Early on Monday morning, March 22, during the Bank of International Settlement’s Innovation Summit, Federal Reserve chair Jerome Powell had this to say about bitcoin or, in his words, “crypto assets”:

“Crypto assets are highly volatile — see bitcoin — and therefore not really useful as a store of value. They’re not backed by anything. They’re more of an asset for speculation… It is essentially a substitute for gold rather than the dollar.” -Chair of the Federal Reserve Jerome Powell.

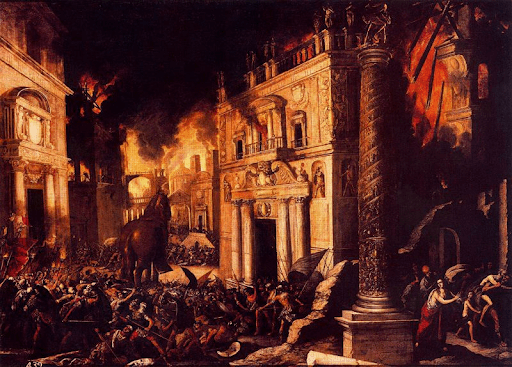

Bitcoin As Digital Gold: A Trojan Horse

This statement made by Powell cannot be understated. Gold served as humanity’s pristine monetary asset for millenia, and as the world continues to transition from the industrial age into the information age, broad change brought about by technological innovation is taking place at an exponential rate.

While gold’s direct link to U.S. government currency was broken in 1971, the underlying properties that enabled the monetary metal to outcompete all other forms of money prior to the 20th century remained. In a global economy built on credit, there is high demand for a bearer monetary asset with no counterparty risk, with the current gold market cap estimated to be $11 trillion at the time of writing. However, a growing number of investors believe that bitcoin is overtaking the role traditionally held by gold.

The comparison to gold is no joke. While the Fed chairman attempted to downplay bitcoin’s role as a medium of exchange due to the asset’s volatility, make no mistake about it, the horse has successfully entered the City of Troy, and Wall Street investors and institutions alike are cheering.

Opening The Gates While Troy Is Asleep

If you are paying close attention to what is being developed in and around the ecosystem, “digital gold” significantly understates the superior attributes and properties that bitcoin possesses in comparison to it’s analog monetary predecessor. In the words of Michael Saylor, gold is a dumb rock. For the first time, we have a digital bearer asset that is capable of settling with finanality at the speed of light. Bitcoin is programmable money, and the possibilities of a sound global monetary system that operates completely peer to peer are limitless. This is possible with neither gold, nor the dollar.

With gold, the shortcomings are obvious. The metal is expensive and extremely slow to transport and assay/verify. While there are financial instruments that provide gold exposure, a trusted third party is required, negating many of the benefits of a monetary asset with supposedly “no counterparty risk.” After all, trusted third parties are security holes.

However, bitcoin is not just competing with gold. All forms of money, whether a monetary metal or a liability of the central bank, are in constant competition with each other. The preferences of what individuals demand to acquire, hold and spend are expressed in the exchange rate between various media. No form of money is insulated from competition.

Shortcomings Of The Dollar

With the dollar, there are obvious shortcomings which Bitcoin vastly improves upon. The very nature of a credit-based monetary system means that counterparty risk always exists, as value is transferred between entities. Satoshi Nakamoto outlined this in the Bitcoin white paper.

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes.” -Satoshi Nakamoto

Prior to the development of Bitcoin, development of the internet faced a major hurdle involving payments and settlement across it. With the launch of Bitcoin in 2009, along with the development of the Lightning Network, value can now be transferred across the internet in a decentralized and trustless fashion. The applications that are, and will be built, on top of an open-source monetary network are truly limitless.

The problems with the dollar system are much more foundational than just the one highlighted above. When it comes to trust, the settlement of value is just the start. As Satoshi noted in an online forum more than a decade ago:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

The Sacking Of Troy: Outcompeting the Dollar

To many, the most important problem that bitcoin solved is pegging money. The monetary debasement that has occurred for decades created the need for an incorruptible monetary system, outside of the power of any human to control or manipulate. The notion that a small group of humans are “needed” to manage the monetary supply on behalf of the rest of the civilization is archaic at best, and insidious at worst.

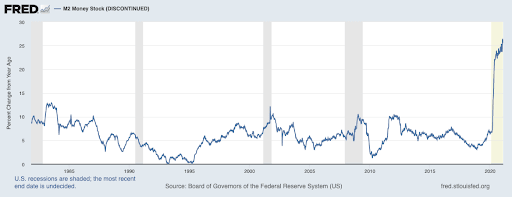

Pictured below is a chart of the year-over-year change of M2 money stock, which is calculated by the Federal Reserve System by “summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs [money market funds], each seasonally adjusted separately, and adding this result to seasonally adjusted M1.”

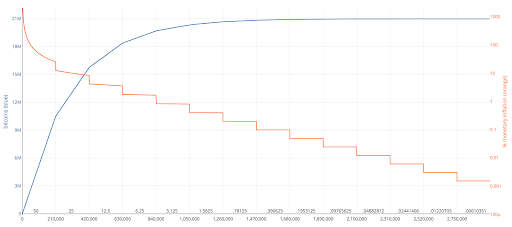

With the advent of bitcoin came the first absolutely scarce monetary asset. A monetary asset with a perfectly inelastic supply issuance is a discovery akin to the discovery of electricity. Demand for bitcoin and bitcoin production has continued to increase in an exponential fashion for the last 12 years, however no additional units of supply can be created. The same cannot be said about gold, and certainly cannot be said about the dollar.

Source

With proof-of-work mining, bitcoin is the first monetary network that perfectly respects the laws of thermodynamics, a truly monumental breakthrough for humanity. Wth an absolutely scarce monetary asset built into an incorruptible monetary protocol, humanity for the first time has a ruler for economic calculation that is pure signal, and no noise. There has never been an asset/commodity with the supply side of the supply/demand equation completely fixed. The implications are immense, and any comparison to gold are either misguided or purposefully deceitful.

To conclude, after hearing the chair of the Federal Reserve address bitcoin earlier this week, there are two distinct possibilities:

- The incumbents of the global monetary system are threatened. Bitcoin clearly disrupts their monopoly on money and credit, and renders them useless. To try and combat this, a smear campaign on bitcoin is attempted where “volatility,” “speculation” and “money laundering” are thrown around in a never-ending cycle of FUD.

- The second possibility is that they are truly asleep. The horse has entered Troy, and they have no idea what is inside the belly of the beast.

The good news for humanity is, regardless of what Powell or any other unelected bureaucrat says or thinks, bitcoin is much more than just digital gold. The powers that be are in for a rude awakening if they believe that’s how this ends.

Troy will be ransacked. The dollar will fall, and out of the ashes truth, liberty and sovereignty will prevail.