The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

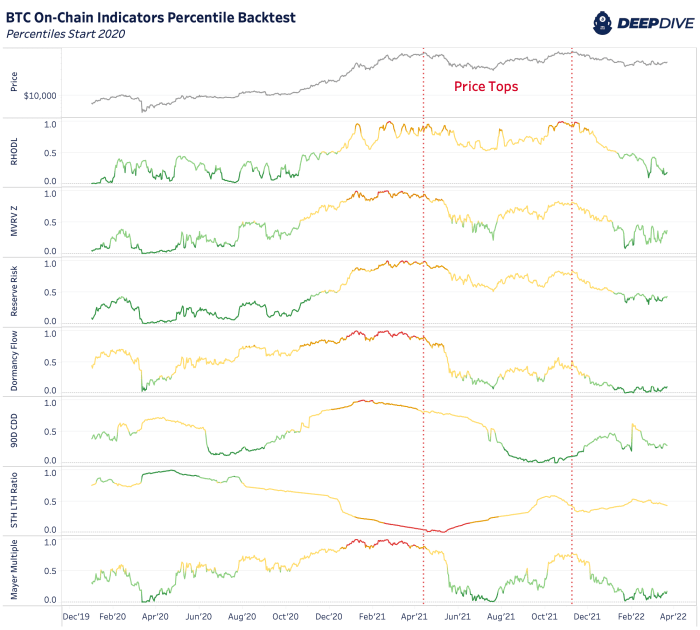

In previous Daily Dives and analyses, we’ve highlighted the importance and trends of major on-chain cyclical indicators across the realized HODL ratio, market-value-to-realized-value z-score, reserve risk, dormancy flow, 90-days coin days destroyed and the ratio between short-term holders and long-term holders. The analysis today covers these metrics in aggregate including the Mayer Multiple.

By no means are these metrics perfect at predicting the market in the short term but they do provide us with valuable insights on when the market may be at a secular or cyclical turning point. We prefer to use these metrics together to get confluence around long-term signals and changing behaviors in the market.

One way to do that is to look at these top on-chain metrics across their historical percentile distributions in different time periods. To make sense of the percentile data for each metric, we segment the percentiles into five different groups and colors ranging from dark green to green, yellow, orange and red. Lower percentiles correspond to the greens while higher percentiles correspond to orange and red.

Below you can see how some of the best on-chain indicators did well at identifying the March 2020 bottom and the April 2021 top.

As for the April 2021 top, every indicator in this analysis was showing overheated signs right before or during the price peak.

The caveat here is that as bitcoin matures and volatility falls, comparing on-chain indicators to the full history may not give the best results for their predictive power in the future. If we’re to continue to see less blow-off-top events in price then that will also be reflected in many indicators.

Final Note

There are key on-chain indicators that are valuable in determining long-term cycle tops and bottoms. Yet as Bitcoin matures and changes, so do the analytical predictive power of these metrics.