The Dow and broader U.S. stock market declined on Thursday, as earnings anticipation zapped trade volumes and bond yields rose following better than expected jobs data.

Dow Edges Lower; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes headed lower in afternoon trading, which reflects a tepid pre-market for Dow futures. The benchmark Dow Jones Industrial Average fell 80 points, or 0.3%, to 26,077.00. Roughly half of the 30 index members traded in the red.

Dow Jones Industrial Average edges lower ahead of earnings. | Chart via Yahoo Finance.

The broad S&P 500 Index declined 0.2% to 2,883.43, with most sectors reporting declines. Health care was the biggest laggard, falling 1.5%.

The technology-focused Nasdaq Composite Index fell 0.3% to 7,939.62.

Turnover in the large-cap index was 20% lower than the 30-day moving average, a sign that traders had already shifted focus to corporate earnings. The financial reporting season begins in earnest on Friday with JPMorgan Chase & Co (JPM) and Wells Fargo & Co (WFC) releasing their quarterly results. Several Dow blue chips will report early next week.

Tepid market conditions were also reflected in the CBOE Volatility, an indicator that tracks expected volatility over the next 30 days. The so-called VIX was little changed on Thursday, trading at 13.25.

Trump Presides Over Tightest Labor Market in 5 Decades

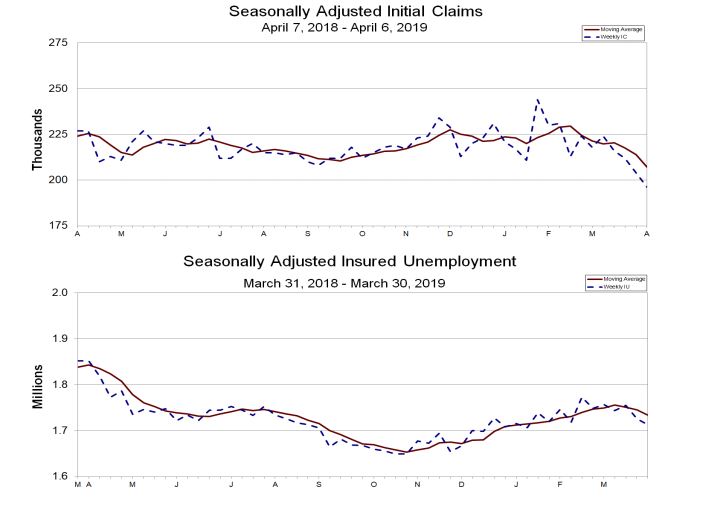

Trump now oversees the tightest labor market in five decades. | Source: BLS

The U.S. labor market appears to be in solid shape at the start of the second quarter, alleviating fears that the world’s largest economy was barreling toward stagnation. Jobless claims, which track the number of Americans laid off from their jobs, plunged last week to the lowest level since 1969.

Claims dropped by 8,000 to a seasonally adjusted annual rate of 196,000 for the week ended April 6, the Department of Labor reported Thursday. A median estimate of analysts had called for an increase to 211,000.

The 10-year Treasury yield moved to a session high of 2.51% after the weekly jobs report was released. Yields rise when bond prices fall.

U.S. economic growth accelerated at the start of last year as President Trump’s tax reforms took effect. Growth has moderated significantly in the last two quarters but remains well above comparable economies in Asia and Europe. A solid labor market is generally viewed as a good measuring stick for how well the overall economy is doing. Combined with a solid uptick in average hourly earnings, a tight labor market suggests the U.S. economy is well positioned to weather international headwinds.