Get Trading Recommendations and Read Analysis on Hacked.com for just $39 per month.

The head of Singapore’s central bank is hoping the technology behind cryptocurrencies will stick around after predicting an eventual “crash” of cryptocurrency markets.

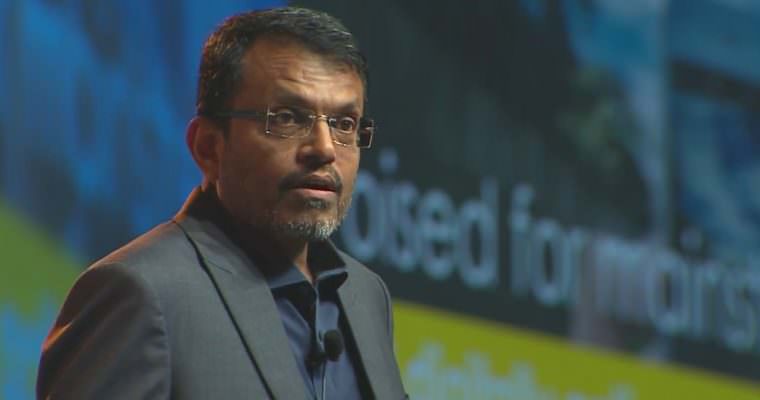

Speaking at a banking industry event in Singapore today, Ravi Menon – managing director of the Monetary Authority of Singapore (MAS), Singapore’s central bank, said he hoped blockchain technology would not be ‘undermined’ by a tumbling of the cryptocurrency ecosystem once the hype is eroded.

In statements reported by Reuters, the central bank official said:

“I do hope when the fever has gone away, when the crash has happened, it will not undermine the much deeper, and more meaningful technology associated with digital currencies and blockchain.”

While it’s easy to dismiss the remark as an opinion similar to those offered by most central bankers around the world, Menon has previously criticized adopters’ “misguided approach” that bitcoin and other cryptocurrencies are merely being seen as an “investment vehicle…that’s going to rise in value.”

In a televised interview in October 2017, Menon added: “I think that’s a rather misguided approach to cryptocurrencies. They can have potentially good applications in particular use cases.”

Citing an example for a wider, real-world application for cryptocurrencies, Menon raised the possibility of benefitting migrant workers in sending “money back to their villages” with “cheaper, faster and more efficient” cross-border transfers.

Menon, who was recently voted the best central bank governor in the Asia Pacific, stated:

“If it [cross-border remittance] was going through a blockchain using cryptocurrencies, it could yield benefits. That ought to be the question, rather than whether bitcoins or ether are going up in value or not.”

Menon’s remarks today follow a public caution by the central bank in December expressing concern in the public’s investments in cryptocurrencies. The price surge in 2017, the central bank said, is driven by market speculation that could eventually see a high risk “of a sharp reduction in prices”.

Further, Menon did not rule out the possibility of issuing a central bank cryptocurrency directly to the public. The authority has already trialed issuing the digitized token of the Singaporean dollar on a private Ethereum blockchain in mid-2017.

Featured image from YouTube/MAS.

Follow us on Telegram.

Advertisement