone via the “e-Residency program”. It has attracted thousands of entrepreneurs and digital nomads, many of which also innovating in the cryptocurrency and blockchain space. With the ground prepared for instant adoption, Estonia is even considering to launch an “Estcoin” in their efforts to open source their rulesets for the benefit of all. Many other countries all over the globe have joined the race to be the new ‘silicon valley of crypto’, with Switzerland currently in the lead.

Stricter regulation can benefit startups looking for funding via token sales as well. As Andre Eggert, partner at Lacore LLC, puts it: “Securities law is making sure that the market has the information it needs. An informed market is more liquid and that might even result in increased prices and demand for tokens.”

And already there are a number of companies rising to the challenge. In the US, Equibit and t0 work on bringing equity and financial instruments more generally into the token era. Filecoin, in collaboration with Coinlist, pioneered the SAFT agreement which has since been adopted by a large number of ICOs. Now, Pegasus Fintech is floating the idea for a novel type of token-assisted fundraising they call PIBCO: Public Initial Blockchain Offering.

“The PIBCO model advances the ability of Blockchain and Cryptocurrency based businesses to raise funding in a global environment and meet jurisdictional regulatory compliance.”

~ David Lucatch, Founder & Chair of Pegasus Fintech

In this model, Listed corporates will be able to release Class A shares for conventional currency and Class B shares for cryptocurrency tokens. The tokens are then redeemable for Class B shares, which in turn will be redeemable for Class A shares. Clever!

Over in Europe, a number of ICO platforms routinizing the tech and marketing, but none have brought much legal innovation to the table. The German financial authority BaFin recently announced that it is watching the ICO space closely, warning both ICO organizers and investors to be careful. So far Neufund is the only player in the European market to explicitly push forward the legal and regulatory aspects. A German GmbH (private limited company), Neufund has created what they call Equity Token Offerings (ETO). They plan to make this mechanism available to any number of companies, independent of whether their business model is based on blockchain.

Featured image courtesy of Shutterstock.