The price of bitcoin (BTC) has rebounded significantly since our last markets update. BTC markets reached a high of $16,100 across many global exchanges around 11:00 am EDT on December 26. The price spike is a big jump from yesterday’s weighted global averages of $13,800-14,000 per BTC on Christmas day.

Also read: Bundesbank Board Member: No Plans to Issue State-Backed Cryptocurrency

After the Holiday Lull Crypto-Markets Bounce Back

Cryptocurrency markets are rebounding today as 9 out of the top 10 digital assets are seeing gains between 1-16 percent. Bitcoin core (BTC) markets have seen the most significant percentage gains and the most volume during the bounce back. At the moment traders are swapping over $12.7Bn worth of bitcoin during the course of the past 24-hours. BTC markets are up 16.2 percent and its market capitalization is around $270Bn. This metric has improved BTC dominance among the 1382 other digital assets by 45.8 percent, after it reached a low of 42 percent over the holiday weekend.

The top five trading platforms exchanging the most bitcoins globally include Bitfinex, Bithumb, Binance, Bittrex, and Bitflyer. At the moment Bitfinex 24-hour volumes are very close to touching $1Bn while the rest of the top five exchanges are swapping $250M or more. The U.S. dollar is still the most traded national currency with BTC at the moment, but Japanese yen volumes have increased. The USD is dominating by 38 percent while the yen is 32 percent, followed by the Korean won, tether (USDT), and the euro. Tether volumes have dropped significantly as traders who once used USDT as shelter seem to be exiting that market in high numbers. Over the past three hours BTC prices have ranged between $15,700-$16,100 during the early afternoon eastern standard time.

Technical Indicators

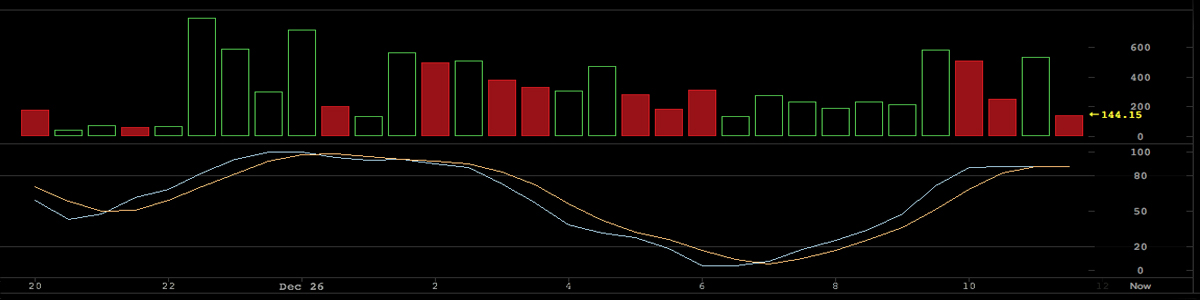

Bitcoin core charts look very bullish today as there has been a lot of changes since yesterday’s holiday trading action. Right now the two Simple Moving Averages (SMA) both the short-term 100 SMA and the longer term 200 SMA have converged at 11 am EDT. This means the path to the upside will likely have less bearish pressure in the short term. The Stochastic and RSI oscillators are showing bullish sentiment in the markets as both indicators have seen an uptick northbound.

If bulls continue to wage war against the sell-side order books, they will meet more substantial resistance in the $16,250-16,500 zone. Anything $16,700 and above has even thicker resistance, and it will take some strength to break these regions. On the backside, support is definitely narrowing down, and strong foundations can be found in three key areas including $15,500, $15,000 and even stronger support around $14,500.

The Top Ten Digital Asset Markets Are On the Move Northbound

The top ten cryptocurrencies are all in the green except for NEM which is coming down from a recent price high. Ethereum (ETH) is up close to 2 percent as one ETH is averaging $771. Bitcoin cash (BCH) markets are doing well today as markets have increased around 1.3 percent, seeing BCH prices reach $3,010 per token. The fourth top market capitalization held by ripple (XRP) is still hanging above a dollar at $1.10 per XRP. Litecoin markets are moving up the ladder, seeing gains above 2 percent with one LTC is averaging $281 per coin. The rest of the top ten digital asset markets are slowly nurturing their wounds after last week’s big dip.

The Verdict

Overall digital asset traders are optimistic about the increase after experiencing one of the year’s biggest drops in value. The rebound has been a breath of relief for those not used to the big tumbles after cryptocurrencies spike in value. However, some skeptics don’t believe we are out of the woods just yet, and bears could attack this coming New Years weekend again. Other more positive individuals think we will be reaching more all-time highs at the beginning of 2018.

Bear Scenario: Order books on the buy side are much thinner than the sell side, but are definitely stronger than prior to the last ATH. Although, if bulls can’t manage to keep the upwards pressure going $13-14K prices are still in the cards at this vantage point.

Bull Scenario: Buyers have done a great job bouncing back from the holiday lulls which has required a lot of energy. If bulls can manage to muster up even more strength, we will see prices touch the $16,500 zone in the short term. From there they have a harder fight ahead of them.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images courtesy of Shutterstock, Bitcoin Wisdom, Pixabay, and Bitstamp.

Get our news feed on your site. Check our widget services!