When things go south in crypto land it happens fast, a digital avalanche sweeping away everything that stands in its path and blasting most of digital coins into oblivion.

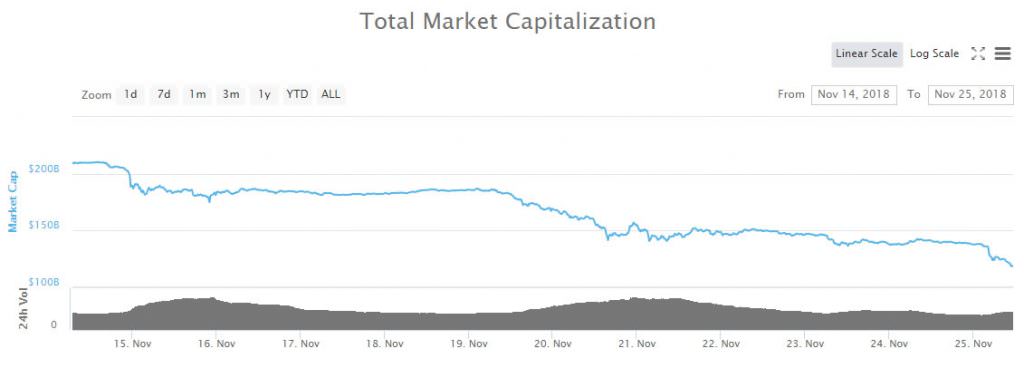

This weekend’s exodus has been a third wave of selling which has resulted in the loss of over $90 billion from crypto markets this month alone. In a fortnight the market has shrunk by 43% in what has been the largest loss this year.

Since Bitcoin still dominates proceedings and performance for the rest of the market it should be BTC that we look to when searching for a bottom. It was widely predicted that Bitcoin would find a plateau at around $6,000 which it did for a couple of months. External influences such as the SEC or ICOs, or even the Bitcoin Cash fork, have been blamed for it dropping below that level but this is unlikely to be the case.

As we have seen, $6k was not the bottom, not even close to it. The next level predicted was $4,500 but Bitcoin plunged through this support level yesterday as it dropped below $4k for the first time since September 2017.

The next level is $3,000 and this one is key if longer term charts and trends are to be observed. Taking previous price swings into consideration, market analyst Murad Mahmudov predicted things will fall even further if Bitcoin is to replicate previous patterns before it recovers.

5/ low 3000s not outside the realm of possibility if the Descending Triangle pattern plays out fully pic.twitter.com/i96zTtPQ5V

— Murad Mahmudov ? (@MustStopMurad) November 15, 2018

A fall to around $3,000 will leave the entire crypto market with a capitalization below $100 billion and the rest of the altcoins in severe pain. Once this level is reached things are likely to stay there for several months before any sign of recovery so hold on to your seats because things will probably get worse before they improve.

Others predict an even lower bottom with Bitcoin back at $1,000. Either way, Bitcoin and crypto has fallen this fast and this heavy before, in several instances over the past decade BTC has lost over 80% in less than a year. It has recovered before and will do so again, the fundamentals for this technology are still extremely strong.

The bear market this year has simply weeded out all of those that got into crypto to make a quick buck, usually with little understanding of what they were investing in. Things will find their equilibrium and eventually the trends for the market will start to reverse. Those in for the long haul will be adding value, building, and working on wider scale adoption of cryptocurrencies which is the only thing that will sustain their development and secure their place as part of our technological future.

Image from Shutterstock