The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The Grayscale story is very well known at this point. It’s an open-ended trust that found a workaround to the U.S. Securities and Exchange Commission’s (SEC’s) egregious regulations and figured out a way to deliver bitcoin exposure to institutional capital and brokerage accounts before nearly everyone else.

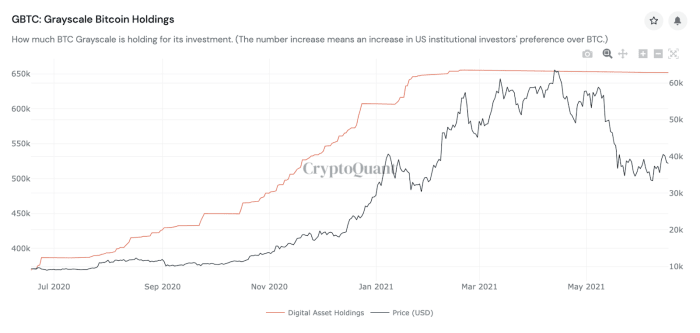

You have to give credit where credit is due: The GBTC product was a tremendous success for Grayscale. The trust currently holds an astounding 651,884 bitcoin, or around 3.10% of all bitcoin that will ever exist.

During the later months of 2020, shares of GBTC traded at a significant premium due to the trust’s structure.

With shares trading at a steep premium, accredited and institutional investors could acquire shares of GBTC at NAV (net asset value), but these shares had to be locked up for six months before being able to hit secondary markets.

Investors absolutely piled into the trade, as the seemingly risk-free arbitrage was too enticing to pass up.

From June 18, 2020, to February 18, 2021, Graycale bought an incredible 284,393 bitcoin. For context, that is equivalent to 127% of the bitcoin that was mined over the same period.

On February 18, 2021, however, shares of GBTC began to trade at a discount to NAV, and as expected, new redemptions of GBTC shares completely halted. With one of the market’s biggest buyers sidelined, bitcoin lost steam, but there is more to the story.

All of the shares of GBTC that were redeemed and locked up for six months have began to hit the market in waves, and this has created an unexpected development in the market.

While on the way up, with the premium, Grayscale was hoovering up bitcoin while retail investors were bidding up the price of GBTC shares on the secondary market, all of those shares that now are trading at a discount to NAV have most definitely siphoned demand for spot bitcoin for the time being.

Just over the last seven days, the equivalent of 11,512 BTC worth of GBTC shares have been unlocked, and undoubtedly some of these have been sold onto the market. As an institutional allocator, if you would like exposure to bitcoin, do you buy spot bitcoin (which still may be very challenging, with many legal and regulatory hoops to jump through), or do you buy shares of GBTC that are trading at a 10% to 20% discount to NAV?

That is a no brainer, and the reality is that this dynamic has taken a lot of buying pressure out of the market.

Over the next two months, the equivalent of 82,818 BTC worth of GBTC shares are being unlocked, and as long as GBTC continues to trade at a discount to NAV (which should be entirely expected), lots of bitcoin demand will go toward GBTC, which won’t be reflected in the bitcoin price.

Want to read more from this issue of the Deep Dive? You can access the rest here.