Today, Bitcoin is turning 10-years old. It’s a wonderful opportunity to kick-off the celebrations with a summary of the biggest milestones in the cryptocurrency’s history.

Cypherpunks and the Release of the Bitcoin White Paper

Exactly 10 years ago today, on the 31st Oct 2008, the Bitcoin white paper has been published marking an official beginning of the cryptocurrency’s adventure and the Birthday of Bitcoin. The paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” has been written by an anonymous person or a group of people working under a pseudonym Satoshi Nakamoto. Satoshi’s identity has never been discovered and remains a mystery and a source of continuous speculation.

Bitcoin’s white paper has been first released on an emailing list of the famous cypherpunks. The activist group’s goal, as stated in their 1993 manifesto, was to defend online privacy using software, cryptography, and digital currency. The email list was first founded in 1992 by Eric Hughes, John Gilmore, and Timothy May, and since 1997 it worked as an anonymous remailer service that would strip each email off their sender’s information and redistribute it among the group. It created a safe and anonymous hub for brainstorming and open source innovations in the fields of cryptography and digital privacy. Many ideas and early digital cash solutions discussed between the cypherpunk activists like Nick Szabo, Wei Dai, and Hal Finney would later lay the foundation of Bitcoin cryptocurrency as we know it.

Genesis Block

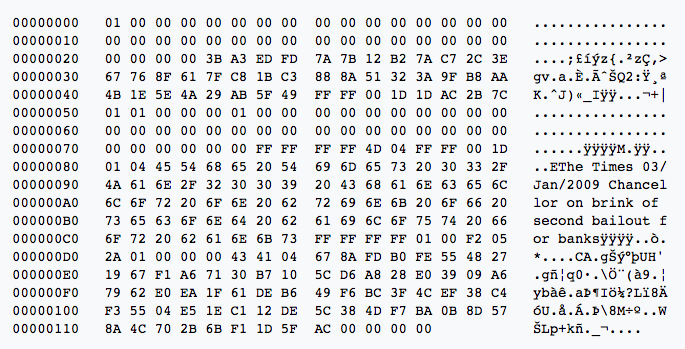

On the 3rd of January 2009, the Bitcoin network was activated and the genesis block — the very first block in the Bitcoin blockchain — was mined. The block mined by Satoshi contained a timestamp and a short excerpt from an article published in The Times. It read:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

The genesis block is unique as it doesn’t contain the hash reference to a previous block, and the transactions placed in the block are unspendable.

The Bitcoin Genesis Block Hash: 000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

The message hidden in the Bitcoin genesis block is considered an additional timestamp for the block, but also a political commentary on the bailout strategy midst the financial crises. It also refers to the ultimate goal behind the creation of the digital currency to:

“allow online payments to be sent directly from one party to another without going through a financial institution.”

The bitcoin genesis block with a hidden message from Satoshi.

The First Bitcoin P2P Transfer

The first ever bitcoin transaction was sent to Hal Finney, a Caltech engineer and early Cypherpunk, who was also the creator of the first Proof-of-Work system. Hal downloaded the bitcoin software on the day of its launch and subsequently received the very first bitcoin transaction of 10BTC from Satoshi Nakamoto on the 12th January 2009. Many suspected that Hal could have been Satoshi Nakamoto himself, but the programmer strongly denied the allegations and called himself an early adopter and supporter of bitcoin, up until his death in 2014. The first ever BTC transaction proved that peer-to-peer payment transfer of digital currency is possible.

The Bitcoin Pizza

Hal Finney might have made history obtaining the first bitcoins in existence, but it was Laszlo Hanyecz who first used Bitcoin to actually buy something, namely two large pizzas. Laszlo was an early adopter and miner of Bitcoin, and he wanted to inspire people to adopt the digital currency in real world situations. On 18th of May 2010, he posted on BitcoinTalk “I’ll pay 10,000 bitcoins for a couple of pizzas.. like maybe 2 large ones”, and on the 22nd May he shared pictures of successfully getting his pizza.

Though many people focus on how much the 10,000 BTC would have been worth today, it was never about the money, and as Laszlo explained on BitcoinTalk forum, he thought it would be interesting if he could say that he paid for a pizza in bitcoin. Laszlo remains confident that his historical move served as a proof of concept for a decentralized peer-2-peer economy and likely contributed to Bitcoin’s wider adoption as the real-world payment method.

The First Bitcoin Exchanges

On 17th March 2010, Bitcoin has been listed on the first ever Bitcoin exchange, BitcoinMarket.com, at 1309:1 to the US dollar. In July the same year, the infamous MtGox exchange launched their services, an exchange which in the next two years would grow to become the largest Bitcoin exchange in the world, operating 70% of the world’s BTC trading volume.

In early 2014 MtGot admitted to having lost circa 900.000 Bitcoin due to hacks and filed for bankruptcy protection. The prices of Bitcoin, which around November 2013 surged dramatically from 200USD to 1000USD, possibly due to suspicious MtGox bot activity, suddenly dropped back to the 250USD levels, marking the beginning the first serious market correction for Bitcoin which lasted up till the end of 2015.

The Blocksize debate

Originally, Bitcoin’s block size was restricted to 500–750kb because of the database locks (max. 1000) required to process it. In March 2013, it was accidentally discovered that Satoshi Nakamoto imposed an explicit 1MB block size limit in two hidden commits dating back to 2010. The limit came to light only when a Bitcoin Core version v0.8.0 failed to enforce the block-size limit and accidentally split the network.

In 2015, the increasing worries about the block-size limitations and its effect on transaction fees and scalability of the Bitcoin driven P2P economy prompted a renewed debate.

In August, 2017 SegWit (Segregated Witness) was activated to help bitcoin scale. The promise of SegWit was to circumvent the block-size and other protocol restrictions without causing a hard fork of the Bitcoin blockchain. It was a software upgrade or a series of BIPs (Bitcoin Improvement Proposals) to improve Bitcoin’s scalability and malleability. For example, it enabled Lightning network on top of the BTC blockchain, that could, in theory, allow for faster 2nd layer transactions without affecting Bitcoin’s block-size limits.

SegWit2x was a proposed hard fork that would have increased the block-size to 2MB, together with implementing Segwit. However, it failed to gain consensus in the community and SegWit2x has been canceled in November 2017.

On the 1st of August 2017, a group of developers split from the Bitcoin Core blockchain and created a Bitcoin Cash (BCH) to follow the vision of online scaling on the Bitcoin blockchain by increasing the block size. Initially, the block-size has been increased to 8BM, and in May 2018 further up to 32MB.

Bitcoin Adoption

Bitcoin’s adoption began with the cypherpunks, anarchists, and digital privacy activists but it was still mostly experimental. It all changed in June 2011 when Adrien Check published an article in Gawker exposing Bitcoin as an anonymous and secure peer-2-peer payment used on the “underground website where you can buy any drug imaginable.” He, of course, meant the infamous Silk Road. That exposé gave Bitcoin adoption a boost but also contributed to cryptocurrency’s bad reputation, as an untraceable digital cash used for criminal activities. After the Silk Road was busted by the FBI in 2013, the cryptocurrency started to attract a more mainstream audience in the Silicon Valley that understood its potential but also its privacy limitations.

Around 2014 and 2015, venture capital companies started massively investing into blockchain businesses, with reportedly circa $90 million investment in 2015, and $150million the following year. The Winklevoss Brothers were ahead of that pack, their investments dating back to 2013.

2016 brought a wider retail investor adoption, albeit the price increase contributed to bitcoin often being considered a long-term investment or a store of value rather than a P2P payment method it was initially designed for.

December 2017 saw CBOE trade the first Bitcoin Futures in history, marking Bitcoin’s entry into the stock markets, opening it to accredited investors. Efforts to create Bitcoin ETFs or ETF alternatives are in the pipeline, which milestone could open cryptocurrency markets to a massive flow of investor capital.

Summary

As retails and business adoption of bitcoin and the blockchain technology is advancing, many supporters still believe in the core principals that led to the development of bitcoin: to allow simple, fast and inexpensive peer-2-peer payment system without third parties. Others, in the spirit of the first Cypherpunks and digital anarchists, hope that blockchain technology could decentralize the broader economy, disrupting the central governance and baking systems, and secure individual’s rights to privacy.

Bitcoin Birthday Celebration

Join the BTC.com team for an epic birthday party at the House of Nakamoto Amsterdam. You can check-in here and join us for an evening of fun and celebrations at Oude Spiegelstraat 3, 1016 BM Amsterdam.

Already have plans for the Bitcoin Birthday? Tell us about it in the comments below!

Join the bitcoin revolution!

Create your web wallet now at wallet.btc.com or download the BTC.com wallet app for iOS and Android to buy, store and spend your Bitcoin or Bitcoin Cash!

Credits for the article go to Natalia Nowakowska. Natalia is a freelance copywriter based in Amsterdam, NL. She loves to learn new things and write about finance, technology, and crypto.

Happy 10th Anniversary for Bitcoin! was originally published in The BTC Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.