The below is an excerpt from the monthly recap by the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Supply Reaccumulation

The overarching trend in Bitcoin since the start of 2020, but more broadly, over the course of Bitcoin’s history, has been an increasing amount of the network’s verifiably scarce supply becoming illiquid.

The hoarding of supply, or as bitcoiners call it, “hodling,” creates a virtuous cycle of adoption, as an ever growing number of proponents/adopters are competing to acquire an ever shrinking free float of supply, which in turn attracts more curious individuals to learn about bitcoin and the attributes which make it objectively the best monetary asset humanity has ever seen.

This broad trend of growing illiquid supply causes what some bitcoiners refer to as “number go up” technology, which is a great simplification of what bitcoin has done historically better than any other asset — accruing additional value, in exponential waves of adoption and price appreciation.

With an absolutely scarce supply, and an ever-increasing pool of network participants, betting on bitcoin to stop its trend of exponentially increasing in value over time is extremely unwise, even if growth on a percentage basis is less explosive than it was during the network’s early days.

Illiquid Supply

Read here for more information on the classification between liquid and illiquid supply.

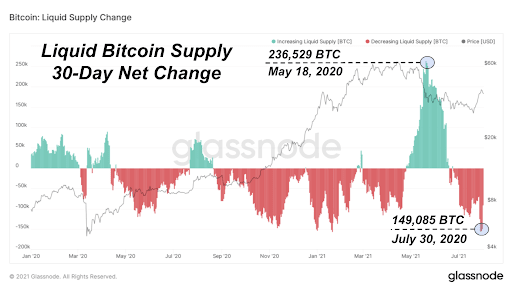

As July arrived, a sudden and sharp increase in previously illiquid supply becoming liquid helped to send the price spiraling downwards as sentiment quickly changed and over-leveraged speculators sold positions at a loss, or were liquidated entirely.

Our views have stayed unchanged since the middle of May, that a deviation from the broad trend of illiquid supply increasing (thus more dollars changing for the marginal unit of bitcoin) does not mark the conclusion of the trend, but instead a momentary pause while coins are reaccumulated from weak hands.

Liquid Supply Change

One of the hardest things for many market participants to understand about bitcoin is that price does not go up on good news; price goes up when the marginal seller has been exhausted, which may or may not be influenced by the news cycle. It is the first point however that is fundamentally important to understand.

In a global market that has some liquidity in every technologically-able market on the planet, price is entirely set by the marginal buyer and seller; and against an ever-growing passive daily buyer base, the marginal seller is very often the driver of price.

This is why looking at illiquid supply can provide value to investors looking to visualize changes in trend and holder behavior.

On May 18, the previous 30 days saw 248,529 bitcoin re-enter the liquid supply, as 2021 investors capitulated for historic levels of realized losses on-chain in May and June. On July 6, we said the following regarding the on-chain reaccumulation that was taking place:

“When a breakout comes, it seems extremely likely to come on the upside, as strong-handed hodlers have once again begun to aggressively accumulate.” – The Daily Dive #016 – Price Consolidation Continues

The price has since rallied approximately 20% and we expect further momentum to the upside over the course of the third and fourth quarters of 2021.

Highly correlated to changes in liquid/illiquid supply is the aggregate bitcoin balances across exchanges. While not every buy/sell goes through an exchange (i.e., settlement between two counterparties directly on-chain for goods/services), the BTC/USD exchange rate is set by spot bitcoin demand for bitcoin across various exchanges.

WIth the sharp increase in liquid supply during the month of May came a corresponding increase to bitcoin balances across exchanges.