By CCN: Konstantin Ignatov, the CEO of the multi-billion-dollar “crypto” Ponzi scheme OneCoin, has pleaded not guilty to wire fraud. According to court documents, Ignatov entered the plea during a May 28 preliminary hearing via conference call.

As CCN reported, Ignatov — a Bulgarian national — and his sister Ruja Ignatova were charged with wire fraud, securities fraud, and money laundering related to their sham cryptocurrency, OneCoin.

The U.S. Department of Justice indicted the Ignatovs for scamming investors through a multi-national Ponzi scheme that made false promises of “guaranteed” profits.

Grifting Brother-Sister Con Artists

Shockingly, the brother-sister grifters never launched an actual cryptocurrency. Instead, they used a proprietary SQL database to log transactions within the “OneCoin network.”

The FBI arrested Konstantin Ignatov on March 6 at the Los Angeles International Airport as he was attempting to flee to his native Bulgaria. That same day, Konstantin posted a smug Facebook photo from the Hollywood Hills. It’s unclear if the selfie was posted before or after his arrest.

Ironically, the con artist who allegedly stole billions of dollars from unwitting investors had the audacity to whine that someone had stolen his phone and suitcase.

Konstantin Ignatov, the CEO of the crypto Ponzi scheme OneCoin, is accused of securities fraud, wire fraud, and money laundering. | Source: Twitter

OneCoin Revenues Topped $3.8 Billion

OneCoin, which is based in Sofia, Bulgaria, was co-founded in 2014 by Ruja Ignatova and her younger brother Konstantin Ignatov.

Ruja served as CEO until she abruptly went into hiding in October 2017. Shortly afterward, Konstantin took over as CEO.

OneCoin was a typical Ponzi scheme. It operated as a multi-level network through which members received commissions for recruiting others to purchase bogus cryptocurrencies.

OneCoin Pretended to Be a Crypto Company

According to the Department of Justice, OneCoin generated a stunning $3.8 billion in sales between 2014 and 2016. During that time, the Ignatov siblings robbed scores of gullible investors out of billions of dollars.

“These defendants created a multi-billion-dollar cryptocurrency company based completely on lies and deceit. They promised big returns and minimal risk. But, as alleged, this business was a pyramid scheme based on smoke and mirrors.”

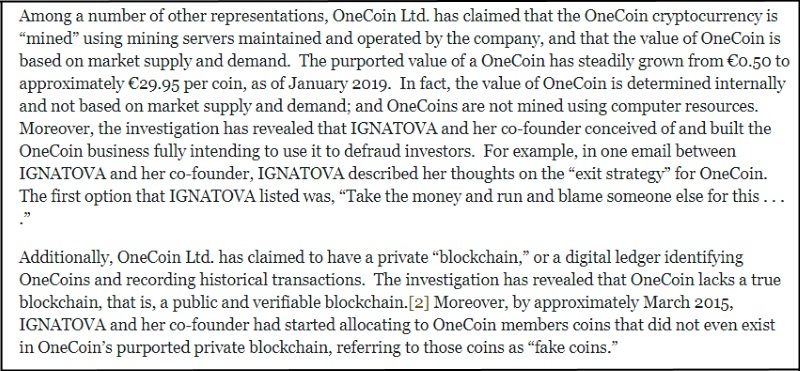

Basically, OneCoin pretended to be a crypto company to take advantage of the hype the nascent industry had started to generate in 2014. In reality, it had very little to do with actual cryptocurrencies.

“This is an old scam with a virtual twist. The cryptocurrency OneCoin was established for the sole purpose of defrauding investors. Ignatov and Ignatova allegedly convinced victims to invest in OneCoin based on complete lies about the virtual currency.”

| Source: DOJ.gov

Swindlers Tarnish Crypto Industry by Hijacking the Name

Moreover, the Justice Department pointed out that unlike authentic cryptocurrencies, OneCoin had no value, and there were no records of transaction histories involving the bogus currency.

“It offered investors no method of tracing their money, and it could not be used to purchase anything. In fact, the only ones who stood to benefit from its existence were its founders and co-conspirators.”

While it might be easy to dismiss the OneCoin debacle as yet another crypto scam, the fact is, con artists have increasingly started to hijack cryptocurrencies to operate criminal activities. Often, many of these “cryptocurrency” companies have nothing to do with crypto.

Many ‘Crypto’ Scams Have Nothing to Do With Crypto

Once recent example is Longfin Corp., a bogus Nasdaq-listed fintech company that pivoted to “crypto” during the bitcoin bull market. The transition caused the company’s stock to spike 2,600% amid the bitcoin boom.

In reality, the company had nothing to do with crypto, as CCN reported. According to the indictment:

“Longfin did not engage in any revenue-producing cryptocurrency transactions, and did not use ‘blockchain’ to empower any solutions at all.”

However, Longfin and OneCoin are being spotlighted by the media as “proof” that the entire virtual currency industry is teeming with scam artists. To be sure, there are con artists in the ecosystem — just like there are in other industries.

Flashback: Wells Fargo Systematically Scammed Its Own Customers for 15 Years

Case in point: In December 2018, Wells Fargo — the third-largest U.S. bank with $1.6 trillion in assets —agreed to pay a $575 million fine after admitting that it systematically scammed its own customers for 15 years.

Wells Fargo Says Bitcoin Too Risky for Clients, Pays $575 Million Fine For Scamming Them https://t.co/NLB3RHplLC #bitcoin

— CCN.com (@CCNMarkets) December 30, 2018

Pursuant to a federal investigation, Wells Fargo admitted that its employees opened more than 3.5 million sham, unauthorized bank and credit card accounts in customers’ names between 2002 and 2017.

The bank then illegally charged its clients for various financial services products they never signed up for. Wells Fargo has racked up more than $2 billion in fines since its fake-accounts scandal was revealed in 2016.

Could a crypto company get away with scamming its own customers for 15 years? Not a chance.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.