ETHEREUM PRICE SURGED 9-PERCENT IN A DAY | SOURCE: COINMARKETCAP.COM

The ether-to-dollar exchange rate surged as much as 9-percent to establish an intraday high towards $175.97. The asset experienced a similar bullish bias against its peers in the cryptocurrency industry. The ether-to-bitcoin exchange rate, for instance, rose as high as 9.45-percent, indicating that traders were hedging their bitcoin holdings into the Ethereum market.

The bitcoin price dropped up to 2.45-percent during the Monday session.

The Ethereum pairs posted $7.43 billion worth of volume this Monday, according to CoinMarketCap’s 24-hour adjusted timeframe. Considering that 95-percent of the total reported trading activity is typically fake, the Ethereum pair originally posted $371.5 million worth of volume. The ETH-enabled trades looked well-spread across both regulated and unregulated exchanges.

CFTC Saved the Day

An official close to the Commodity Futures Trading Commission (CFTC) revealed Sunday that they were planning to approve an Ethereum-based, cash-settled futures contract.

The rumor helped driving the fresh wave of buying sentiment in an otherwise bearish Ethereum market. Traders may have picked the CFTC announcement as a sign of institutional investment, which explains why Ethereum was among the only few assets across the cryptocurrency board that trended in positive territory throughout Monday.

the @CFTC saved $ETH

that’s a sentence i thought i’d never say pic.twitter.com/cVE80mC6eT

— Josh HODLonautszewicz (@CarpeNoctom) May 6, 2019

Nevertheless, an Ethereum-based future contract means that speculators will not require to purchase the actual ether tokens to settle their contracts. Instead, they will use cash, which makes the ongoing Ethereum price rally baseless. Moreover, the capital injection into the Ethereum market could turn weak once a fully-corrected bitcoin prepares itself for another upside push. The move could see traders swapping their Ethereum tokens for bitcoin, believing that the latter will attempt a run towards $6,000, its support-turned-resistance level, to strengthen its bullish bias.

Opportunities

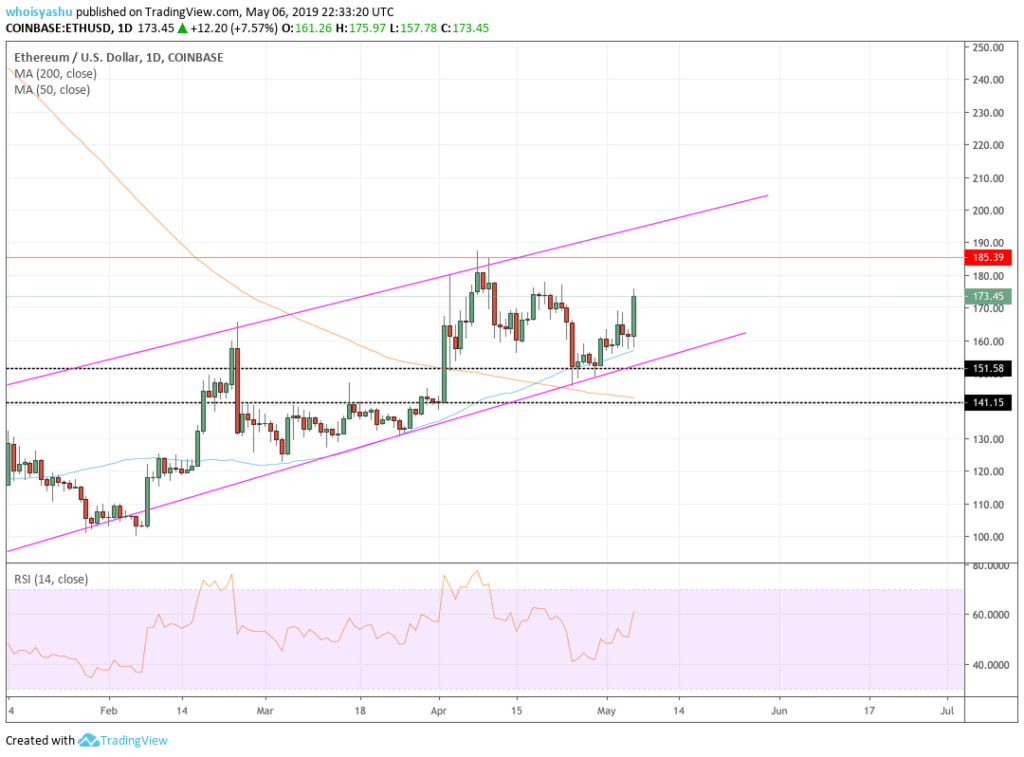

ETHEREUM PRICE CHART | SOURCE: TRADINGVIEW.COM, COINBASE

The Ethereum price has established support at its 50-period moving average (indicated via blue) which is maintaining the asset’s overall bullish bias. The price could face resistance in $177-180 area as it tests $185.39 as its upside target. A break above either of these areas would expose Ethereum’s upside to the parallel channel resistance (indicated via pink). At the same time, the price could also attempt a pullback action at any of those resistance levels, which would open decent short opportunities toward the 50-period MA.

Click here for a real-time Ethereum price chart.