By CCN: The Dow and broader U.S. stock market rebounded sharply on Tuesday after Federal Reserve Chairman Jerome Powell more or less laid the groundwork for rate cuts in the near future.

The Fed chief’s comments came less than a day after CCN reported that Wall Street was becoming more convinced that the era of ultra-loose monetary policy would return very soon.

Dow Returns to Strength; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes posted massive gains on Tuesday, mirroring a strong pre-market for Dow futures. The blue-chip Dow Jones Industrial Average advanced 432.18 points, or 1.7%, to 25,251.96.

Dow Jones Industrial Average is back on the offensive Tuesday, gaining more than 400%. | Source Yahoo Finance.

The broad S&P 500 Index of large-cap stocks surged 1.7% to 2,792.32. Nine of 11 primary sectors contributed to the rally, with information technology and consumer discretionary shares climbing more than 2%.

Surging technology stocks powered the Nasdaq Composite Index to higher gains. The technology-laden benchmark spiked 2.2% to 7,492.92. On Monday, the Nasdaq closed at its lowest level in over four months.

Fed Capitulates, Puts Rate Cuts on the Table

Fed Chair Jerome Powell said Tuesday that monetary policy could change in the event that a prolonged trade dispute with China impacts the U.S. economy. Powell’s comments mirror what futures traders have been saying for months – namely, that the central bank is angling toward a rate cut in the not-too-distant future.

“We do not know how or when these issues will be resolved,” Powell said on Tuesday in prepared remarks in Chicago. “We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2% objective.”

The threat of a multi-front trade war with China and Mexico has triggered a bond-buying frenzy, with investors snatching up U.S. Treasurys at an ever-increasing pace. As a result, the yield on the benchmark 10-year U.S. Treasury fell on Monday to a new 18-month low.

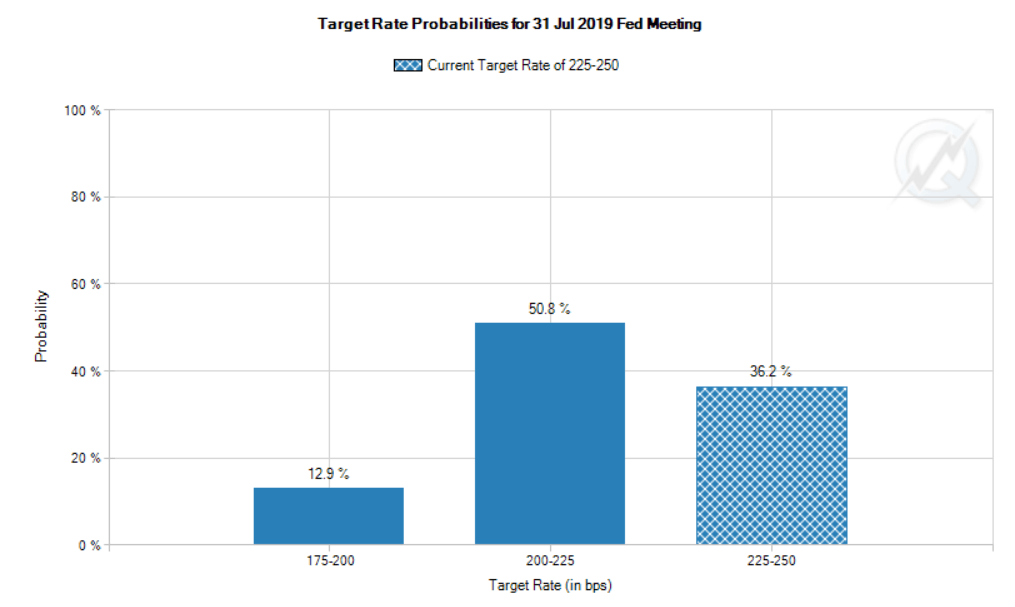

Markets believe the central bank could lower interest rates as early as this summer. According to CME Group‘s Fed Fund futures prices, the likelihood of a July rate cut currently stands at 64.1%.

Fed Fund futures prices imply a high probability of a rate cut in July. | Source: CME Group.

The reaction to Powell’s comments suggests that investors are once again looking to monetary policy to bail them out of a possible recession. Morgan Stanley believes that another recessionary cycle could be a year away if trade-war tensions between the United States and China aren’t resolved soon.

Another round of quantitative easing or expectations around the same suggests Tuesday’s hope-filled rally was all smoke and mirrors. If the Fed has to intervene at this stage, investors should consider quantitative easing to be the new normal for an economy that has yet to fully bounce back from the 2008 financial crisis.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.