Last Friday, Uber held its first day as a publicly traded company with a starting price of $42 – already three dollars below its IPO price. Throughout the day, the stock continued to slide, ending at $41.70. In the process, investors lost a record $655 million with the Saudi Arabian Public Investment Fund (PIF) taking one of the most substantial hits ($201.5 million).

Uber Stock Risks Becoming a Bottomless Money Pit

If you foolishly threw $1,000 into the Uber IPO, you’d only have $821.11 today, equating to an almost 18 percent loss in just a weekend. While many tout Uber as a successful company, there’s a laundry list of reasons why its stock is performing so terribly.

Uber stock continues to fall after an abysmal IPO. | Source: Yahoo Finance

The company’s slim margins aren’t sustainable over the next five or even ten years. Last year, it had operating losses of $3 billion. Although the ridesharing giant continues to grow its user base, its adjusted net income has already plateaued (even dropping a little bit in Q4 2018). It’s going to be incredibly difficult for Uber to fix this by raising prices without losing a ton of customers to competitors.

Additionally, the Uber brand is consistently the center of controversy. Whether it’s legal battles with drivers, harassment allegations, or its revolving door of C-suite executives, it’s evident that the company is a dumpster fire of bad publicity and management.

Lyft Stock Isn’t Performing Any Better

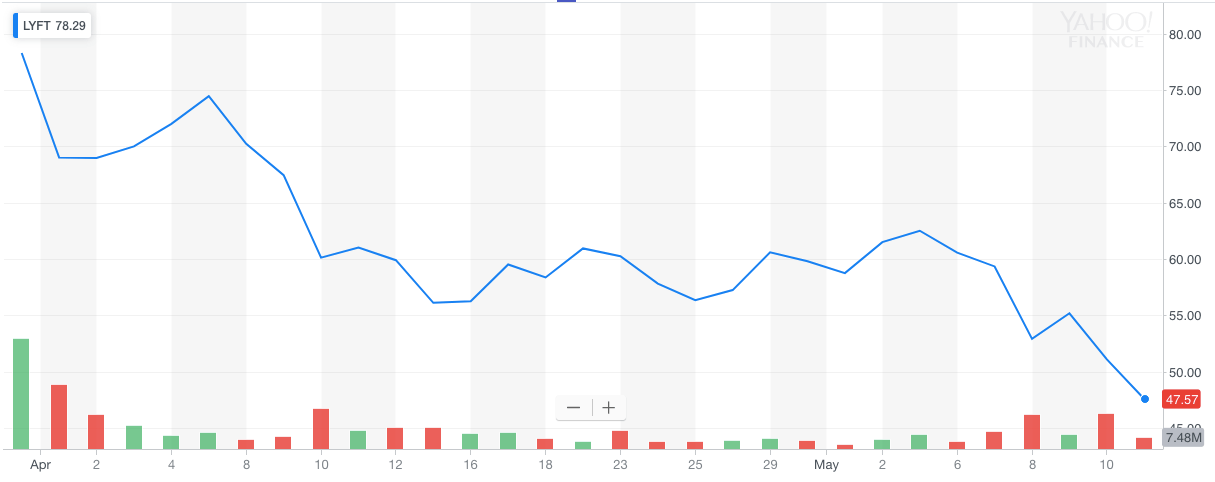

Looking at the Lyft stock performance, it’s apparent that ridesharing companies, in general, aren’t ready for the public trading market. If you bought $1,000 worth of Lyft stock during its IPO, you’d currently be down to $661.39, almost 34 percent in the red.

The Lyft stock chart shows how Uber may pan out after a couple of months of trading. | Source: Yahoo Finance

Like Uber, Lyft isn’t profitable. The company lost nearly a billion dollars last year and has no concrete plan to reach profitability. The comparisons continue as Lyft has its own set of legal troubles with drivers too.

More importantly, though, both companies face the looming threat of transportation automation. Once competitors like Google or Tesla get a fleet of driverless cars on the road, the only option for Uber and Lyft will be to join them or risk being driven out of the market.

Is This The End of ‘Growth at Any Cost?’

The spectacular failure of Uber and Lyft’s IPOs further the evidence that Silicon Valley’s “growth at any cost” attitude is on its way out the door. Snapchat, with a stock price down over 55 percent since going public, still isn’t profitable. Blue Apron, another unprofitable startup darling, is down over 90 percent.

On the other hand, you’ve got profitable companies like Zoom dominating the market post-IPO. The Zoom stock price is up almost 30 percent since the day the company when public earlier this year.

There is a clear correlation between profitability and stock performance, as there should be. As unprofitable companies continue to fail in the public market, we’ll (hopefully) see a shift away from the “growth at all costs” attitude. Because in the end, it’s the retail investors who feel the failures the most – not the venture capital firms paying $3.70 per share of Uber well before the IPO.