The CBOE is moving to offer futures and options trading for Bitcoin. This is a move to take advantage of a nearly $1.6 billion potential revenue opportunity for the CBOE (NASDAQ: CBOE). CBOE is one of the largest options and futures exchanges worldwide. This lends a huge amount of validity to the crypto-currency and is a game changer for Bitcoin. With increased access to mainstream Wall Street investors and the legitimacy of a major exchange trading the crypto-currency, far greater demand will continue to push Bitcoin higher.

The news on this sent Bitcoin upwards about 10%:

In the past 6 months, BTC has moved upward by a multiple of 5; in May, BTCUSD was trading at $1,200.00 and recently topped $6,000.00. I expect this trend to continue for a very long time. And when you factor in more and more mainstream operators – such as one of the world’s largest futures and options exchanges – moving into BTC then the crypto-currency is going to receive a continued amount of support.

A lot of individuals I get emails from asking me how to get involved in Bitcoin trading. There is a process; albeit not difficult, just time-consuming. A potential investor would have to exchange their respective currency into Bitcoin and then transferring the newly purchased coins into a trading exchange. With the move by CBOE, anyone who already has a commodities trading account will then have instant access to trading Bitcoin.

The future potential of this demand will be significantly increased. This is the game-changer aspect of this development. By having CBOE offer Bitcoin, the greater access will continue to push the currency higher over a long, extended period of time. There have been numerous articles written on the subject of Bitcoin $1 million, my article as well. The upside, long-term potential is still very large.

This deal is partnered up with the Winklevoss twins of Facebook fame who previously tried to put an ETF on the market back in April of this year, but were turned down by the SEC.

What I found interesting is that the SEC, the United States regulatory body for equities, said no to the ETF. Now the CFTC is allowing CBOE Bitcoin futures to happen. That is an interesting turn of events. This also will push the coin into mainstream access quite easily. With the ability to trade Bitcoin futures and options, anyone who previously had a reason to stay out is finding it more and more difficult to stay out.

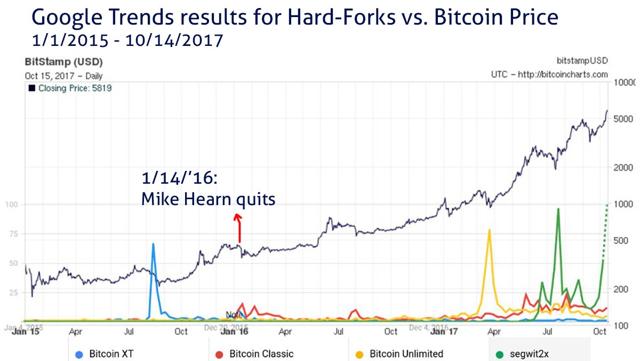

But, lately, Bitcoin has been having trouble with future concerns of the “Hard Fork” that is about to happen in November. I found this chart interesting from Twitter, posted by Tuur Demeester:

The Bitcoin Hard Fork is a way to remedy the scaling issue with Bitcoin. But, once this process is out of the way then any anxiety over what will happen with Bitcoin will be over. Largely, the Hard Fork issue will be a non-event. The hard Fork merely upgrades the Blockhain software within the coins and application software. An individual who does not upgrade immediately will eventually realize their version is outdated and be required to upgrade. The real issue is the volatility that ensues before and after the Hard Fork. Investors will be buying and selling into drops and spikes, respectively for the foreseeable near-term. After time, the market will settle into its own after the exchanges are all transacted.

In the meantime, the anxiety is allowing a buying opportunity on the crypto-currency.

Bitcoin is becoming more and more mainstream. With the ability to trade on a major platform, this surely solidifies the currency’s place as a viable medium of exchange.

The world is already seeing other aspects of the currency becoming mainstream with purchases of homes being transacted in Bitcoin. I had wondered if that had happened yet, did a search and found this. As shifts continue, such as purchasing a home or trading on an exchange, the continued demand will push the currency upwards.

Keep in mind one major thing, there are only 21 million coins available. That number will not increase. So, as access and demand increases, the price will continue to rise. And, if you factor in the fact that individuals lose their Bitcoins stored on their hard drives, that for whatever reason ends up in a landfill – this particular individual is out some $625 million from a careless error – the world will never see the full 21 million coins.

The CBOE expects to earn about $1.6 billion in revenue from this deal. This revenue will be generated from the transactions on its exchange – although, they are calling this a best-case scenario. But, from where I stand, once you have a game changer such as Bitcoin ending up on an official exchange, major Wall Street firms will step in with larger and larger amounts of money to invest in an asset class that has moved upward by a multiple of 5 in 6 months.

Outside of my initial investment, I am continually getting involved in upward price movement, and this is one price movement that I think will add a significant amount of value to the currency over a 5 – 10 year period. First, however, to see more continued increases, the world needs to get the Hard Fork behind it.

I am going long an additional amount of Bitcoin. But, I am hedging my position – as I always do – with options. This way, in case there is any adverse movements in price, such as a move lower with the impending November Hard Fork, I can optimize my position.

I am going long Bitcoin with long put options at a ratio of 1:2. With a spot price of $5,750.00, I am long addition Bitcoin with 2x the size in put options, with the same strike price. If Bitcoin drops in value because of Hard Fork concerns, my spot loses value but my 2x option size means I recover that at twice the price movement. I have a cost for the put options of about $650.00. If the price drops down by that amount I will go long my second coin. I have then locked in my costs for the option as well as enabled myself the opportunity to take profits if the currency moves back upward.

Long term, I see Bitcoin head higher and higher. Demand will continue to increase with easier access. This is a huge game changer from what I can see. However, in the very immediate future, the price may head lower with concerns over the hard fork process taking place. That, to me, is a buying opportunity. But, with the structure I have put together, I empowered myself in case anything truly adverse occurs.

Disclosure: I am/we are long COIN, BTCUSD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.