Bitcoin’s popularity has unleashed a race for digital money dominance, which is likely to intensify with the emergence of Central Bank Digital Currencies (CBDCs). In a 2021 survey of central banks, 86% of respondents indicated they are actively researching the potential for CBDCs. The question that emerges is how will CBDCs live alongside borderless cryptocurrencies like bitcoin?

This paper is a three-part study on CBDCs within the context of the evolution of money. Readers will find that CBDCs will play an important role in the normalization of money as a digital concept. The paper outlines several factors that will contribute to the rise of CBDCs in the coming years, as well as the design limitations of CBDCs that will drive demand back to bitcoin.

- Part 1: Humans and Change — We recreate old things before we reimagine new things.

- Part 2: How CBDCs Fit In The Evolution Of Different Types Of Money — How CBDCs compare to bitcoin, in the context of fiat money, representative money, and commodity money.

- Part 3: The Challenges Of CBDCs: Digitization Instead Of Innovation — How CBDCs are likely to be rolled out, and the four design limitations that will drive demand back to bitcoin.

Part 1: Humans And Change

History shows that humans rarely make the direct leap to new breakthrough technologies.

The human change cycle often starts by adopting a semi-improved version of the old thing before reimagining a new frontier. The pattern of old ⇒ semi-new ⇒ new is evident across numerous industries:

- Transportation: Horses ⇒ Horses on wheels ⇒ Automobiles

- Visual images: Photos ⇒ Moving pictures ⇒ Videography

- Money: Fiat money ⇒ Digital fiat money ⇒ Bitcoin and cryptocurrencies

Fiat money by any other name is still fiat money, dictated by land borders. Digital money, on the other hand, is transnational by nature. CBDCs and stablecoins operate in a hybrid state, where they are an online version of offline currencies.

Going from physical cash to CBDCs and stablecoins is equivalent to going from photographs to moving pictures — a novel innovation but a semi-improved version of the old product. History shows us that semi-improvements are usually a transient innovation. Typically, these versions are replaced by innovations that can reimagine the future rather than recreate the past.

Part 2: How CBDCs Fit In The Evolution Of Different Types Of Money

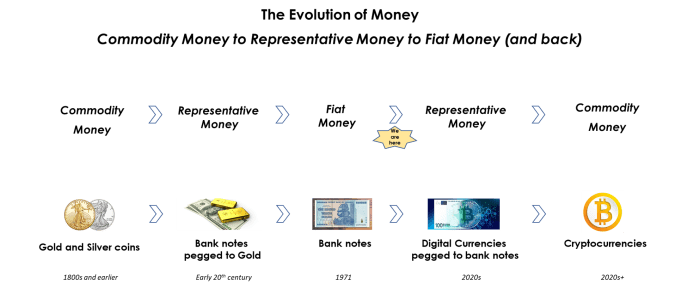

To better understand the evolution of money, it is important to understand the three different types of money: commodity money, representative money and fiat money.

- Commodity money: An asset that has intrinsic value based on market demand (e.g., gold and silver).

- Representative money: An asset that has no intrinsic value but provides a claim over another asset (e.g., cheques and gold certificates).

- Fiat money: A money which has intrinsic value because the government says so (e.g., Today, national currencies are examples of fiat money).

The two main types of money are commodity money and fiat money, while representative money is more of a hybrid state. Prior to the 20th century, gold and silver were the dominant forms of global money: This was the era of commodity money. During the early 20th century (gold standard), banknotes became popular, although they were still pegged to gold. Since 1971, our banknotes no longer have to be pegged to anything else. This completed an evolution from commodity money to representative money to fiat money.

We are now experiencing a trend in the opposite direction, by migrating from fiat money to digital representative money. The representative money of the 20th century were banknotes pegged to gold, and the representative money of the 21st century are digital currencies pegged to fiat money. A century ago, banknotes solved a divisibility and portability problem for gold. Today, digital fiat money is similarly solving a divisibility and portability problem for banknotes. The next step in this cycle is digital money with intrinsic value on its own — a commodity money.

CBDCs are likely to be designed with features which digitize the existing monetary architecture with central banks at the center. On the other hand, a digital commodity money like bitcoin offers an entirely different monetary design, which foregoes middlemen altogether.

Part 3: The Challenges Of CBDCs – Digitization Instead Of Innovation

The first challenge with CBDCs is articulating why we need a Central Bank Digital Currency in the first place. Why digitize to a newer system which keeps all the old middlemen in place? There are short-term reasons, like efficiencies in payments and settlements, however, innovations in the private sector (such as the Lightning network) have already been making it easy to transfer money — without needing CBDCs.

As a digital representation of a landlocked currency, CBDCs will still be subject to offline nation-state governance. While CBDCs will provide greater divisibility and programmability than paper money, their economic and social designs are likely to be contrasted by the elephant in the room: How do they compare to bitcoin?

Four key themes are likely to emerge as limitations of CBDCs in the coming years:

- Store of value concerns: Fiat by any other name is still fiat. When central banks in countries like Argentina roll out a digital peso, it will still be subject to inflation and debasement. CBDCs will normalize the concept of a digital medium of exchange, but the uncertainty of central bank monetary policies will leave open the space for a digital store of value with high certainty. Every time a CBDC incurs a major monetary policy debate, it is likely to become a sharp contrast against the predetermined monetary policy and scarce supply of bitcoin.

- Privacy and surveillance concerns: While cash has no memory, CBDC transactions will invariably leave a financial footprint that can be tracked by state governments. The need for privacy-preserving digital money will gain popularity, especially in countries where minorities may be punished for their ideological beliefs or sexual preferences. We are likely to see a black market for cash, along with a demand for digital currencies like Monero and Decred capable of providing privacy without central party surveillance.

- Sanctions and censorship concerns: When authoritarian regimes can monitor dissenting individuals, they will also be able to censor their financial activity. CBDCs will supercharge the powers to sanction people, which, in turn, will create a demand for an uncensorable financial network. Much like SWIFT operates as a messaging network today, demand for a neutral and tamper-proof financial network will draw people to the censorship resistance of the Bitcoin settlement network.

- Lack of switching costs for currencies: In a physical money world, countries are able to enforce their borders for currencies. But once all money is digitized, switching costs of currencies are likely to be eroded. Businesses will no longer have to worry about carrying the day’s cash to their local bank, and merchants will be freed to accept the best form of electronic money, not just the local currency. Online money won’t care about offline borders, freeing consumers to choose the best forms of money, which will go beyond their local currencies.

Once most governments have rolled out digital currencies, currency competition is likely to become fierce. Some nation-states may try banning the use of bitcoin and alternative currencies, while others will tie their national currency to patriotic appeals.

Today’s patriotic slogan: “Buy local.”

Tomorrow’s patriotic slogan: “Buy with local currency.”

CBDCs will almost certainly be promoted via “helicopter money,” where governments can airdrop social assistance exclusively in local currencies. Legal tender laws will enforce CBDCs as mediums of exchange, although people may choose to keep their savings in a more superior store of value.

The lasting impact of CBDCs will be to normalize the concept of money as a digital native product, and their design limitations will create the demand for a permissionless, inflation-proof digital store of value. The leading contender to meet this demand is bitcoin.

This is a guest post by Ammar Naseer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.