A “paradigm,” as defined by Ray Dalio, is a period of time during which “Markets and market relationships operate in a certain way that most people adapt to and eventually extrapolate.” A “paradigm shift” occurs when those relationships are overdone, resulting in “markets that operate more opposite than similar to how they operated during the prior paradigm.”

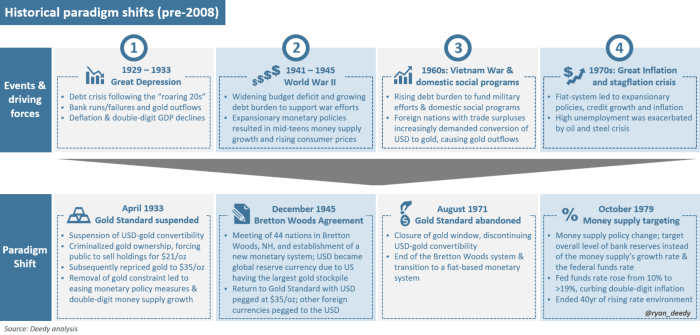

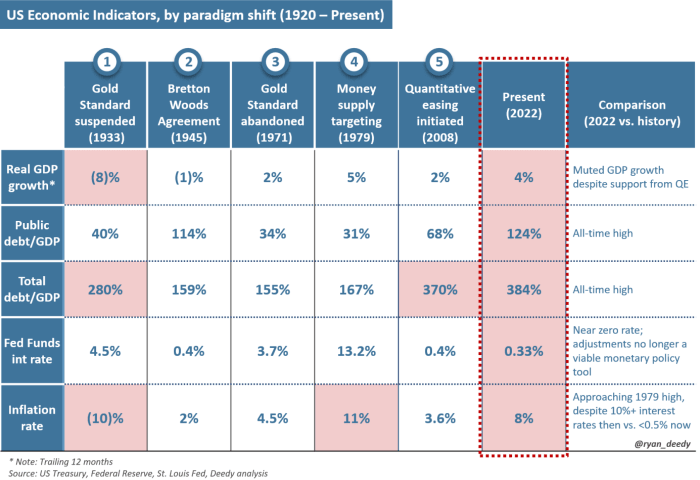

Prior to 2008, there were four such paradigm shifts, each identified by a material change in the Federal Reserve Board’s monetary policy framework in response to unsustainable debt growth. In 2008, we saw the fifth and most recent paradigm shift, when former Fed Chair Ben Bernanke introduced quantitative easing (QE) in response to the Great Recession. Since then, the Fed has been operating in uncharted territory, launching multiple rounds of an already unconventional monetary policy with detrimental outcomes.

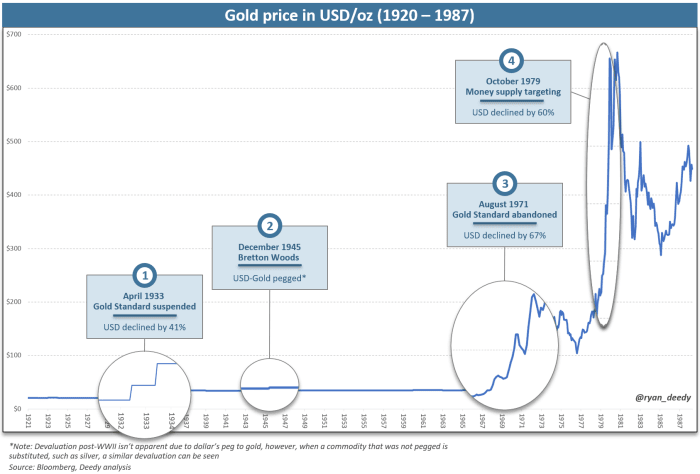

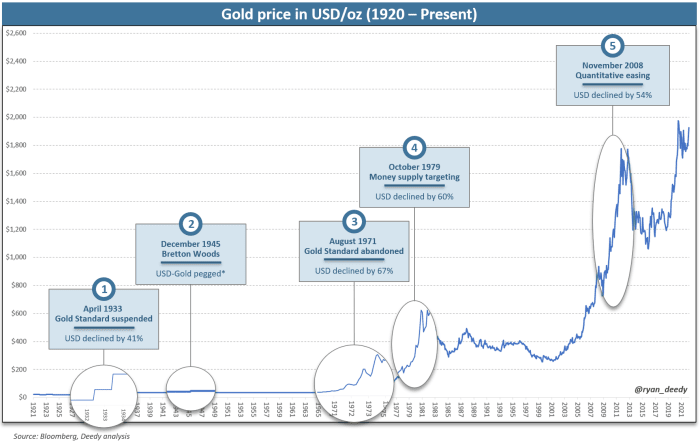

A significant and painful consequence of the past five paradigm shifts has been the devaluation of the U.S. dollar. Since the first shift in 1933, the dollar has lost 99% of its value against gold.

We are currently living through a period with unprecedented levels of national debt, increasing inflationary pressures and escalating geopolitical conflicts. This is also coming at a time when the global influence of the United States is waning and the dollar’s reserve currency status is being called into question. All of this indicates that the end of the current paradigm is fast approaching.

Analyzing past paradigm shifts will lead some to anticipate a return to the gold standard, but we now live in a world with an alternative and superior monetary asset – bitcoin – which is quickly gaining adoption among individuals and nations. Unlike in past paradigms, the invention of bitcoin introduces the potential for a new monetary framework – a Bitcoin standard.

To better assess the potential impact from a change to the current monetary system, it is important to understand how we arrived at this point. Armed with this knowledge, we will be better positioned to navigate the upcoming paradigm shift, the associated economic volatility, and understand the potential impact on the dollar’s value. Bitcoin will likely play a central role in this transition, not only as a savings tool, but also in shaping future monetary policy.

Debt’s Role In The Business Cycle

A business cycle refers to the recurrent sequence of increases and decreases in economic activity over time. The four stages of a business cycle include expansion, peak, contraction and trough. The expansionary phase is characterized by improving economic conditions, rising consumer confidence and declining interest rates. As growth accelerates and the supply of credit expands, borrowers are incentivized to take on leverage to fund asset purchases. However, as the economy reaches the later years of the cycle, inflation tends to increase and asset bubbles are formed. Peak economic conditions can be sustained for years, but eventually, growth turns negative, leading to the contraction phase of the cycle. The severity and length of these downturns can vary from a mild recession lasting six months to a depression that lasts for years.

The amount of debt accumulated during the expansionary phase of the business cycle plays a vital role in how policymakers react to economic crises. Historically, the Fed navigated most recessions by relying on its three monetary policy tools: open market operations, the discount rate and reserve requirements. However, there were four instances prior to 2008 where the Fed pivoted from historical norms and introduced a new monetary policy framework, marking the end of one paradigm and the beginning of another — a paradigm shift.

Historical Paradigm Shifts

The first paradigm shift occurred in 1933 during the Great Depression when President Franklin D. Roosevelt suspended the convertibility of dollars to gold, effectively abandoning the gold standard. Severing the dollar’s link to gold allowed the Fed to increase the money supply without constraint to stimulate the economy.

Following years of global central banks funding their country’s military efforts in WWII, the monetary system experienced another paradigm shift in 1945 with the signing of the Bretton Woods Agreement, which reintroduced the dollar’s peg to gold. Reverting to the gold standard led to nearly 15 years of mostly prosperous times for the U.S. economy. Nominal gross domestic product (GDP) averaged 6% growth, while inflation remained muted around 3.5%, despite very accommodative interest rate policies.

However, government spending picked up in the 1960s to support social spending programs and to fund the Vietnam War. Before long, the government found itself saddled again with too much debt, rising inflation and a growing fiscal deficit. On the evening of August 15, 1971, Richard Nixon announced that he would close the gold window, ending dollar convertibility to gold — an explicit default on its debt obligations — in order to curb inflation and prevent foreign nations from retrieving any gold that was still owed to them. Nixon’s announcement officially marked the end of the gold standard, and the transition to a purely fiat-based monetary system.

Like in the 1930s, abandoning the gold standard allowed the Fed to increase the money supply at will. The expansionary policies that followed fueled one of the strongest inflationary periods in history. With inflation exceeding 10% by 1979, then-Fed Chair Paul Volcker made a surprise announcement that the Fed would begin managing the volume of bank reserves in the financial system, as opposed to specifically targeting the money supply’s growth rate and daily federal funds rate. He warned that the change in policy would allow interest rates to have “substantial freedom in the market,” subjecting it to more “fluctuations.” The federal funds rate subsequently began to increase and eventually exceeded 19%, sending the economy into a recession. Volcker’s policy change and the reset of interest rates to all-time highs marked the end of 40 years of a rising rate environment.

Historical Paradigm Shifts

The first paradigm shift occurred in 1933 during the Great Depression when President Franklin D. Roosevelt suspended the convertibility of dollars to gold, effectively abandoning the gold standard. Severing the dollar’s link to gold allowed the Fed to increase the money supply without constraint to stimulate the economy.

Following years of global central banks funding their country’s military efforts in WWII, the monetary system experienced another paradigm shift in 1945 with the signing of the Bretton Woods Agreement, which reintroduced the dollar’s peg to gold. Reverting to the gold standard led to nearly 15 years of mostly prosperous times for the U.S. economy. Nominal gross domestic product (GDP) averaged 6% growth, while inflation remained muted around 3.5%, despite very accommodative interest rate policies.

However, government spending picked up in the 1960s to support social spending programs and to fund the Vietnam War. Before long, the government found itself saddled again with too much debt, rising inflation and a growing fiscal deficit. On the evening of August 15, 1971, Richard Nixon announced that he would close the gold window, ending dollar convertibility to gold — an explicit default on its debt obligations — in order to curb inflation and prevent foreign nations from retrieving any gold that was still owed to them. Nixon’s announcement officially marked the end of the gold standard, and the transition to a purely fiat-based monetary system.

Like in the 1930s, abandoning the gold standard allowed the Fed to increase the money supply at will. The expansionary policies that followed fueled one of the strongest inflationary periods in history. With inflation exceeding 10% by 1979, then-Fed Chair Paul Volcker made a surprise announcement that the Fed would begin managing the volume of bank reserves in the financial system, as opposed to specifically targeting the money supply’s growth rate and daily federal funds rate. He warned that the change in policy would allow interest rates to have “substantial freedom in the market,” subjecting it to more “fluctuations.” The federal funds rate subsequently began to increase and eventually exceeded 19%, sending the economy into a recession. Volcker’s policy change and the reset of interest rates to all-time highs marked the end of 40 years of a rising rate environment.

Impact of Paradigm Shifts On The U.S. Dollar

Gold is one of the few commodities that has been used throughout history as both a store-of-value asset and as a currency, evidenced by its role in monetary systems around the world, i.e., “the gold standard.” Regardless of its physical form, gold is measured by its weight and purity. Within the United States, a troy ounce is the standard measure for gold’s weight and karats for its purity. Once measured, its value can be quoted in various exchange rates, including one that references the U.S. dollar.

With gold having a standard unit of measure, any fluctuation in its exchange rate reflects an increase or decrease in the respective currency’s purchasing power. For example, when the purchasing power of the dollar increases, owners of dollars can buy more units of gold. When the dollar’s value declines, it can be exchanged for fewer units of gold.

At the time of writing, the U.S. dollar price for one troy ounce of gold with 99.9% purity is roughly $2,000. At this exchange rate, $10,000 can be exchanged for five ounces of gold. If the purchasing power of the dollar strengthens by 20%, the price for gold would decline to $1,667, allowing the buyer to purchase six ounces for $10,000 compared to five ounces from the first example. Alternatively, if the dollar weakens by 20%, gold’s price would increase to $2,500, allowing the buyer to purchase only four ounces.

With this relationship in mind when observing gold’s historic price chart, the decline in the dollar’s purchasing power during historical paradigm shifts becomes obvious.

Quantitative Easing In The Current Paradigm

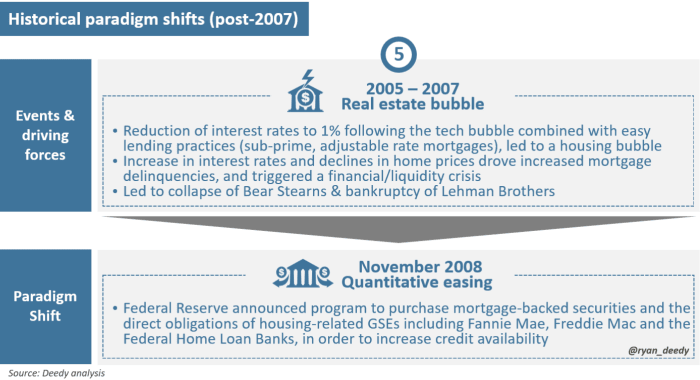

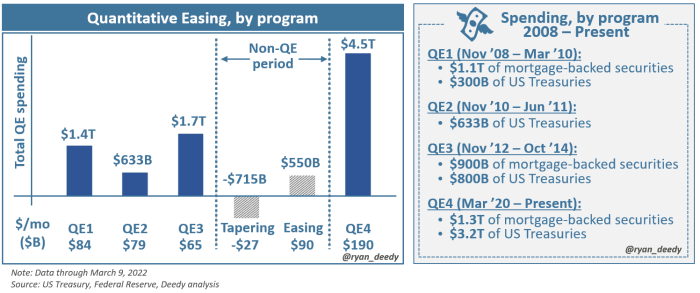

The most recent paradigm shift occurred at the end of 2008 when the Fed introduced the first round of quantitative easing in response to the Great Recession.

While rising interest rates and weakness in home prices were the key catalysts for the recession, the seeds were sown long before, dating back to 2000 when the Fed first began lowering interest rates. Over the following seven years, the federal funds rate was lowered from 6.5% to a meager 1.0%, which concurrently drove a $6 trillion increase in home mortgage loans to over $11 trillion. By 2007, household debt had increased from 70% to 100% of GDP, a debt burden that proved to be unsustainable as interest rates rose and the economy softened.

Like past shifts, the unsustainable debt burden was the key factor that ultimately led the Fed to adjust its policy framework. Not surprisingly, the outcome from implementing its new policy was consistent with history — a large increase in the money supply and a 50% devaluation in the value of the dollar against gold.

However, this paradigm has been unlike any other in history. Despite taking unprecedented actions — four rounds of QE totaling $8 trillion of stimulus over the last 14 years — the Fed has not been able to improve its control of the broader economy. Rather, its grip has only weakened, while the nation’s debt has ballooned.

With national debt now exceeding $30 trillion, or 120% of GDP, a federal budget deficit nearing $3 trillion, an effective federal funds rate of just 0.33% and 8% inflation, the economy is in its most vulnerable position compared to any other time in history.

Government Funding Needs Will Increase In Economic Instability

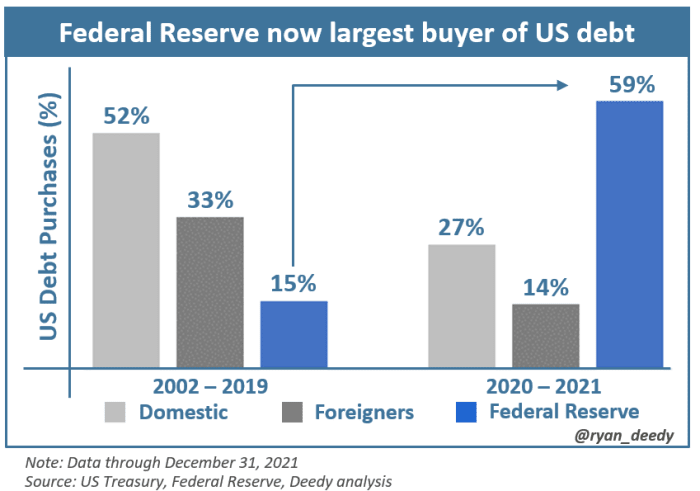

While the Fed discusses further tapering of its financial support, any tightening measures are likely to be short-lived, given the economy’s continued weakness and reliance on debt to drive economic growth.

Less than four months ago, Congress increased the debt ceiling for the 78th time since the 1960s. Given the nation’s historically high debt level and its current fiscal situation, its need for future borrowing is unlikely to change.

However, the funding market for the government’s debt has changed. Since the pandemic-related lockdowns and the associated financial relief programs that were announced in 2020, demand for U.S. debt has dried up. The government has since relied on the Fed to fund the majority of its spending needs.

As demand for U.S. debt from domestic and foreign investors continues to wane, it’s likely that the Fed will remain the largest financier of the U.S. government. This will drive further increases in the money supply, inflation, and a decline in the value of the dollar.

Bitcoin Is The Best Form Of Money

As the nation’s debt burden grows and the purchasing power of the dollar continues to decline over the coming months and years, demand for a better form of money and/or store-of-value asset will increase.

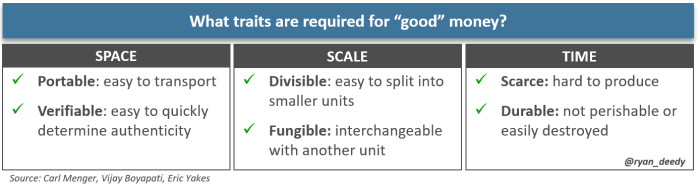

This leads to the questions, what is money and what makes one form better than another? Money is a tool that is used to facilitate economic exchange. According to Austrian economist Carl Menger, the best form of money is that which is most saleable, having the ability to easily be sold in any quantity, at any point in time and for a price that is desired. That which has “almost unlimited saleableness” will be deemed the best money, for which other lesser forms of money are measured.

Saleability of a good can be assessed across three dimensions: space, scale and time. Space refers to the degree to which a good can be easily transported over distances. Scale means a good performs well as a medium of exchange. Lastly, and most importantly, time refers to a good’s scarcity and its ability to preserve value over long periods.

As seen many times throughout history, gold has often been sought for its saleability. The dollar has also been viewed similarly, but its monetary traits have degraded meaningfully since losing its gold backing. However, with the advent of the internet and Satoshi Nakamoto’s invention of Bitcoin in 2009, there is now a superior monetary alternative.

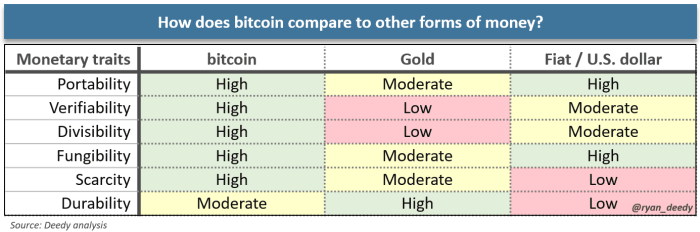

Bitcoin shares many similarities with gold but improves upon its weaknesses. Bitcoin has the highest saleability — it is more portable, verifiable, divisible, fungible, and scarce. The one area where it remains inferior is its durability, given that gold has been around for thousands of years compared to only 13 years for bitcoin. It is only a matter of time before bitcoin demonstrates its durability.

The Next Paradigm Shift

The dollar’s loss of its reserve currency status will prompt the sixth paradigm shift in U.S. monetary policy. With it will come yet another significant decline in the value of the dollar.

Historical precedents will lead some to believe that a transition back to the gold standard is most likely. While this is entirely possible, another probable and realistic monetary alternative in the digital age is the adoption of a Bitcoin standard. Fundamentally, bitcoin is a superior monetary good compared to all of its predecessors. As history has shown in the case of gold, the asset that is most saleable, with the strongest monetary traits, is the one that everyone will converge to.

Bitcoin is the hardest form of money the world has ever seen. Some have already realized this, but with time, everyone from individuals to nation-states will come to the same conclusion.

This is a guest post by Ryan Deedy. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.