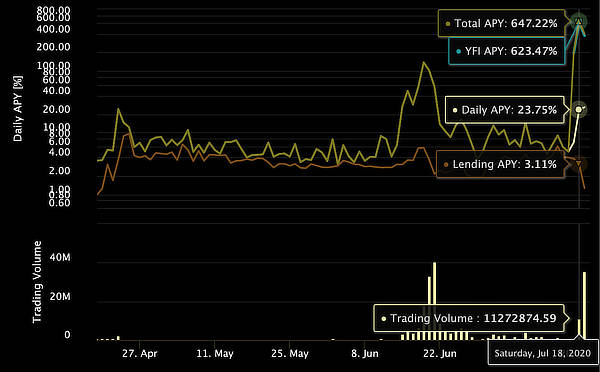

Depositors to the Y Curve decentralized finance (defi) pool received as much as 2,000% in interest this Saturday and about 600% (annualized) for the entire day.

Before this increase, liquidity providers had been earning an aggregate rate of 10.58%.

The latest interest rate growth follows Yearn Finance’s release of a YFI token to govern the Y pool that runs on the Curve defi platform, reports Trustnodes.

The same report notes that as soon as the token launched, the assets under management (AUM) in the pool “jumped from about $8 million to $100 million.”

Announcing the release of the ERC20 token Friday, Andre Cronje had said that the YFI is valueless “yet the market seems to completely disagree with him” according to the report.

In a statement on Medium, Cronje says Y pool “has control mechanisms, configurable fees, maintenance controls, and rules that can be modified. Thus far, these have been managed by us.”

However, Cronje explains changes to the controls and why the YFI has no financial value:

In further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it.

Despite this statement, the annual percentage yield (APY) earned by liquidity providers still went up.

Earning YFI is simple according to Cronje, “provide liquidity to one of the platforms, stake the output tokens in the distribution contracts (we will provide an interface for this), and you will earn a (governance controlled) amount per day.”

Finally, Cronje says standard voting rules apply, the minimum quorum required (>33%) to propose a change, usual veto rights (>25%), and usual agreement thresholds (>50%) required to pass a vote and update a change.

All these are configurable, “governance can feel free to change as required.”

What do you think of Y Curve’s interest rate growth? Tell us your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Trustnodes

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.