By CCN: Kik might very well have good intentions by inviting a fight with the U.S. Securities and Exchange Commission. If the litigation, which the securities regulator has filed against the company, goes Kik’s way, it will set a precedent for other blockchain startups that have taken a similar approach to raise funds in an initial coin offering (ICO). But if the other shoe drops, Kik could find that it has placed a target on the backs of its peers that have pursued a similar fundraising path – an ICO seemingly with the SEC’s blessing.

Kik filed a Form-D with the securities regulator, paving the way for the company to leapfrog the registration process and accept funds from accredited investors only. In doing so, the company attracted some $100 million to its coffers. They were not the only blockchain-based startup to pursue this route. According to stats in MarketWatch, there were nearly 300 of such deals last year, raising a combined $8.7 billion.

The number of Form-D ICOs has tapered off in 2019. | Source: MarketWatch/SEC/Edgar

Among them was Telegram, which raised an eye-popping $1.7 billion in its ICO. Now all of the companies that completed Form-D filings are likely waiting with bated breath for the outcome of Kik’s trial. Crypto attorney Katherine Wu told MarketWatch:

“If Kik loses to the SEC in court, the vast majority of ICOs that raised money using similar fund-raising mechanisms could suffer negative consequences as a result.”

Kik’s Form D

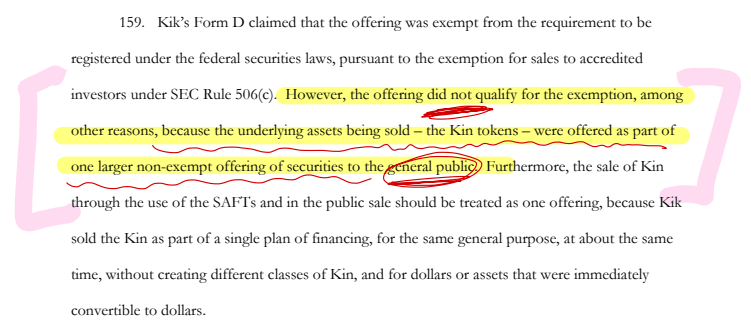

So if Kik actually filed with the SEC for its ICO, why are they fighting? According to the SEC’s complaint, which Katherine Wu has marked below, Kik did not qualify for the securities registration exemption in which it was claiming.

The SEC says Kik’s Kin tokens are securities. | Source: Katherine Wu/SEC Complaint

Among other details, something other Form-D ICO companies are probably studying is the SEC’s belief that:

“Kik did not undertake, through its KYC process or otherwise, to determine whether these public sale investors qualified as “accredited investors,” as that term is defined by federal securities regulations.”

The complaint is chock-full of plenty of other details, which Wu summarized as a “scathing read.”

Kik’s Chances

Kik has been defiant against the Wall Street regulator, with the company’s attorney previously stating of the SEC:

“We do not believe they will withstand judicial scrutiny.”

They are expected to face a jury trial, however, which according to Wu is an “important” distinction as the plaintiff makes its case against the blockchain-based company – including the fact that its messaging business has yet to be profitable. The plaintiffs will argue that the ICO, using the words of a Kik board member, was a “hail Mary pass.”

If it fails, it could not only deflate Kik’s future but that of other ICO companies that filed a Form D with the SEC. Wu says Kik faces an “uphill battle in winning against the SEC.” If that’s the case, we could begin to see a wave of settlements unfold between other Form-D ICO companies and the securities regulator.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.