Legendary billionaire hedge fund investor Mike Novogratz stated that there may be a bubble in bitcoin in certain regions but the cryptocurrency itself isn’t a bubble.

As CCN previously reported, Novogratz noted that bitcoin and the cryptocurrency market could become the biggest bubble “of our lifetimes.”

“I think this [crypto] is going to be the biggest bubble of our lifetimes by a long shot. To be fair, this is a bubble and there’s a lot of fraud mixed in. We look at tons of projects. And some get funded, and they literally look like Ponzis,” said Novogratz.

Novogratz further emphasized that there were many bubbles in the past around innovative and revolutionary technologies such as the Internet. The dotcom bubble for instance overvalued projects by significant margins, with several companies selling at billions of dollars by owning a domain or an online business.

But, the Internet itself was evidently not a bubble. It has transformed every industry in the world by revolutionizing communication and processing of information. There was a bubble around Internet, as demonstrated by the dotcom era, however the technology itself was not a bubble, a fraud, or a scam.

The dotcom era surrounding the Internet technology is similar to non substantial and scam-like projects surrounding bitcoin and the global cryptocurrency market. There exists many fraudulent companies within the cryptocurrency market and projects that operate like ponzi schemes structurally, but there are also a few projects that genuinely compliment bitcoin by providing technologies or solutions the Bitcoin blockchain network currently lacks, like Ethereum.

“Historically, manias or bubbles happen around things that fundamentally change the way we live. If it’s the railroad bubble or the Internet bubble, it really changed the way we live,” said Novogratz.

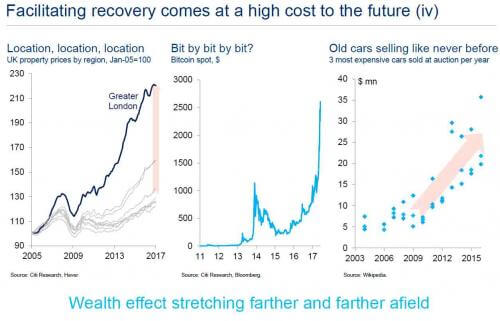

Furthermore, as Citigroup’s recent research revealed, if some analysts decide to describe bitcoin itself as a bubble, virtually every technology, company, and asset tha demonstrate significant gains are also bubbles. Throughout the past two decades, analysts claimed Amazon, Tesla, Facebook, UK properties, second hand cars, and other forms of investments are “bubbles.”

The Citigroup research paper emphasized that if bitcoin is considered a bubble, everything else is a bubble as well.

In regions like South Korea, the third largest bitcoin market behind the US and Japan, a short-term bubble has formed because of the tendency of the country’s traditional finance market to invest in any popular asset which rises in value at an exponential rate. Korbit founder and CEO Tony Lyu said in an interview with Nathaniel Poppers that South Korean investors tend to “join the party” once others are invested.

Over the past few weeks, kids and teenagers in the South Korean bitcoin market have purchased the cryptocurrency with the funds of their parents without their authorization and ultimately suffered major losses as the price of bitcoin corrected.

Middle-aged and old investors who have no underlying knowledge in cryptocurrencies and bitcoin have started to invest in bitcoin out of pure speculation, without any regards to the future growth trend of bitcoin and its use case.

In the mid to long-term, these short-term buys and small bubbles will dissipate, through price corrections. If bitcoin itself is a bubble, it should not be able to withstand major corrections that occur at least two times on a monthly basis, as investors and the market fail to adapt to the increasing value of bitcoin. Bitcoin has suffered many corrections throughout its nine-year history and through that, it is rapidly evolving into a more mature and liquid store of value.

Featured image from Shutterstock.