Another week, another of Crypto Tidbits. At long last, the Bitcoin price saw some bullish action this week, gaining some 10% over the past seven days according to Coin360.io. While BTC is trading 4% lower from its weekly highs, analysts are starting to believe that the trend for the cryptocurrency market is finally pointing upward again, with the 35% correction seen in July and August seemingly having ended.

The fundamentals support the idea that the “bull is back on”, with there being a smattering of positive crypto and blockchain developments observed over the past week. They, along with some not so positive news events, are as follows.

Related Reading: Crypto Tidbits: Bakkt Bitcoin Custody, China’s Cryptocurrency On the Horizon, XRP In Hot Water

Bitcoin & Crypto Tidbits

- Bakkt Starts to Custody Bitcoin Ahead of Futures Launch: This week, Bakkt finally launched its Bitcoin custody product, giving institutions a way to securely store their BTC via the new platform. “Today our Warehouse opens for customer bitcoin deposits and withdrawals as we prepare for the Bakkt Bitcoin Daily & Monthly Futures, launching September 23. The availability of physical delivery brings more flexibility in managing bitcoin exposure,” the platform announced in a recent tweet.

- Ethereum Istanbul Testnet Integration Pushed Back: Sorry Ethereum fans, Istanbul hasn’t happened yet. The upgrade (or at least the testnet iteration), which is expected to bring the popular blockchain a number of improvements and changes, was recently pushed back by the core developer team. According to CoinDesk, Hudson Jameson, a community manager at the Ethereum Foundation, told developers in a call on Friday that Istanbul’s testnet activation date will be pushed to October 2nd from the original tentative September 4th date. According to the developers, the later date is due to an influx of Ethereum Improvement Protocols submitted for review for the upgrade.

- Federal Reserve Chairman Jerome Powell Drops Comment on Crypto: In a meeting in Switzerland sponsored by the Swiss Institute of International Studies, Federal Reserve Chair Jerome Powell touched on the topic of cryptocurrency. He stated, presumably in response to moves from China to launch a digital currency of its own, that his organization is not “actively considering” its own cryptocurrency. Powell then touched on Libra, remarking that the Facebook-backed project has the ability to become “systematically important very quickly.” Powell didn’t touch on the regulation of Bitcoin.

- VanEck Launches Institutional-Centric Bitcoin Product: On Tuesday, VanEck Securities Corp. and SolidX Management LLC, two pro-crypto firms that are behind a leading Bitcoin exchange-traded fund (ETF) application, revealed that they were going to be proactive, launching a workaround product. According to Bloomberg, they said that by utilizing a certain rule of a historical securities act, the duo would be able to issue shares in the VanEck SolidX Bitcoin Trust to qualified institutional investors. VanEck’s head of ETF product, Ed Lopez, is hopeful that institutional demand for Bitcoin will materialize in demand for this new “clear” product.

- China Confirms ‘Deets’ About Centralized Crypto: Speaking of central banks, an official of the People’s Bank of China purportedly stated that the new centralized crypto will be supported across major e-payments platforms, including WeChat Pay and Alipay. Mu Changchun added that the tokens are effectively digital versions of the yuan.

- Social Media Giant Telegram Continues Blockchain Launch: Social media giant Telegram continues to roll out its own blockchain. The firm recently released the code for running a node for the blockchain, dubbed the Telegram Open Network (TON). Developers can begin launching full nodes, validator nodes, and blockchain explorers for the product, according to a report from CoinDesk.

- Samsung Launches a Crypto-Centric Iteration of Galaxy Note 10: According to a Wall Street Journal Article published Thursday, South Korean technology behemoth Samsung is launching an iteration of its flagship smartphone — the Galaxy Note 10 — centered around crypto and blockchain. Dubbed the “KlaytnPhone”, a name attributed to the device in reference to social media firm Kakao’s blockchain, the Samsung phone will purportedly only be sold in South Korea. It, the report states, is effectively identical to the stock Note 10. But, it will sport a pre-installed crypto wallet and certain blockchain applications. Also, owners of the device will purportedly be sent some of the Klay cryptocurrency (too bad it’s not Bitcoin, eh?), the currency of Klaytn.

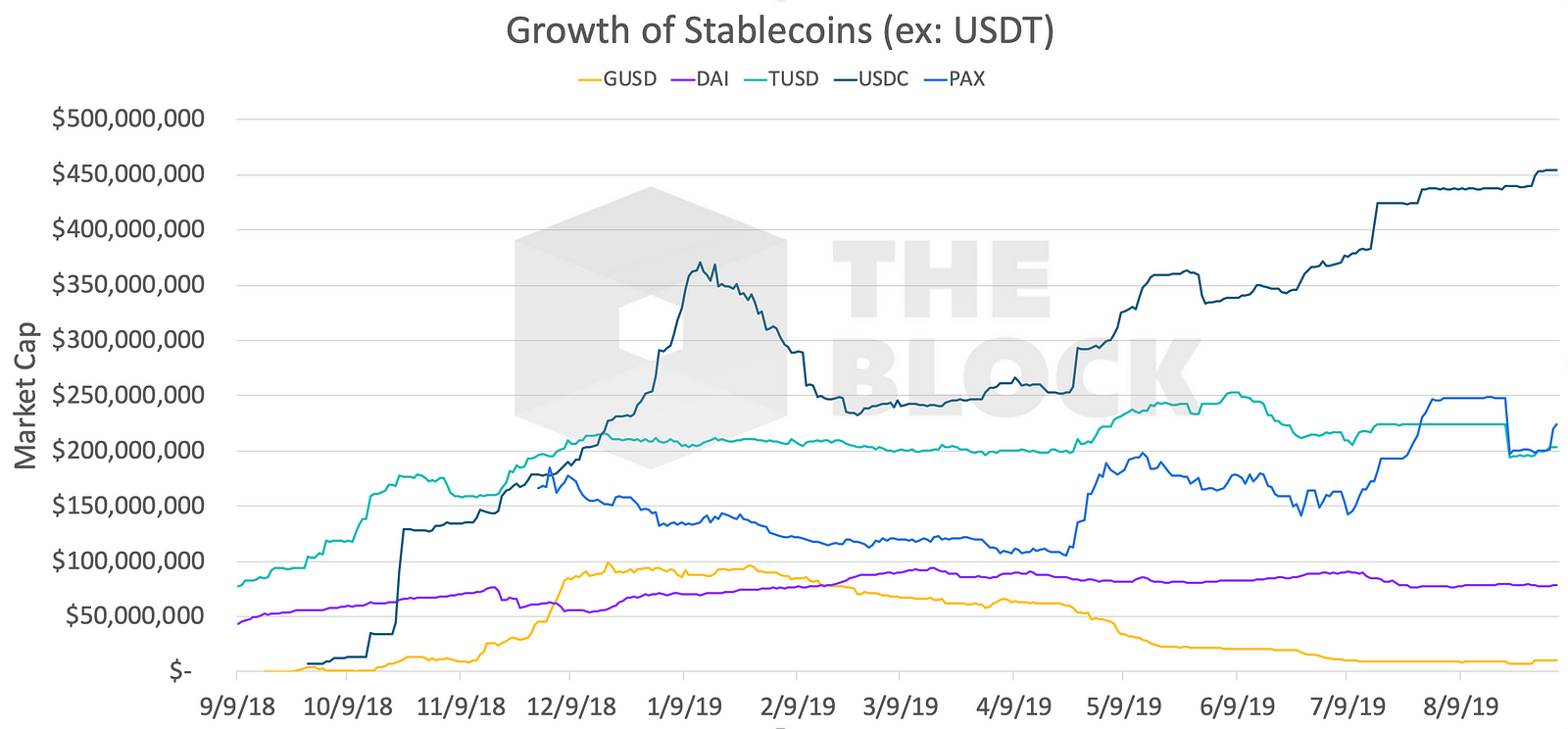

- Binance Launches USD-Backed Stablecoin: This week, Binance revealed that it would be launching its own flagship stablecoin, Binance USD (BUSD), which is slated to be pegged 1:1 to the U.S. dollar. For now, the stablecoin will be built on Ethereum and will be created by Binance in collaboration with Paxos. The duo claims that they have received approval from the New York State Department of Financial Services (NYDFS), making BUSD available for New York investors.

- Apple Sees Potential in Cryptocurrency, Yet Unlikely to Take the Plunge Yet: Speaking to CNN, Apple finds cryptocurrency “interesting” — whatever that means. Jennifer Bailey, vice president at Apple Pay, explained in an interview that the topic has “interesting long-term potential”, but added that right now, Apple’s digital payments ecosystem is only focused on “what consumers are using today”. While this statement was short and seemingly forcefully nebulous, Bailey seems to be hinting that should digital assets gain enough traction, Apple may delve into the crypto game.

- PWC’s Luxembourg Branch Now Accepts BTC: On Monday, PricewaterhouseCoopers (PWC) — one of the “Big Four” companies — revealed that one of its regional divisions, Luxembourg, will be accepting payments made in Bitcoin, marking a small yet positive step forward in the adoption cycle of cryptocurrency.

Featured Image from Shutterstock