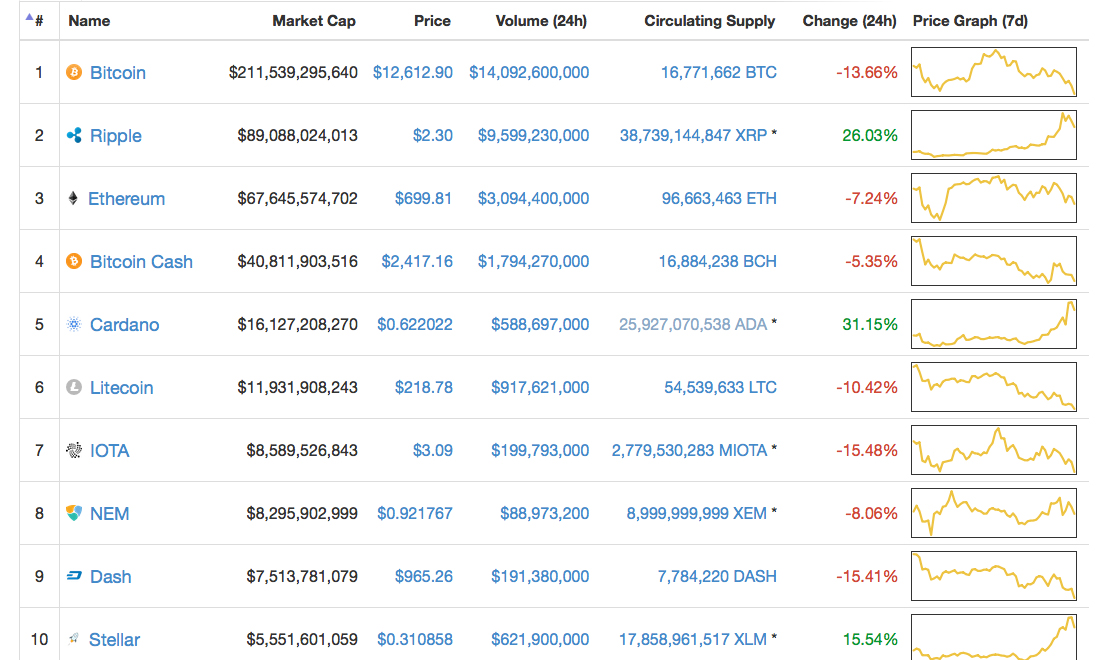

Another holiday cryptocurrency market slump is here as bitcoin, and a broad swathe of other digital assets, are hitting new lows during New Year’s Eve weekend. On Saturday, December 30 around 7am EDT, the price of bitcoin (BTC) touched a low of $12,240 across global exchanges after coasting along at $14,300 for most of Friday’s trading sessions.

Also Read: Ripple Gains 1,000% in One Month – Now the Second Largest Cryptocurrency

Markets See a Tide Shift as the Price of BTC Drops Significantly Before 2018

It looks like we are in for another price storm this New Year’s Eve weekend as far as BTC markets and a slew of other digital assets are concerned. Bitcoin’s slide in value has had a strong correlation with a wide variety of other markets which are also seeing price drops. At the moment, volume has picked up during Saturday morning’s trading sessions as exchanges are swapping $14Bn over the past 24 hours.

It looks like we are in for another price storm this New Year’s Eve weekend as far as BTC markets and a slew of other digital assets are concerned. Bitcoin’s slide in value has had a strong correlation with a wide variety of other markets which are also seeing price drops. At the moment, volume has picked up during Saturday morning’s trading sessions as exchanges are swapping $14Bn over the past 24 hours.

Most of those swaps are taking place in USD trades as the most dominant currency traded with BTC is the U.S. dollar by 44 percent. The Japanese yen has dropped significantly as the currency only captures 27 percent today. These two currencies are followed by tether USDT, the euro, and the Korean won. As usual, during BTC dips tether has the fourth highest volume among all digital assets due to the price decline, as traders are finding a safe haven within its one-dollar hold.

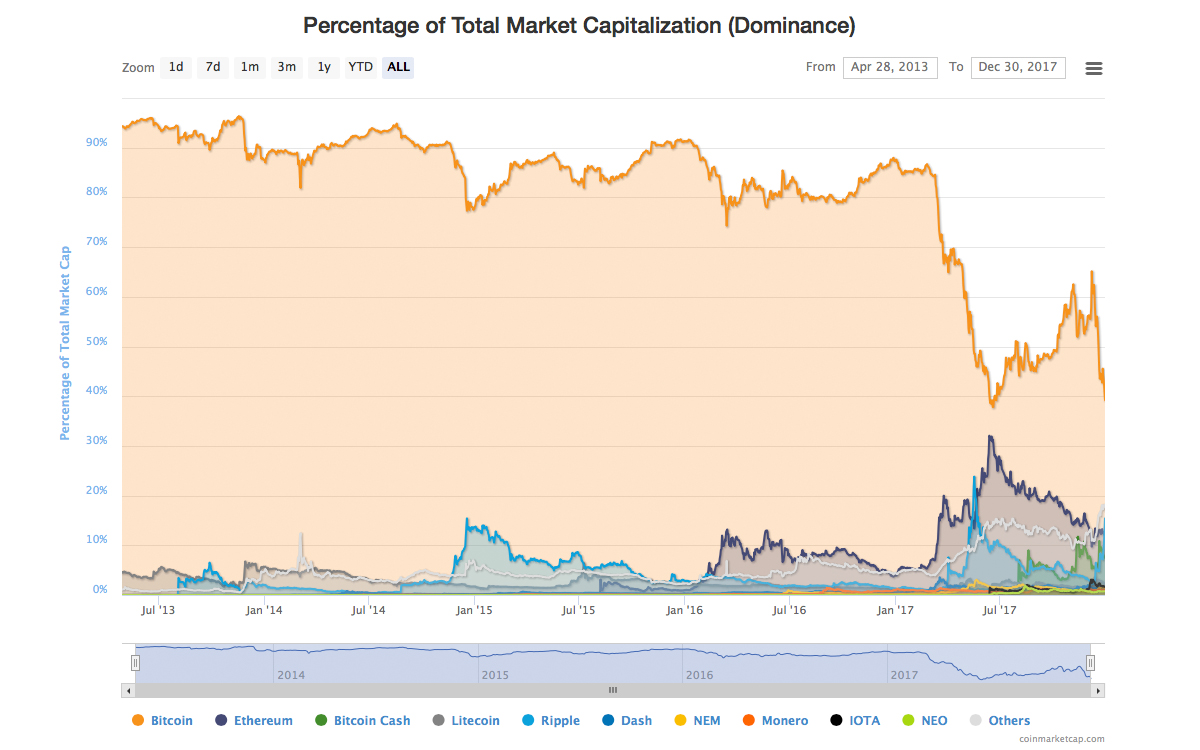

Right now the biggest market makers trading the most BTC include Binance, Bitfinex, Poloniex, Bittrex, and GDAX. However, 3 out of 5 of these top exchanges are mostly trading BTC with ripple (XRP) as opposed to the USD. Ripple markets have seen an incredible run up over the past two weeks capturing parity with the USD and since spiking over $2.20 per XRP. The token’s market occupies the second highest trade volume worldwide and is now the second largest market capitalization, bumping ethereum down a notch. Today ripple markets are seeing a 24-hour trade volume average of over $10Bn and a market cap of $86Bn.

Technical Indicators

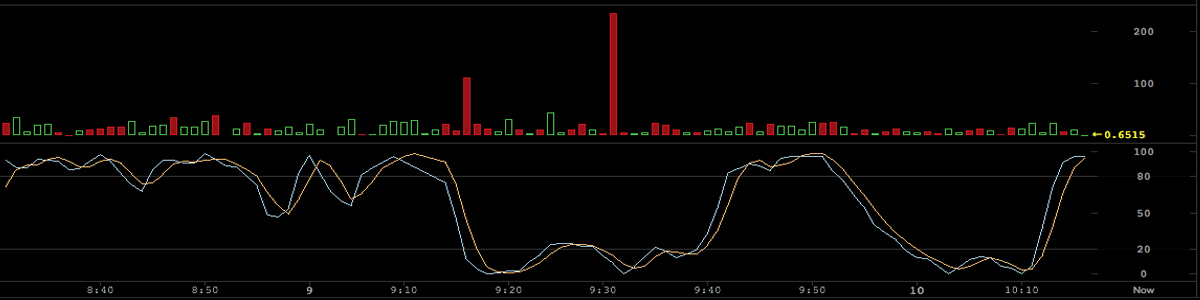

Looking at the weekly, daily, and hourly bitcoin core (BTC) charts show a significant three leg drop down to the $12,240 zone. Bearish sentiment is still plaguing bitcoin markets after its downturn started following the $19,600 all-time-high. Traders looking for more prominent scalps should watch for the Displaced Moving Average (DMA) to break $11,900 zone. The two Simple Moving Averages (SMA) both short and long-term have a decent spread with the 100 SMA below the 200 SMA. This indicates the sell-off is not over and the path to resistance is on the downside for the short term.

Relative Strength Index (RSI) and Stochastic shot up northbound after this morning’s big dip, and there’s been some buy pressure during the initial low. There are currently two pretty solid foundations for support at the moment if BTC markets continue to slide downwards, which will be around the $11,900 and $11,400 territories. Bulls have a lot of work to do to press back into last week’s value of $15-16K. There is substantial resistance within the $13,000, $13,500, and $13,800 areas, so look for pit stops in those regions. At press time, BTC/USD markets are meandering between $12,500-12,800 per token.

Ripple, Cardano, and Stellar Steal the Bull Market

The top ten digital asset markets, in general, are seeing a downward pattern correlated with BTC’s market movements. However three tokens in the top ten are doing very well despite the dip as ripple, cardano (ADA), and stellar (XLM) are all seeing price gains. Ripple (XRP) markets are seeing an increase of 25 percent over the past 24 hours as one XRP is $2.20. Ethereum is now the third highest market cap after XRP jumped ahead and ETH markets are down 6 percent with a global average of $706 per token.

The fourth highest valued market is bitcoin cash (BCH) which is down roughly 4.4 percent seeing a global weighted average of $2,425 at press time. Bitcoin cash markets have around $1.7Bn in global volume and the fifth highest digital asset trade volume worldwide. The fifth highest market capitalization is now held by cardano (ADA) which is seeing a 31 percent gain today. The rest of the digital currencies like dash, litecoin, nem, and iota are all seeing percentage dips between 8-15 percent. The digital asset stellar (XLM) which is a fork of ripple XRP is up 15.5 percent today as one XLM is averaging $0.31 per token.

Uncertainty Is In the Air and Predictions Are Skewed

Market sentiment is mixed at the moment as many traders are uncertain where the price of BTC will go, and where it may take the other correlated assets. Some traders including myself have noticed a head and shoulders formation, and the last of the right shoulder seems to be forming. There could be a possible upswing reversal at the bottom of the right shoulder.

Some traders envision prices hitting a low point between $8-10K and some believe the floor will be no lower than $11,000. While others see some significant sideways consolidation happening over the past three days, and feel BTC prices are getting close to its deepest lows. If markets start rallying again the probability of BTC running back up to the $15-16K zones is possible but not likely until after the New Year.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images courtesy of Shutterstock, Bitcoin Wisdom, Pixabay, and Bitstamp.

Get our news feed on your site. Check our widget services!