The Dow barrelled higher after Friday’s opening bell, as the US stock market bounded into the week’s final trading session no longer burdened by recession warnings. Wall Street also responded to Donald Trump’s revelation that US-China trade negotiations would likely wrap up within the next four weeks.

Dow Jumps Higher as Nonfarm Payrolls Climb by 196,000

The Dow Jones Industrial Average leaped at the opening bell, rising 80.80 points or 0.31 percent to 26,465.43. The S&P 500 added 7.03 points or 0.24 percent to climb to 2,886.31, and the Nasdaq bounced back with a 23.85 point or 0.31 percent advance to 7,916.05.

On Thursday, the Dow brushed off a weak opening to surge 166.5 points or 0.64 percent and close at 26,384.63. The S&P 500 also provided investors with a positive return, climbing 5.99 points or 0.21 percent to 2,879.39. The Nasdaq, in contrast, lost 3.77 points or 0.05 percent; weighed down by Tesla, the index fell to 7,891.78.

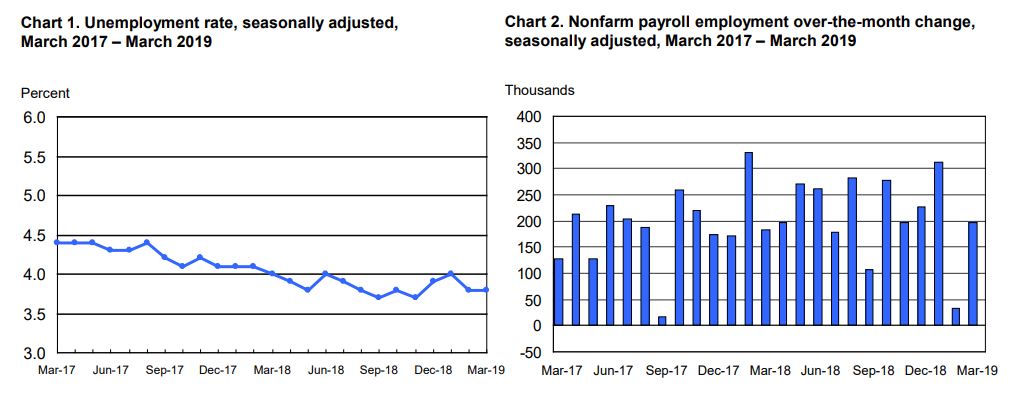

This morning, the Dow received a noticeable bump from a bullish jobs report, which indicated that nonfarm payrolls rose by 196,000, significantly better than the Dow Jones estimate of 175,000. According to the Bureau of Labor and Statistics, the unemployment rate remained unchanged at 3.8 percent.

US nonfarm payrolls grew by 196,000 in March, up from a dismal 33,000 in February. | Source: BLS

The jobs report brought a sigh of relief to Wall Street analysts, many of whom had begun to sound the recession alarms last month when the BLS reported that the US private sector had added just 20,000 jobs in February. That figure was revised up to 33,000 in this morning’s report, and when averaged with January’s excellent 312,000 increase, the US economy averaged a solid – if not spectacular – 180,000 jobs per month for the quarter.

Today’s jobs report should quell fears that the US is lurching toward a recession following a decade-long bull market – at least in the near-term. Most economists believe a recession will strike within the next few years, perhaps even before the end of President Trump’s first term.

Still, the solid growth in nonfarm payrolls suggests that the parabolic stock market recovery during the first several months of 2019 is more than a dead cat bounce and could propel the Dow and its peers to new highs before a slowdown sets in.

Trump Sets 4-Week Window for US-China Trade Deal

Meanwhile, Wall Street continues to digest the latest developments in the ongoing US-China trade war. Those developments are a bit of a mixed bag.

On the one hand, Chinese state news services Xinhua reported that Vice Premier Liu He said that the two economic superpowers had reached a “new consensus” as they continue to finalize the actual text of a new trade agreement. A steady diet of positive comments like this has helped feed the Dow’s breathtaking climb since its recovery began in late December.

On the other, reports indicated that Donald Trump would conclude his meeting with Liu by announcing a summit with Chinese President Xi Jinping – an event that failed to materialize.

Instead, the president said that “we’ll know over the next four weeks” whether a trade deal will happen at all, apparently setting a new deadline more than a month after his original one had passed.

“If we have a deal, there will be a summit. I’d say we’ll know over the next four weeks,” President Trump said. “If it’s not a great deal, we’re not doing it,” he added. “But it’s going very well.”

According to Global Times editor-in-chief Hu Xijin, the US and China have reached a critical stage in their negotiations. At this point, only a few key sticking points remain – the question is whether negotiators are more committed to getting their way on these points or bringing an end to the trade war that has roiled stock markets in both countries.

He observed:

“China-US trade talks are like a fruit that is almost grown, but it remains uncertain when the fruit will fall. As negotiations have reached current stage, the remaining problems can be serious, or not problems at all.”

Based on information I received plus my understanding, China-US trade talks are like a fruit that is almost grown, but it remains uncertain when the fruit will fall. As negotiations have reached current stage, the remaining problems can be serious, or not problems at all.

— Hu Xijin 胡锡进 (@HuXijin_GT) April 4, 2019