The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

There’s a new paradigm unfolding among the large public bitcoin miners: They don’t want to sell their bitcoin, and they also want to acquire more. As a result, they are finding creative ways to raise capital or leverage their bitcoin holdings to help cover operating costs rather than having to sell for fiat.

One strategy is to loan out a portion of their bitcoin holdings, thus earning fiat yield that can directly go towards paying their operating expenses. Hut 8 Mining has been doing this, loaning out 2,000 BTC (nearly 40% of their BTC holdings) to earn a 4% interest rate starting in January. That interest rate has since come down to 2.00% to 2.25% as of its latest Q3 financial reporting. At today’s price, 2,000 BTC is worth around $130 million in total value earning an annualized $2.6 million at the lower 2% interest rate. An average bitcoin price for the entire year of $46,792 would generate $1.8 million.

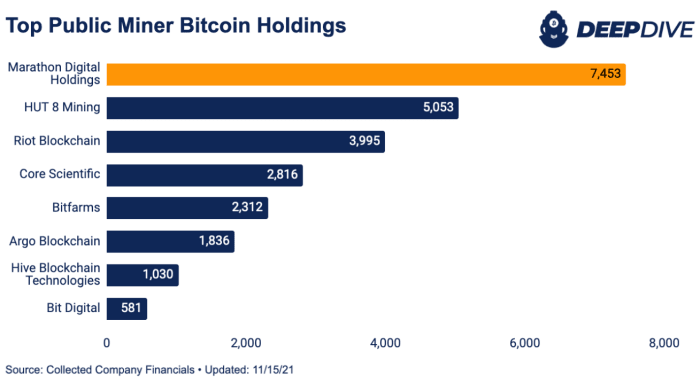

Generating revenue from loaned bitcoin to cover costs allows public miners to better execute on their increased HODL strategies. The Hut 8 bitcoin treasury is now 5,503 BTC which is already up 68% since March of this year. It’s the second-largest public miner treasury behind Marathon. Marathon and Riot, major public miners that report November production updates, both increased their bitcoin treasuries over the last month.

Hut 8 deploys 1,000 BTC with Genesis Global Capital and 1,000 BTC with Galaxy Digital. That bitcoin is then used mostly for institutional trading arbitrage opportunities. Interest rates for bitcoin yield have been pushed further down this year as the cash and carry basis trade narrowed and GBTC shares started to trade at a discount instead of a premium.

A decrease in higher-yield opportunities drives lower market demand for bitcoin loans which then drives lower interest rates. Too much bitcoin supply is chasing yields while there is less demand for bitcoin borrowing. However, the futures ETF interest may help raise and sustain BTC market interest rates with a widening cash and carry spread. Right now that contango trade, longing spot and selling futures, is sustaining around 14% yield which is up from single digits in Q3.

Genesis Global Capital noted in its latest reporting that although bitcoin loans have increased, the weighting of their loan book in Q3 favored more ether and USDC loans as investors are pushed further along the risk curve in the search for a higher yield. This is a key market to watch into Q4 as increased interest rates for bitcoin lending will supply miners with yet another financial vehicle to continue their strategies to acquire more bitcoin.