Cryptocurrencies are undergoing a transformation — they are becoming part of our daily lives. We can now buy things with Bitcoin, which means that the mainstream denomination of “useless digital asset” will soon be erased.

Bleeding Cryptocurrency Portfolios

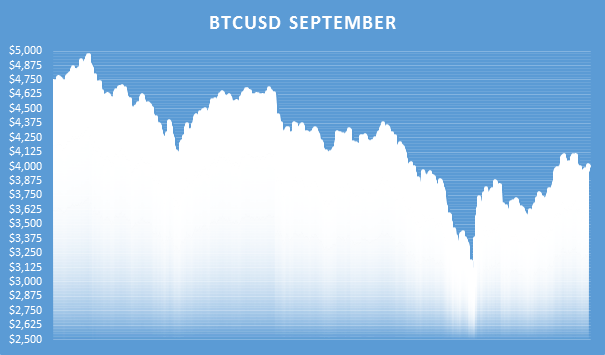

One thing has remained unchanged so far — volatility. Cryptocurrency prices are still extremely volatile, despite the large trading volume and the increasing amount of market participants. Economic theory dictates that as both increase, price discovery should increase, thus stabilizing the market. Figure 1 shows the extent to which standard economic theory does not apply to cryptocurrencies.

Bitcoin’s price in September went from $5,000 to below $3,000 — a 40% drop. Bitcoin and Ether experienced the longest losing streak for 2017, as the combined market capitalization of all cryptocurrencies fell from $167 billion to $99 billion. From China’s ICO regulations to JP Morgan’s fraud statements, cryptocurrency portfolios bled for a long time.

Cryptocurrency markets have always exhibited high volatility and prolonged periods of hyper-enthusiasm, with no signs of stabilization. In fact, cryptocurrencies may actually become more volatile in the future as the market shapeshifts. Future regulatory and legal changes will definitely have an impact on the price of cryptocurrencies and this will surely not be the last market crash. All of this leaves investors with a tough choice — clear your portfolio when prices go down or hold and hope it recovers. Inversely to equity markets, investors are completely unhedged and unprotected against any downside risk.

This problem is yet to be addressed by the stream of ICOs. Until now, no one has offered a solution to cryptocurrency crashes. Rhea is the first to develop a project focused on hedging cryptocurrencies and maintaining a low volatility portfolio. The Rhea team is starting its ICO on October 2 to fund the creation of a market capitalization weighted index of cryptocurrencies with an underlying options trading platform.

Crypto20

The index — the Crypto20 — bundles the top 20 cryptocurrencies by market cap and currently represents 92% of the combined market capitalization of all traded cryptocurrencies. Why is this useful? Because investing in ETFs has historically been a more profitable strategy than stock picking for equities.

In November 2016, ETF investments outstripped hedge fund investments for the first time ever. Capital markets have migrated away from actively managed funds and turned to ETFs as a way of speculating on a general market direction within a certain industry. This allows them to simply bet on a market direction, instead of betting on individual companies to perform well.

Putting your money in a single cryptocurrency can be very risky as there are a considerable number of variables that can impact its price. However, using an index like the Crypto20 presents an opportunity of getting easily invested in this market, while limiting your potential downside as the risk is spread over the top 20 cryptocurrencies.

Hedging a cryptocurrency portfolio presents an even bigger obstacle than getting invested in the first place. Typically, in financial markets, this is achieved through derivatives. While there are many types, options offer the most customization and ease of use, which enables investors to limit their downside risk at a low cost. Buying options on BTC will hedge an investor’s risk only to a BTC drop, but hedging through an index like the Crypto20 will provide protection against a mixed cryptocurrency portfolio. By trading options on the index, investors will finally be able to hedge and diversify their portfolios.

Another benefit of such an index is the ease of access to a basket of cryptocurrencies. While it is true that every investor can manually build a portfolio very similar to the Crypto20 at a given point in time, it goes without saying that it will be a difficult and costly task. Going back to financial markets, low-cost access to baskets of securities is a major reason why ETFs are quickly becoming a more popular than stock picking. Currently, transaction costs for cryptocurrencies can go as high as 2% with a significant execution time. Both can be reduced with options because of their CFD-like features and lower cost.

Finally, indices reduce volatility thereby creating a more predictable and safer investment product. Even though the Crypto20 is composed of over 50% Bitcoin, price drops in the former are bound to be more tamed. As the market matures, such an index can become a very reliable predictor of things to come. Just as top financial indices give investors hints as to where the market is headed, cryptocurrencies should become easier to read.

The early adoption period of cryptocurrencies has passed and cryptocurrencies have proven to be a growing and resilient market. A lot of investors have remained patient, anticipating more regulatory and legal clarity to enter these markets. However, a world of hundreds of cryptocurrencies using different proof algorithms and having different functions is extremely burdensome and requires expertise. Rhea offers a way to bypass these barriers and opens the door to a revolutionary way of trading cryptocurrencies. If the ICO is successful, the cryptocurrency market will undergo a change towards a more stable and transparent place.

Images courtesy of Rhea, Shutterstock

The post Gaining and Hedging Cryptocurrency Exposure with Rhea appeared first on Bitcoinist.com.