Binance Coin (BNB) is expanding its reach after Poloniex revealed that it would be listing the token on its retail platform. The move will provide market access to the cryptocurrency for millions of retail investors worldwide.

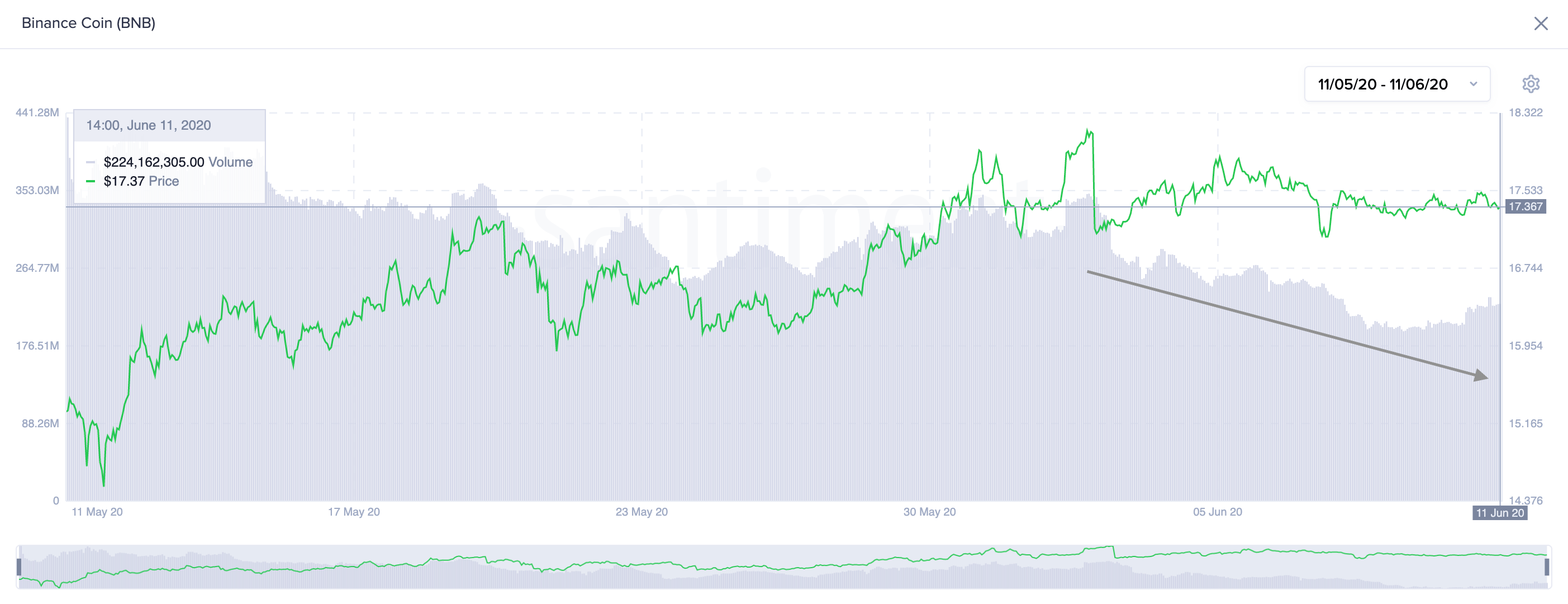

Although the listing brings support for different new trading pairs, including BNB/BTC, BNB/USDT, and BNB/TRX, the announcement failed to spark interest among market participants. The price of this altcoin continues consolidating within a descending triangle without providing any clear sign of where it is headed next.

Moving past the $17 support level could trigger a sell-off that pushes Binance Coin down to $16 while breaking above the hypothenuse at $17.4 may send it towards $18.4.

Despite the ambiguous outlook that BNB presents, multiple on-chain metrics paint a better picture of what the future holds.

Binance Coin’s Social Engagement Metrics Decline

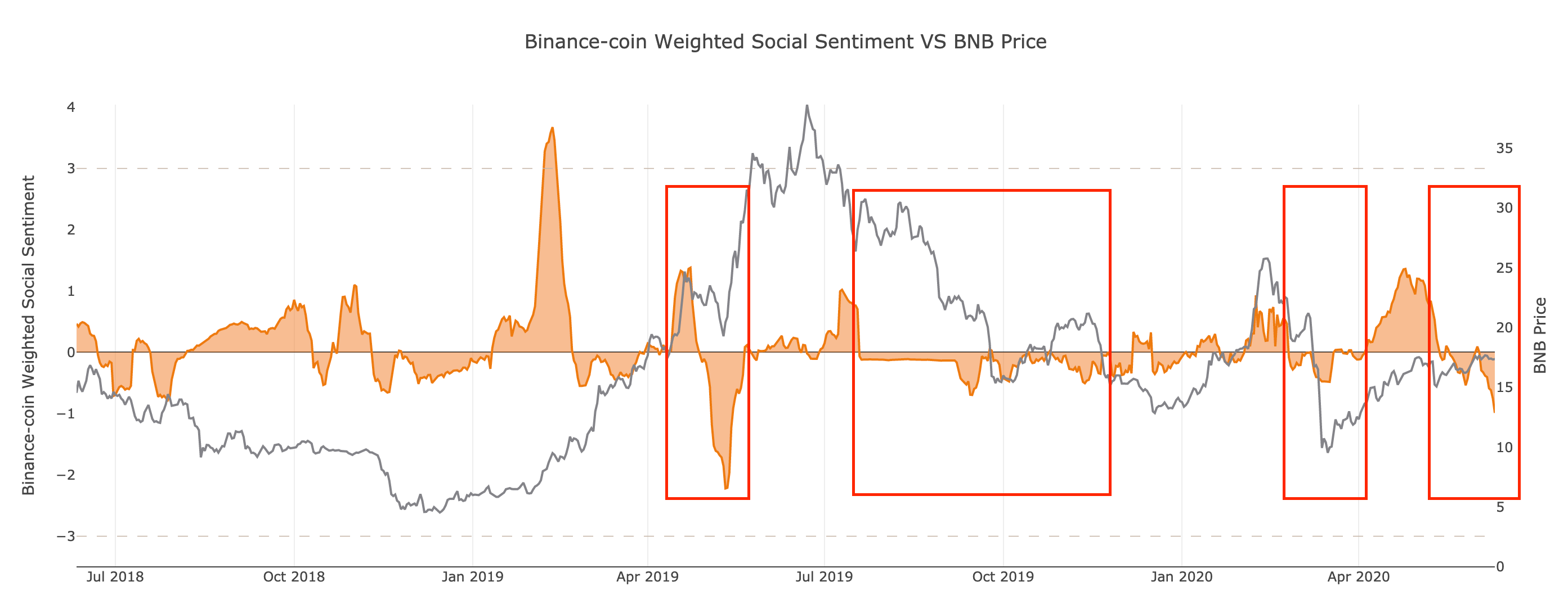

In spite of the Poloniex listing, the social activity around Binance Coin has not really picked up on Twitter or any other social media platforms as much as one would expect. BNB has instead slipped into negative sentiment territory since the beginning of the month.

As the focus seems to be shifting towards small-cap cryptocurrencies, the sentiment volume consumed of Binance Coin is currently at -1. This can be seen as a negative sign based on its correlation with price over the past year.

Indeed, each time BNB’s social sentiment moves below 0, its price tends to drop significantly.

In late April 2019, for instance, the price of this altcoin took a nearly 30% nosedive after its weighted social sentiment dropped to -2.22. A similar phenomenon took place in July of that year, which saw BNB plunge by more than 50%.

If history repeats itself, Binance Coin could be poised for a bearish impulse.

More Bearish Signs Developing

The steady decline in on-chain volume since the peak of June 2 when BNB rose above $18, adds credence to the pessimistic outlook. Such a steep divergence between price and volume represents another negative sign that indicates that momentum for a downswing is building up slowly.

If these on-chain metrics are validated, then it is very likely that Binance Coin will break out of the ascending triangle previously mentioned in a downward direction. A move back down to $16 would likely encourage sidelined investors to get back into the market.

A new inflow of capital from may finally propel Binance Coin to move past the overhead resistance and march towards new yearly highs.

It is worth mentioning that due to the unpredictability of the cryptocurrency market, it is essential to wait for a break of either support or resistance before entering any trade. Now that the market seems to be at the cusp on its next bullish cycle, having fresh capital to deploy is a must.

Featured Image from Shutterstock