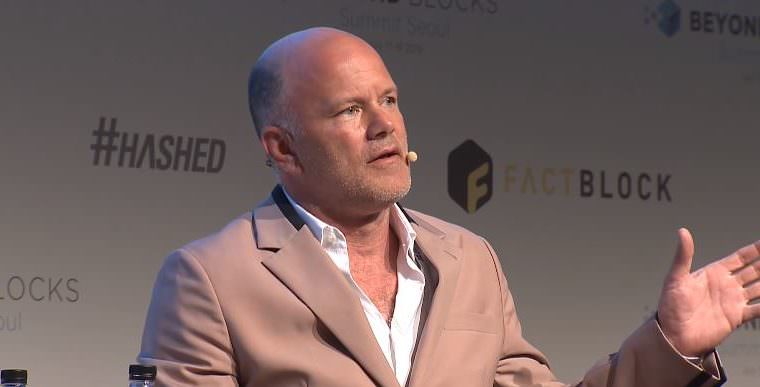

Bitcoin bull Mike Novogratz extolled the tokenization of real estate during this “crappy” crypto bear market, saying asset tokenization is an emerging trend.

Novogratz, the founder of crypto investment bank Galaxy Digital Capital Management, said the cryptocurrency market is in a slump, but there are many exciting developments occurring below the surface.

“While it feels like a crappy bear market — and it has been in coins — underneath it there’s all kinds of positive things,” the billionaire investor told Bloomberg. “There are new technologies coming. There’s positive movement on the institutional adoption of the architecture needed.”

Real Estate Tokenization: An Emerging Trend

Novogratz said several companies had been tokenizing luxury condos in the high-priced real estate markets of New York and Aspen, Colorado. “You’re going to see more and more of that,” he promised.

“It’s not nearly as sexy as Web 3.0, but it’s a part of this broader movement of tokenization, digitalization in blockchain,” Novogratz noted. “The blockchain makes a lot possible.”

Real estate tokenization is not a new concept, and the tokenization of luxury condominiums has become more common with the advent of security token offerings (STO).

Many condo buildings are getting their own tokens, representing a fractional interest in the property. This enables owners to invest in luxury condos even with a small investment — something that previously was extremely difficult.

Tokenization can also be applied to other asset classes, opening up a new universe of investment opportunities for smaller investors.

‘Tokenization Is Paving The Way’

In October 2018, a $30 million Manhattan building comprised of 12 upscale condos was tokenized on the Ethereum blockchain, as CCN reported. The property is now represented with a sum of tokens available for purchase on the blockchain.

New York City real estate agent Ryan Serhant brokered the deal. He said tokenization is a revolutionary financing method.

Ryan heads the Serhant Team, which closed $838 million in real estate deals in 2017 — making it the No. 1 real-estate team by sales volume in New York and No. 2 in the United States, according to Real Trends.

“With blockchain tokenization, we can remove the unruly pressure of traditional bank financing, which is much healthier for the project and all of the stakeholders,” Serhant told Forbes. “Tokenization is paving the way for a new forefront in real estate development.”

To prepare for this, Mike Novogratz recently hired Goldman Sachs veteran Ian Taylor to manage Galaxy Digital’s blockchain advisory-services arm, as CCN reported. Taylor, who worked at Goldman for almost 19 years, will join Galaxy Digital before January 2019.

Featured Image from Beyond Blocks/YouTube

Follow us on Telegram or subscribe to our newsletter here.

Who is Buying Bitcoin? Take the survey here and help us with our study.