The below is a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

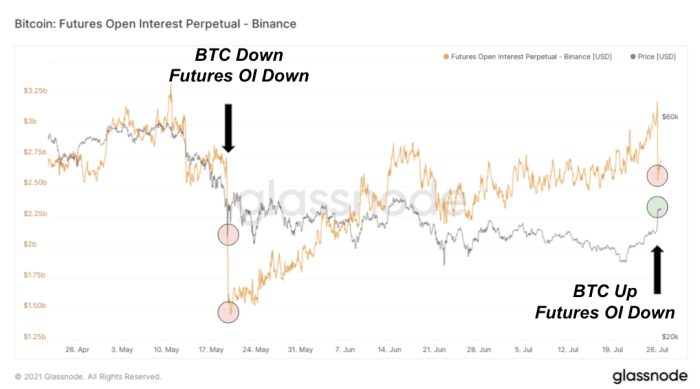

The short squeeze finally arrived.

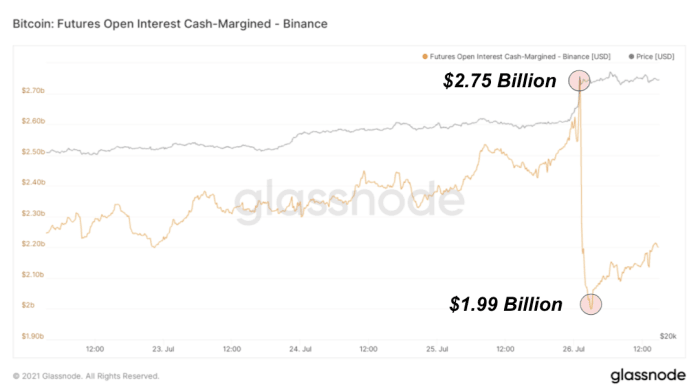

Late Sunday evening, the bitcoin price started to run and absolutely exploded higher, touching $40,000 on certain exchanges and hitting an unbelievable $48,000 on the Binance Perpetual Swap BTC/USDT contract.

What was the reason for the move, and why was it so explosive?

Let’s break it down.

The first thing to understand is how derivatives work and how certain types of derivatives can affect the market.

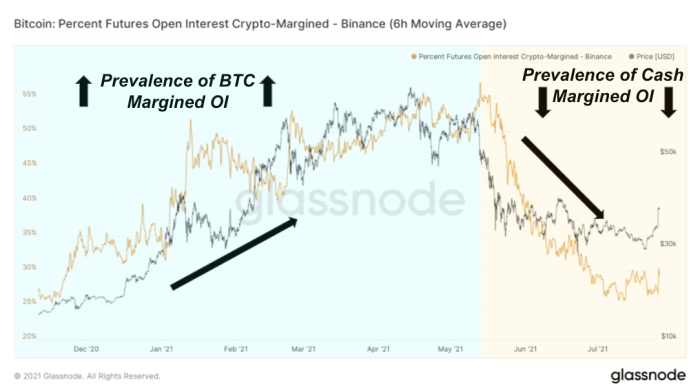

It is advantageous to use stablecoins to long bitcoin instead of bitcoin itself because if bitcoin draws down while you are leveraged long, not only does your position take a hit but the value of the collateral you are using falls in tandem. This is a large reason that the May 19 sell off was so extreme.

“Derivative and futures traders are bearish. Bitcoin stackers and hodlers are bullish. An explosive dichotomy in the market is beginning to emerge.”

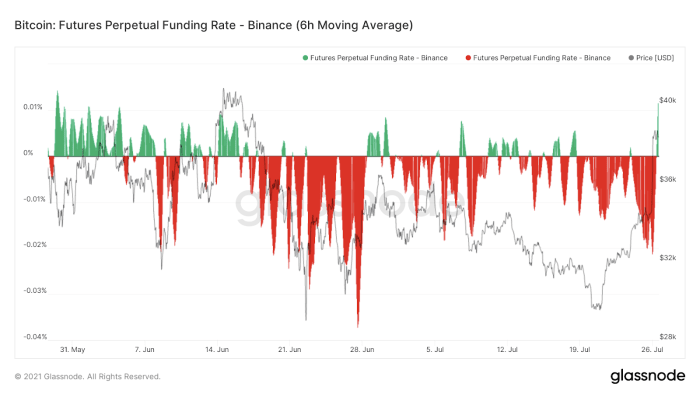

Specifically, bearish bets occurring on Binance using stablecoins as collateral had been occurring in increasing numbers over the past three months.

Leading up to May, traders were increasingly using bitcoin as collateral to long bitcoin. This can be seen in the chart below which shows the proportion of crypto/stablecoin margined futures contracts.

This short squeeze is the opposite. Traders were increasingly shorting bitcoin using stablecoins as collateral (i.e. shorting bitcoin via futures without having the underlying bitcoin).

However, slowly but surely, accumulation by sat stackers ate away at the free float supply, which eventually gave way to a short squeeze.