There’s been a lot of recent attention directed at the digital asset Tether (USDT), as the project has received intense scrutiny because there’s been a few hundred million USDT issued over the past few months. Tether’s supply is now over 1 billion USDT in circulation, and while the project’s controversy continues, it is still a perpetual motion claim because it continues to work for a lot of traders and exchanges.

Also Read: Bitfinex Slaps a Lawsuit on Its Nemesis as the Tether Squabble Gets Ugly

When Bitcoin Markets Are Storming Tether Keeps Many Traders Safe from the Bad Weather

Today we’re going to discuss the Tether project, but this time from the perspective of why individuals and businesses find USDT beneficial. There’s definitely a lot of controversy surrounding the Tether project and whether or not its supply of USDT is backed by real U.S. dollars. The project is a digital asset that was created by a company called Tether Limited, and the supply is issued over the former Mastercoin project, Omni Layer. Tether has become popular over the course of the year due to its ability to hold a stable exchange against the USD. So far that stability has not changed much, and USDTs have always kept a dollar average give or take 1-5 pennies. People can purchase USDT through the website or a cryptocurrency trading platform. Currently, a great variety of exchanges use USDT as its base currency which gives the business a range of benefits.

Today we’re going to discuss the Tether project, but this time from the perspective of why individuals and businesses find USDT beneficial. There’s definitely a lot of controversy surrounding the Tether project and whether or not its supply of USDT is backed by real U.S. dollars. The project is a digital asset that was created by a company called Tether Limited, and the supply is issued over the former Mastercoin project, Omni Layer. Tether has become popular over the course of the year due to its ability to hold a stable exchange against the USD. So far that stability has not changed much, and USDTs have always kept a dollar average give or take 1-5 pennies. People can purchase USDT through the website or a cryptocurrency trading platform. Currently, a great variety of exchanges use USDT as its base currency which gives the business a range of benefits.

Less Friction

Exchanges that utilize USDT as a base currency include Binance, Bitfinex, Poloniex, Bittrex, and more. The advantage of an exchange using tether means the platforms that uses it as base currency can strictly operate in cryptocurrency without ever using fiat. This is both convenient for the exchange and the trader. The trading platform doesn’t need to settle with pre-existing banking institutions, and the customer doesn’t need to enter the world of fiat. Entering the fiat game brings the eyes of banks, tax collectors, alongside a significant time difference to settle.

A Friend During the Bear Markets

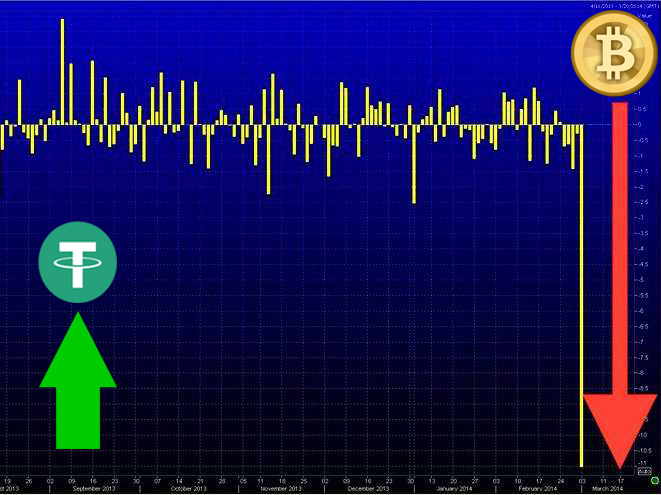

Tether’s advantages are far more obvious to traders during significant bitcoin price dips, and its reserve base model of a Tether/USD pair acts as a safe haven and arbitrage opportunity. Most of the time when bitcoin (BTC) markets dip, nearly every other digital asset’s price will be correlated to the drop in value. Everyone who watches the markets knows this is the case a great majority of the time, but USDT doesn’t budge during bear markets. In fact, during big crypto-market dips the price per tether rises.

The pegged 1:1 status with the USD stays consistent, and during massive BTC market dips USDT can spike anywhere between to $1.02-1.05 per tether. This is very noticeable when people observe that the price of bitcoin is much lower on exchanges like Bitfinex and Poloniex because USDT is trading for more than a dollar. There have also been times, although extremely rare, when tethers have dropped below a dollar and ranged between 98-99 cents. Traders and arbitrageurs use USDT to their advantage, and the scheme has made them millions upon millions of dollars.

Some People Believe USDT Hasn’t Harmed Investors, Its Made Them Rich

These days, a multitude of people are worried that tethers are not backed by real dollars, and they might not be tethered to anything. However, at the moment, tethers do work because traders and exchanges have the firm belief that for the time being the 1:1 backing will work. Tether also provides significant liquidity, something that USD or any other nation-state issued currency can never offer. It takes the fiat friction completely out of the equation, and until the project falls by the wayside, it has made many people rich. If tethers 1:1 USD backing is a house of cards, for now, they have provided investors and traders with the belief that it can be a safe haven, offer friction-free trading, and enable significant arbitrage opportunities.

Problematic Issues With Tether Will Stem From Regulators or Lack of Belief In The Pegging Scheme

However, if the USDT system falls apart, it will cause a lot of disruption in the cryptocurrency space. Many skeptics think that the tether scheme is going to be disastrous to the price of bitcoin, and many other cryptocurrencies, if the business really is a house of cards. Many have called USDT the new ‘Willy bots of 2017,’ recollecting the 2013 trading bots used on Mt Gox to pump up the price that year. Moreover, many exchanges use USDT, and if the project is stopped by a regulator like the Securities Exchange Commission their operations may come to a halt. The tremors felt from the demise of tether will likely be felt far and wide throughout the entire cryptocurrency landscape.

This is only IF regulators find problematic issues with the project, and IF traders stop having faith in tether’s 1:1 USD backing. Until then, the perpetual motion of USDT is almost the perfect model for liquidity, arbitrage, and hedging against market volatility. Sure there’s a lot of controversy surrounding this liquidity vehicle, but at the moment the tether system is not going anywhere, and it’s because people sincerely believe they always will be worth a dollar.

What do you think about tether? Do you think the scheme is a house of cards that’s going to fall apart? Or do you think that USDT will remain in the cryptocurrency space for a while providing arbitrage and liquidity to exchanges and traders alike? Let us know your thoughts in the comments below.

Disclaimer: Bitcoin.com does not endorse nor support these products/services.

Readers should do their own due diligence before taking any actions related to the mentioned company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images via Shutterstock, AMC, Pixabay, and Tether Limited.

Need to calculate your bitcoin holdings? Check our tools section.