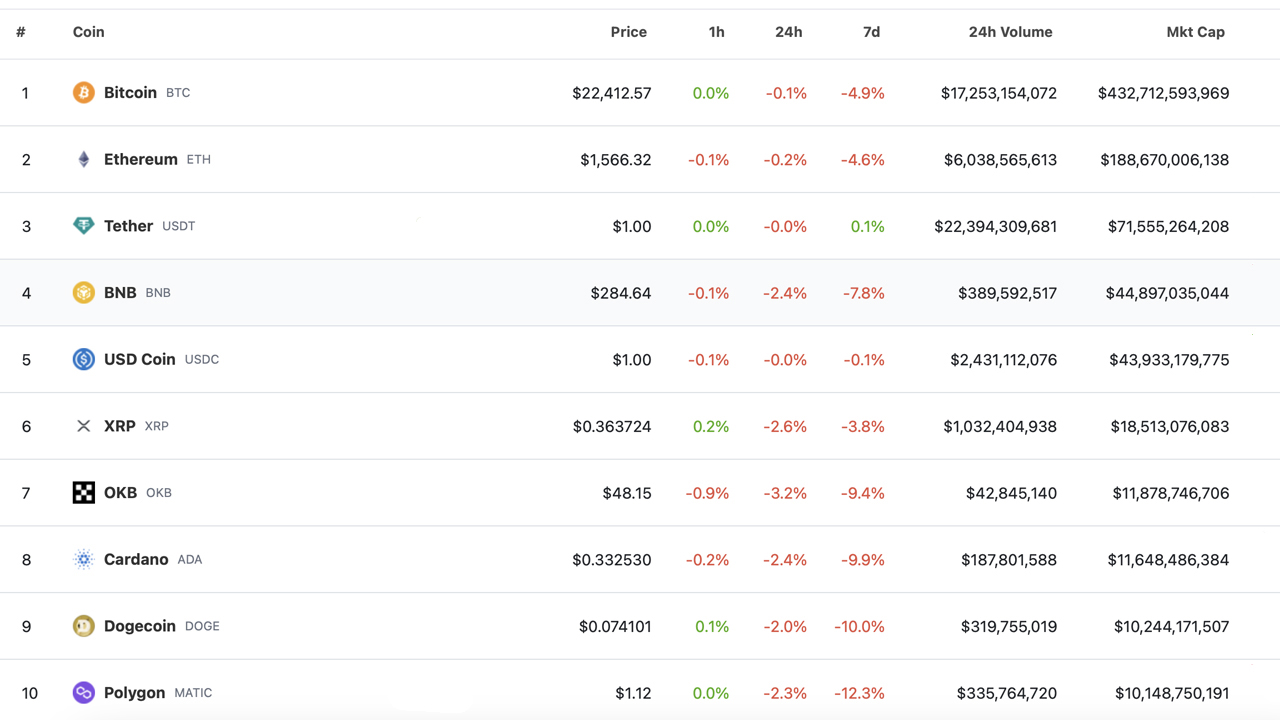

It has been 21 days since Paxos revealed that it would no longer mint the stablecoin BUSD. Since then, over 7 billion BUSD stablecoins have been redeemed. Prior to the announcement, BUSD was once a top-ten crypto asset. However, the top ten cryptocurrencies by market valuation have changed since the redemptions. Presently, there are only two stablecoins in the top ten standings, and the Okx exchange token, OKB, has joined the pack.

2023 Records Changes in the Top 10 Cryptocurrencies by Market Capitalization

Every year, the top ten cryptocurrencies by market capitalization change significantly, such as last year when three stablecoins entered the top ten for the first time. Additionally, the number of proof-of-work (PoW) cryptocurrencies in the top ten fell to two tokens last year (BTC, DOGE), and that remains the case today.

In the 21 days since BUSD was removed from the top ten standings, the top ten cryptocurrency competitors have changed. For example, there are now only two stablecoins in the group, including tether (USDT), the third-largest cryptocurrency by market capitalization, and usd coin (USDC), the fifth-largest crypto in terms of market valuation.

A relatively new entrant into the top ten cryptocurrencies by market capitalization is polygon (MATIC), currently the tenth largest digital token by valuation. The day before Paxos announced it would no longer mint BUSD, MATIC was the tenth largest cryptocurrency by market capitalization, with an $11.55 billion market cap.

On Feb. 12, 2023, Okx’s exchange token OKB was not among the top ten cryptocurrencies by market capitalization, according to an archive.org snapshot. However, the utility token OKB has since moved up a few spots and is now the seventh largest by market valuation.

OKB has risen more than 25% against the U.S. dollar over the past month. Year-to-date, the exchange/utility token is up 176.3%. However, two-week statistics show a 4% loss against the greenback. With OKB, there are now two exchange/utility tokens in the top ten cryptocurrencies, and the fourth-largest cryptocurrency by market capitalization, BNB, is the second.

There are now two stablecoins, two exchange/utility tokens, four smart contract tokens, and two proof-of-work payment crypto assets in the top ten. Two cryptocurrencies that are close to the top ten by market capitalization include solana (SOL) and Lido’s staked ether (STETH).

What do you think the future holds for the composition of the top ten cryptocurrencies by market capitalization? Share your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.