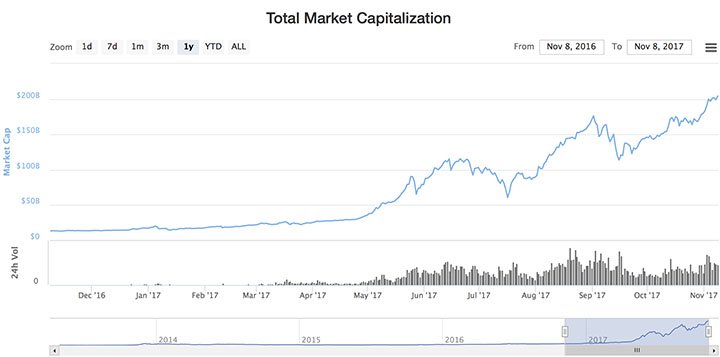

Cryptocurrency and blockchains in 2017 are like a crystal ball: everyone from slack entrepreneurs to corporate giants seems to look into it and see their future business model. If we are to turn to the numbers for cryptocurrency market growth, we have this: in one year the whole industry capitalization exploded from 13 to 300 billion US dollars. Mind-blowing, huh?

But with this exponential growth, the cryptocurrency exchange market is still in its infancy and presents a perfect storm for disruption. One of the most common trading instruments is an exchange arbitrage. It is a commonly known trading strategy based on the difference between the price for the same asset at different exchanges. Arbitration possibilities open up when there is a variation of prices for the asset obtained by means of sell-purchase chain through transitory assets. In this case price variations when going through this chain are accumulated to a significant amount that is reaching up to 1-3% on cryptocurrency market at the moment.

But the trading ecosystem now is not providing any user-friendly tools for a trader who has to make at least two moves from one crypto exchange to another: first, to buy crypto at one exchange, transfer it to another and then sell it there at a higher rate. A newbie trader would be facing an array of difficulties. Opportunities for an arbitrage appear on-the-spot when you need to quickly assess the situation, calculate the profitability of the strategy, make a series of buying-selling transactions and then build an adequate clearing strategy.

Crypto-traders are in drastic need of a solid solution to address all the issues they are facing now that will provide sufficient liquidity with an option to display consolidated data and graphs from multiple exchanges in a single professional interface, thus providing a user-friendly framework for an exchange arbitrage.

Unlike many other overhyped blockchain projects, it looks the team behind Arbidex has already built an operating platform with a set of technical tools for an exchange arbitrage that is interacting with several cryptocurrency exchanges accumulating about 10 million US dollars in deposits. Technical architecture and the efficiency of arbitration strategy were tested over the 4-month period by the team with their own deposits.

Arbidex aspires to minimize trading risks by accumulating liquidity from all major cryptocurrency exchanges and completely automate the arbitration process for the user. It is basically a trading platform designed to aggregate in one terminal crypto-assets and liquidity from all major exchanges with a capability to search for arbitration options and automatically implement them. The platform is able to analyze thousands of crypto-currency pairs and find most favorable ones making up to 2-3% revenue.

Here’s an explanation of how it works. A trader signs up to the platform to start handling transactions with any amount he wants. Deploying a search algorithm for the most favorable exchange rates through multiple exchanges, the platform brings about the opportunity to buy cryptocurrency at a lower rate and sell at a higher. Also trading risks are insured by being shifting to the platform.

In this manner, Arbidex is making trading operations on cryptocurrency market way more convenient and profitable for each stakeholder. Any purchasing transaction with any tradable crypto-asset will be made at the most favorable rate, while the commissions charged by the platform are lower than regular ones charged by crypto-exchanges at the moment.

Arbidex ICO kicks off on December 11 at 1 pm UTC. The product is already technically executed to function as a crypto-liquidity stabilizer and a framework for professional arbitrage strategies. The team is seeking to raise funds through an ICO to draw massive audiences and capital to the platform and to get more exposure on the market.

For more information about Arbidex please visit arbidex.ch and download the project white paper.

Images courtesy of Arbidex CoinMarketCap

The post Disrupting Cryptocurrency Exchange Market appeared first on Bitcoinist.com.