As large financial institutions such as JPMorgan become bullish on the S&P 500, three major stocks – Starbucks, Walt Disney, and Adobe – are threatening to take out their all-time highs.

Starbucks (SBUX) Resumes Strong Uptrend After a Three-Year Consolidation Period

In trading and investing, there’s a saying that goes: “the longer the base, the higher the space.” In other words, assets that go through a lengthy consolidation period tend to exponentially rise after the price breaks out. We are seeing this unfold in Starbucks.

The stock range traded between $62 and $48 for over three years before breaking out in October 2018. Now that the stock has breached resistance of $62, it has steeply risen to the all-time high of $90.48. It is actually in price discovery mode, which means that Starbucks is charting its next resistance. As long as it is in price discovery, it is expected to continue to print fresh all-time highs.

If you’re looking to buy SBUX shares, you might want to wait for it to drop to the diagonal support of $85. Then, you can try riding the stock to as high as it prints a new resistance level.

Blue Skies for Walt Disney Company (DIS) After Four Years of Consolidation

Just like Starbucks, Walt Disney Company (DIS) went into a multi-year consolidation before resuming its uptrend. Its range traded between $90 and $115 from February 2015 to March 2019. In April of this year, the stock finally breached resistance of $115 and never looked back.

A look at the weekly chart shows that the stock has printed a large bull flag to indicate the continuation of the strong uptrend. Based on the height of the pattern, DIS could soon be trading at $170.

To capture the uptrend, you might want to consider buying as close to $142 as possible and then selling as close to the target of $170 as possible.

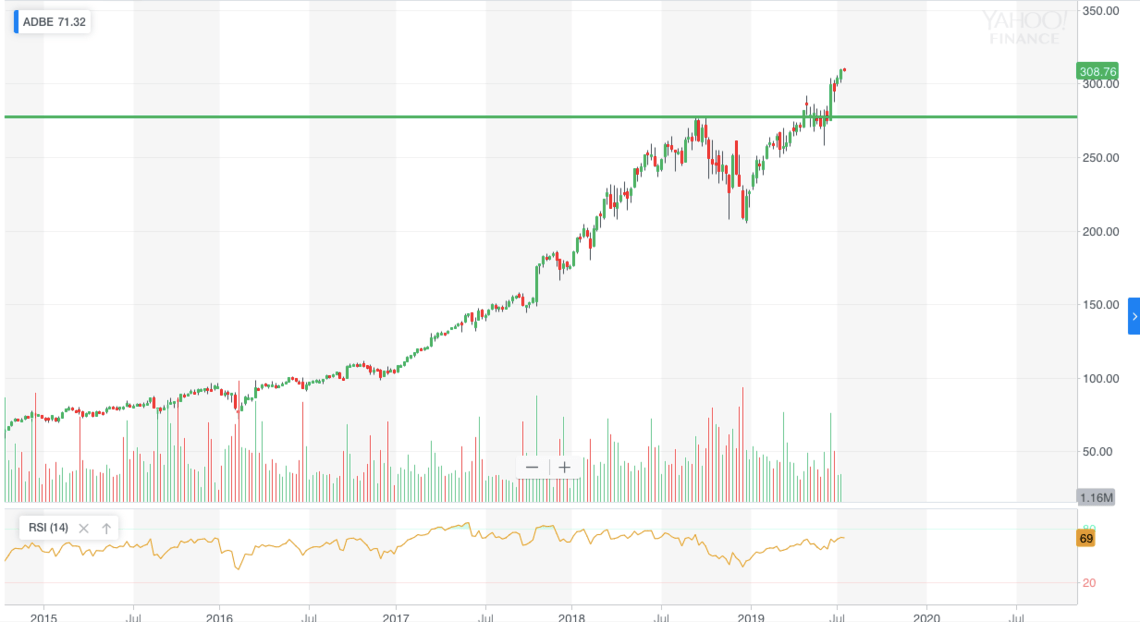

Adobe (ADBE)

Adobe’s case is different from Starbucks and Walt Disney because the stock went into consolidation for less than a year. Nevertheless, during that period, shares dropped from a 2018 high of $277.61 in September 2018 to as low as $204.95 in December 2018. That’s a plunge of over 26 percent in three months.

Fortunately, bulls met the steep drop with a vengeance, driving the stock above the resistance of $275 in June 2019. This created a V-shape reversal to indicate the resumption of the uptrend.

Based on the height of the pattern, ADBE could climb as high as $345 in the coming months. Investors who want to long the equity might consider waiting for it to retest $275 as support.

Bottom Line: Consider Investing in Stocks That Are in a Strong Uptrend

As the S&P 500 goes on a tear, investors might want to look for stocks that have gone through consolidation. Three names quickly caught our eyes: Starbucks, Walt Disney, and Adobe. These equities have resumed their uptrends after lengthy base-building periods.

The solid base that these stocks have built is what’s powering their climb to printing fresh all-time highs on an almost daily basis. The good news is that all three could offer more upside potential. With no known resistance, SBUX, DIS, and ADBE appear ready to blast higher.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.