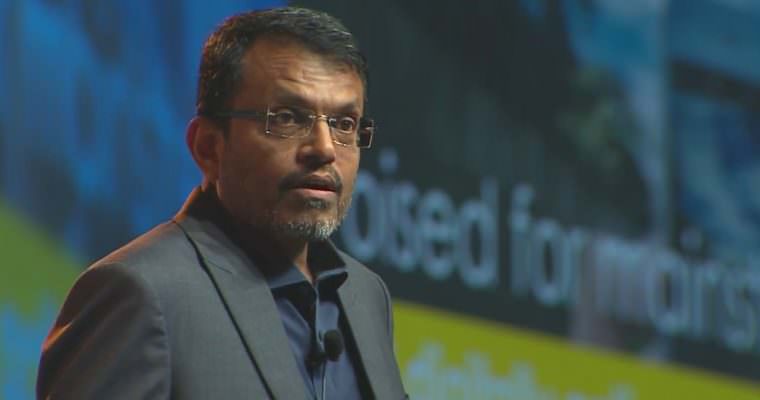

Ravi Menon, the chief of Singapore’s defacto central bank and regulator, has backed domestic cryptocurrency startups and exchanges to gain banking services in the technology-forward city-state.

Monetary Institute of Singapore (MAS) managing director Ravi Menon has called for the banking industry to get over the “hurdle” of offering services to domestic cryptocurrency startups in a marked attempt to foster the fintech industry.

Speaking to Bloomberg, Menon said that while Singapore will not be “an extremely lax regulatory environment” for crypto industry firms locally and beyond, there could be respite coming for startups who have banks reluctant to offer simple banking services like opening banking accounts.

The central bank official stated:

What we are trying to do is to bring the banks and cryptocurrency fintech startups together to see if there is some understanding they can reach.

The embracive, if cautious, approach is a significant contrast to the likes of India, wherein the central bank forced all regulated financial institutions – including banks – to cease offering services to cryptocurrency firms. The Indian central bank’s move has largely dented the industry, leading to the closure of one of India’s biggest cryptocurrency exchanges recently.

For a senior central bank official, Menon has ruled out regulation for decentralized open cryptocurrencies like bitcoin in the past, insisting that bitcoin “itself does not pose the risk that warrants regulation”.

“Our approach is to look at the activity around the cryptocurrency and then make an assessment of what regulation would be suitable,” he said last year, calling for oversight into activities that could abuse cryptocurrencies.

As cryptocurrency markets touched an all-time high earlier in January, driven by a bull-run through much of 2017, Menon sought to bring attention to the “good applications” of cryptocurrencies citing cheap, real-time, international remittance as an example.

“I do hope when the fever has gone away, when the crash has happened, it will not undermine the much deeper, and more meaningful technology associated with digital currencies and blockchain,” Menon said earlier this year.

The permissive ecosystem has seen Upbit, South Korea’s largest cryptocurrency exchange, establish a new cryptocurrency exchange in Singapore last month. Binance, the world’s largest cryptocurrency exchange by trading volume, also announced plans to launch a fiat cryptocurrency exchange in Singapore.

Featured image from YouTube/MAS.

Follow us on Telegram or subscribe to our newsletter here.

• Join CCN’s crypto community for $9.99 per month, click here.

• Want exclusive analysis and crypto insights from Hacked.com? Click here.

• Open Positions at CCN: Full Time and Part Time Journalists Wanted.