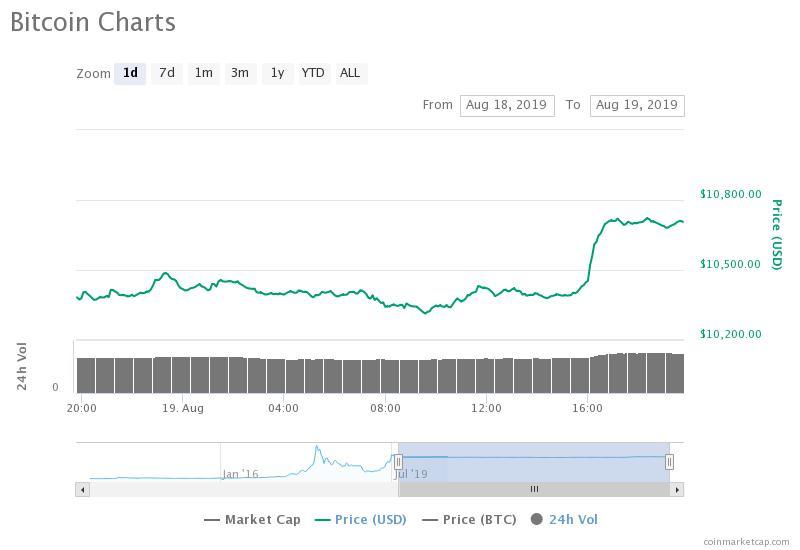

By CCN Markets: Since the official announcement of Bakkt’s bitcoin futures market launch on August 17, the bitcoin price has surged by well over 6 percent against the U.S. dollar to $10,700.

On Saturday, before Bakkt received green light from the Commodities and Futures Trading Commission (CFTC), the bitcoin price was hovering at below $10,000.

“Bakkt is bridging that gap to access this market and solve for factors that have slowed institutional participation. Whether concerns relate to a lack of liquidity, market quality, and regulation, or issues with reliability, fees, and operational risks, we are addressing these challenges with a transparent offering,” said Bakkt.

Within 72 hours, the bitcoin price has surged by nearly $700, possibly signaling a short term trend reversal.

Where is the bitcoin price heading?

According to Thomas Lee, the co-founder of Fundstrat Global Advisors, a key technical indicator in the 4HR 200 moving average was close to being breached at $10,500.

Overnight, the bitcoin price surpassed $10,700, cleanly breaking above the 4H 200 moving average, an important technical indicator for the near term price movement of the dominant cryptocurrency.

“Somewhat encouraging that bitcoin drifting higher over the weekend, even as not a lot of macroeconomic events coming in the next week (although we get Hong Kong data). Looks like BTC wants to break above 4HR 200 moving average, Lee said.

Some traders indicated earlier this week that as bitcoin continues to range, the bitcoin price is likely to rise to $11,200 by the month’s end, demonstrating a slow grind.

“A slow grind here, with lots of sideways in between, that would take us to the end of August and a target of $11,200 would be very ideal,”

one trader said.

Traders anticipate slow movements for bitcoin due to its relatively low volume in comparison to July.

Data published by Messari suggest that the “Real 10” volume of BTC is at around $800 million. In early August, as the bitcoin price spiked to $12,300, the Real 10 volume neared $2 billion.

Altcoins struggling

Historically, when the bitcoin price ranged or demonstrated a sideways movement over an extended time frame, altcoins have tended to record gains against both BTC and the USD.

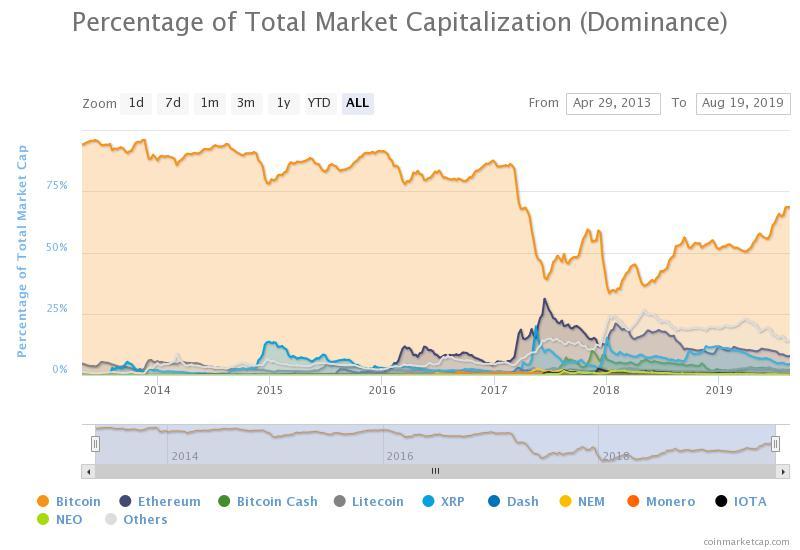

As of August 19, the dominance index of BTC, which calculates the dominance of the asset over the rest of the cryptocurrency market, is at 68.7 percent.

The last time the dominance index of bitcoin rose above 65 percent was in early 2017 when the market valuation of the cryptocurrency market was less than $100 billion.

This article is protected by copyright laws and is owned by CCN Markets.