Jed McCaleb, the co-founder of Ripple (XRP) and Stellar (XLM), as well as the creator of the infamous Mt. Gox cryptocurrency exchange, claimed that cryptocurrency and its underlying technology, Blockchain, should remain decentralized in order to succeed in the future, CNBC reported Friday, March 23. In an interview on CNBC’s Fast Money, McCaleb said that […]<br />Post source: Co-Founder Of Ripple, Stellar: Blockchain Needs To Be Decentralized To Be Successful<br />More Bitcoin News and Cryptocurrency News on TheBitcoinNews.com Source

Author: admin

Qompass Announces Airdrop Ahead of Their ICO Pre-Sale Setting The Stage For A Buying Frenzy As They Launch Revolutionary Blockchain Applications & API With Unique User Benefits

As cryptocurrency becomes more accepted in society, the need for digital currency to operate alongside the traditional fiat is becoming undeniable. Qompass is introducing a cryptocurrency exchange with a rich amount of features that allows the user to buy, trade or exchange their digital currency for local fiat currency via mobile app or online. Hong Kong – March 20th, 2018, Qompass sent shockwaves through the cryptocurrency community this week with the announcement of an ICO and launch of a new Read more …

IRS Reminds Taxpayers to Report Virtual Currency Earnings

Regulation The United States Internal Revenue Service (IRS) recently published a document reminding taxpayers that income derived from virtual currency transactions must be reported on income tax returns. The IRS states that taxpayers who fail to report virtual currency earning may be audited or made liable for “penalties and interest.” Also Read: Bitcoin Adoption Grows in Ugandan Capital City of Kampala IRS Reminds U.S Crypto Investors of Tax Obligations With the U.S tax deadline of April 17 fast Read more …

Trump Bans Petro, a Pacquiao ICO and the Caribbean Goes Crypto: Week in Review

Join our community of 10 000 traders on Hacked.com for just $39 per month. What happened in crypto this week? Price Watch Bitcoin is up 16% this week to $9,000. This comes as part of an increase across the entire cryptocurrency market. It’s also likely the result of higher trading volumes. Fundstrat’s Thomas Lee made a price prediction of Bitcoin reaching $91,000 by March 28, 2020. Morgan Stanley likened Bitcoin to the dotcom crash. Ethereum is up 4% this week to $539. Read more …

The Axeman Cometh – U.S. Gov’t Cuts Bitcoin Futures Watchdog CFTC Budget

Bitcoin futures watchdog, the CFTC, is “astounded” by Congressional budget plans which reduce their budget but increase spending for U.S securities regulators. The U.S Commodity Futures Trading Commission (CFTC) Chairman, J. Christopher Giancarlo, is reportedly taking a $1 million USD reduction in the agency’s annual budget as a personal affront after requesting a 13 percent increase. Fewer Funds to Regulate Bitcoin Futures and Fintech Innovation The CFTC has been allocated $249 million for futures and swaps regulation, including newly launched Read more …

Slush Pool Mines the First ASIC Boost Block Sparking More Debate

Mining On March 24, the mining operation Slush Pool announced it had mined a block using the controversial ASIC Boost protocol and did so using a Halong Miner. The news follows the pool revealing it was compatible with ASIC Boost which sparked up a heated debate just recently. Also read: What is Asicboost? — An Interview With Developer Jeremy Rubin Slush Pool Mines Block 514882 Using ASIC Boost Technology and a Halong Miner According to a recent announcement Read more …

Exec Who Published First Wall Street BTC Price Analysis Co-Founds Blockchain Fund

Sheri Kaiserman, the now former head of Wall Street’s Wedbush Securities, has left the company in order to co-found a Blockchain investment fund and advisory business, Bloomberg reported March 20. Kaiserman is seen as a Bitcoin pioneer in the traditional finance world — she had been Wedbush Securities’ head of equities in 2013 when she approved the release of an analysis of Bitcoin’s (BTC) value, the first Wall Street company to do so. In 2014, Wedbush Securities had also begun Read more …

JobChain Readies For Impending ICO Pre-Sale – Adds A New Paradigm To The Global Job Market Industry

JobChain is the World’s First Blockchain Recruitment Marketplace. It will be an open API integrated blockchain-powered decentralized Job and CV verification marketplace that is incentivized by the JobChain Token. London, United Kingdom, March 22, 2018, Anybody that has ever looked for a job knows that it can be a very cumbersome process. With the advent of the internet and job recruitment web platforms, one would think it would be easier, but it is not… until now. The JobChain ICO is Read more …

Zimbabwe’s only Crypto Exchange Aims for a National Digital Revolution

Join our community of 10 000 traders on Hacked.com for just $39 per month. Cryptocurrency exchanges currently serve as the ideal gateway for entry into the ecosystem and therefore the designated channel of adoption into the mainstream. The effect of these exchanges in the financial solutions industry is obvious in a number of areas. Payments and clearance, remittances, operations and several other aspects have experienced one form of intervention or the other as a result of crypto implementation through exchanges. Read more …

TON Pool ICO Platform: Universal New Generation Crypto Currency Platform

As the practice of the last few years has shown, the powerful potential that the cryptocurrencies are endowed with, allows us to ensure decentralization and security of money operations in the modern world. But nowadays there is still no single currency that could be considered universal in the mass market and unite a multi-million audience in the global community. 2018 can be significant in this respect. The world will see a project called the Telegram Open Network (TON). Its key Read more …

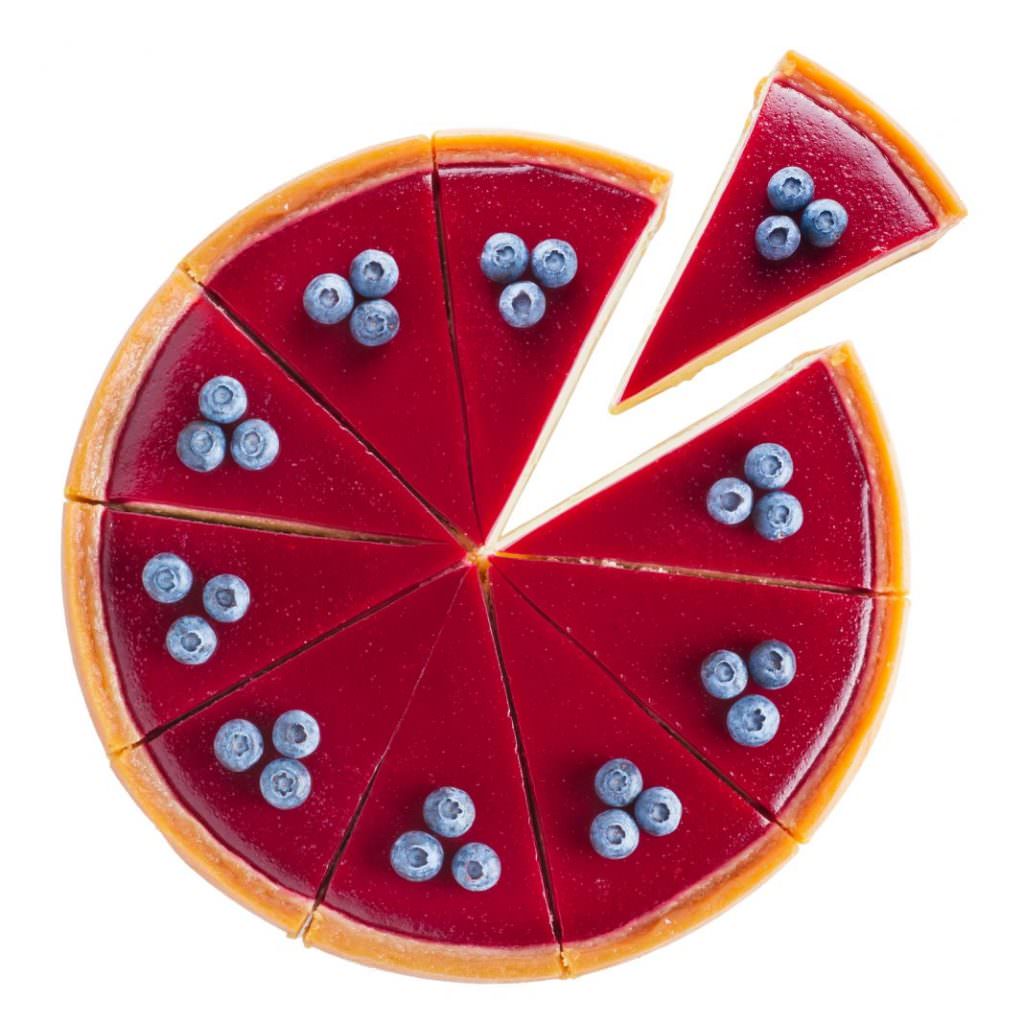

ICOs Are Keeping More of the Pie to Themselves

Crowdfunding With diminishing returns, increased demand, and pre-sales muscling out public sales, profiting from ICOs in 2018 is a tall order. Just to add to investors’ woes, the percentage of tokens allocated for public sale is also on the decline. On average, ICOs now keep more of the pie to themselves and dole out increasingly slender pieces to the public. Also read: Game of Thrones Bitcoin Hacker Included in Broader Iranian Sanctions Public Token Allocations Are Down 12% Read more …

Santander Confirms Ripple-based Cross-border Payments are Coming “Soon”

Ripple has made a lot of headlines over the past 18 months. The company is intent on disrupting the financial sector with digital ledgers and its XRP asset. Santander has confirmed they will carry out cross-border payments with Ripple’s technology this year. Another Notch in the Belt of Ripple Various financial service providers have taken a keen interest in what Ripple has to offer. The growing focus on distributed ledgers and digital assets is very tangible. Especially when it comes Read more …